Question: Help with homework! B D E F G H I J K L M 1 3 4 5 6 Talmadge Company Manufactures 100,000 units of

Help with homework!

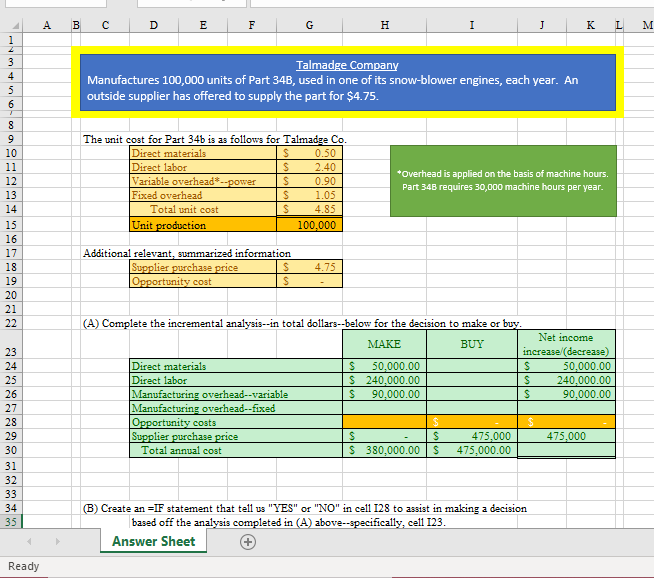

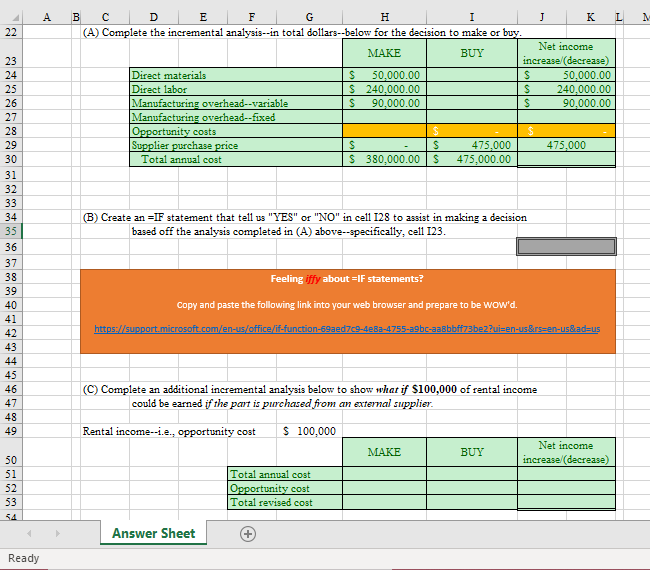

B D E F G H I J K L M 1 3 4 5 6 Talmadge Company Manufactures 100,000 units of Part 34B, used in one of its snow-blower engines, each year. An outside supplier has offered to supply the part for $4.75. The unit cost for Part 34 is as follows for Talmadge Co. Direct materials S 0.50 Direct labor $ 2.40 Variable overhead-power $ Fixed overhead $ 1.05 Total unit cost S 4.85 Unit production 100,000 0.90 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 *Overhead is applied on the basis of machine hours. Part 348 requires 30,000 machine hours per year. Additional relevant, summarized information Supplier purchase price $ Opportunity cost S 4.75 23 24 25 26 27 28 29 30 31 32 33 34 35 (A) Complete the incremental analysis--in total dollars--below for the decision to make or buy. Net income MAKE BUY increase (decrease) Direct materials S 50,000.00 $ 50,000.00 Direct labor $ 240,000.00 S 240,000.00 Manufacturing overhead--variable S 90,000.00 $ 90,000.00 Manufacturing overhead--fixed Opportunity costs Supplier purchase price S S 475,000 475,000 Total annual cost $ 380,000.00 475,000.00 B) Create an =IF statement that tell us "YES" or "NO" in cell 128 to assist in making a decision based off the analysis completed in (A) above--specifically, cell 123. Answer Sheet Ready A N 22 B D E F G H J K L (A) Complete the incremental analysis--in total dollars--below for the decision to make or buy. MAKE Net income BUY increase (decrease) Direct materials S 50,000.00 $ 50,000.00 Direct labor $ 240,000.00 S 240,000.00 Manufacturing overhead--variable $ 90,000.00 S 90,000.00 Manufacturing overhead--fixed Opportunity costs $ Supplier purchase price $ S 475,000 475,000 Total annual cost $ 380,000.00 475,000.00 B) Create an =IF statement that tell us "YES" or "NO" in cell 128 to assist in making a decision based off the analysis completed in (A) above-specifically, cell 123. 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Feeling iffy about EIF statements? Copy and paste the following link into your web browser and prepare to be wow'd. https://support.microsoft.com/en-us/office/if-function-59aed7c9-4e3a-4755-a9bc-aabbbff73be2?uj=en-us&rs=en-us&adeus (C) Complete an additional incremental analysis below to show what if $100,000 of rental income could be earned if the part is purchased from an external supplier. Rental income--i.e., opportunity cost $ 100,000 Net income MAKE BUY increase (decrease) Total annual cost Opportunity cost Total revised cost 50 51 52 53 54 Answer Sheet Ready B D E F G H I J K L M 1 3 4 5 6 Talmadge Company Manufactures 100,000 units of Part 34B, used in one of its snow-blower engines, each year. An outside supplier has offered to supply the part for $4.75. The unit cost for Part 34 is as follows for Talmadge Co. Direct materials S 0.50 Direct labor $ 2.40 Variable overhead-power $ Fixed overhead $ 1.05 Total unit cost S 4.85 Unit production 100,000 0.90 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 *Overhead is applied on the basis of machine hours. Part 348 requires 30,000 machine hours per year. Additional relevant, summarized information Supplier purchase price $ Opportunity cost S 4.75 23 24 25 26 27 28 29 30 31 32 33 34 35 (A) Complete the incremental analysis--in total dollars--below for the decision to make or buy. Net income MAKE BUY increase (decrease) Direct materials S 50,000.00 $ 50,000.00 Direct labor $ 240,000.00 S 240,000.00 Manufacturing overhead--variable S 90,000.00 $ 90,000.00 Manufacturing overhead--fixed Opportunity costs Supplier purchase price S S 475,000 475,000 Total annual cost $ 380,000.00 475,000.00 B) Create an =IF statement that tell us "YES" or "NO" in cell 128 to assist in making a decision based off the analysis completed in (A) above--specifically, cell 123. Answer Sheet Ready A N 22 B D E F G H J K L (A) Complete the incremental analysis--in total dollars--below for the decision to make or buy. MAKE Net income BUY increase (decrease) Direct materials S 50,000.00 $ 50,000.00 Direct labor $ 240,000.00 S 240,000.00 Manufacturing overhead--variable $ 90,000.00 S 90,000.00 Manufacturing overhead--fixed Opportunity costs $ Supplier purchase price $ S 475,000 475,000 Total annual cost $ 380,000.00 475,000.00 B) Create an =IF statement that tell us "YES" or "NO" in cell 128 to assist in making a decision based off the analysis completed in (A) above-specifically, cell 123. 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Feeling iffy about EIF statements? Copy and paste the following link into your web browser and prepare to be wow'd. https://support.microsoft.com/en-us/office/if-function-59aed7c9-4e3a-4755-a9bc-aabbbff73be2?uj=en-us&rs=en-us&adeus (C) Complete an additional incremental analysis below to show what if $100,000 of rental income could be earned if the part is purchased from an external supplier. Rental income--i.e., opportunity cost $ 100,000 Net income MAKE BUY increase (decrease) Total annual cost Opportunity cost Total revised cost 50 51 52 53 54 Answer Sheet Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts