Question: help with the attachments below 15 Keyspan corp. is planning to issue debt that will mature in 2033. In many respects, the issue is similar

help with the attachments below

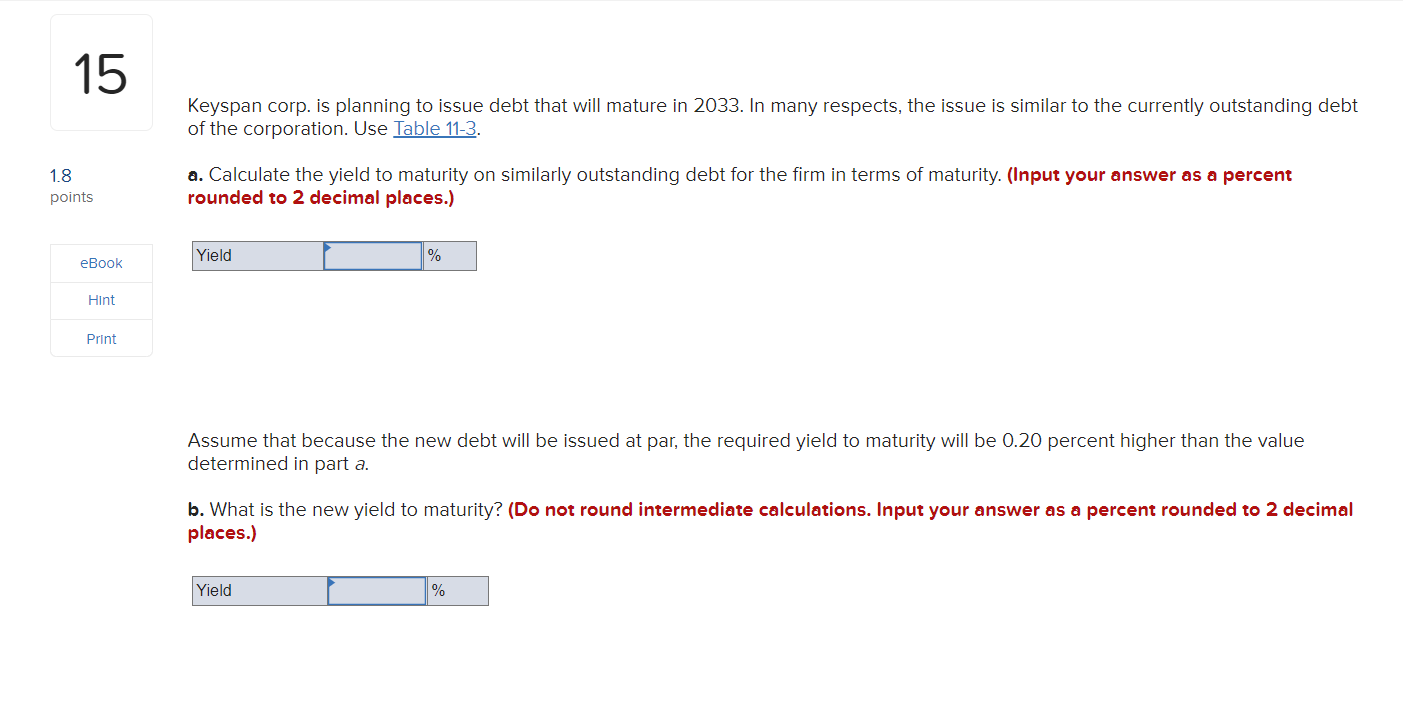

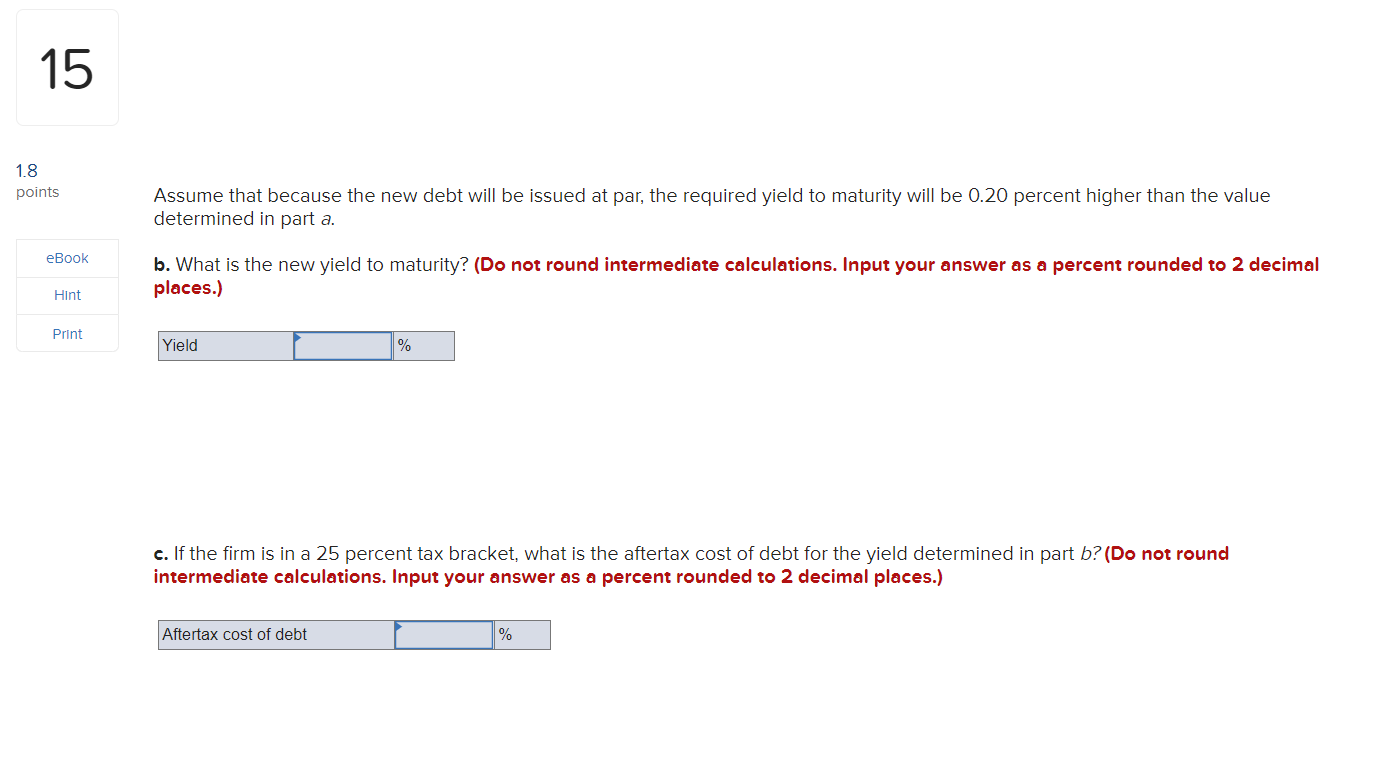

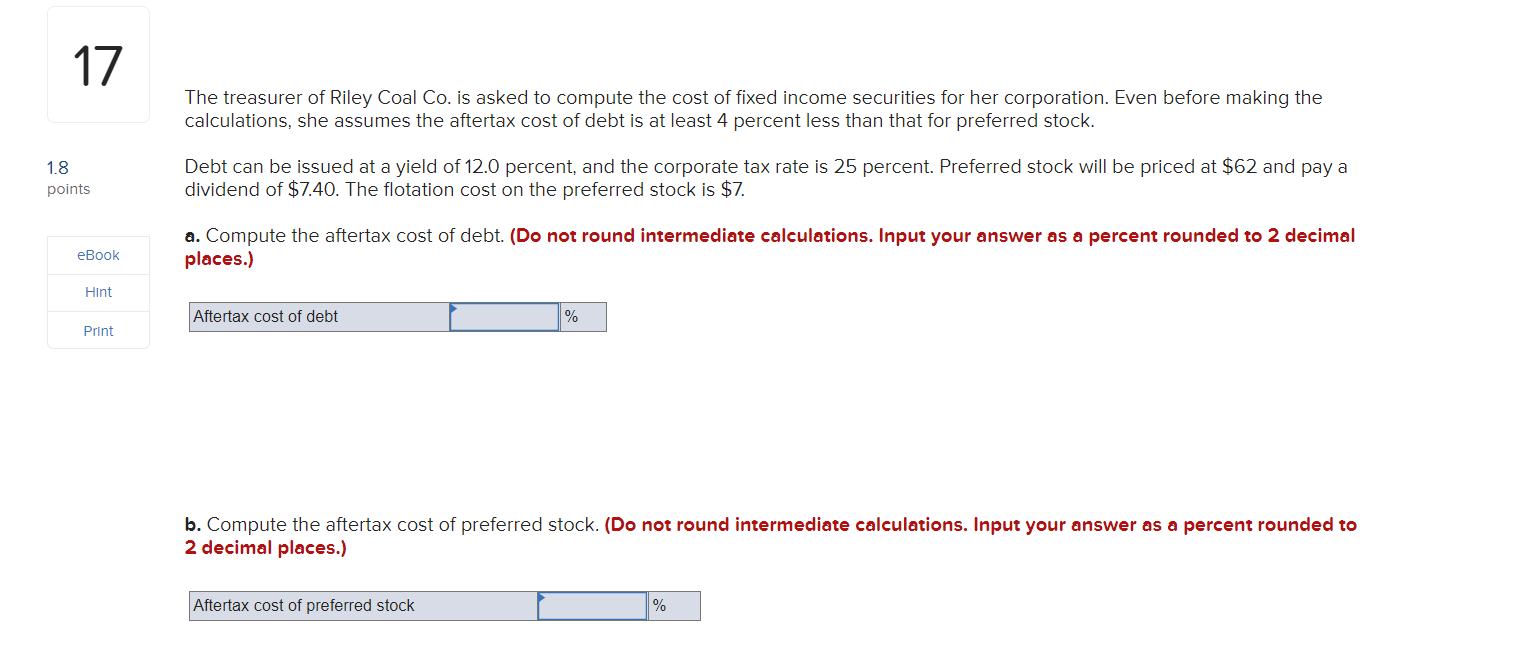

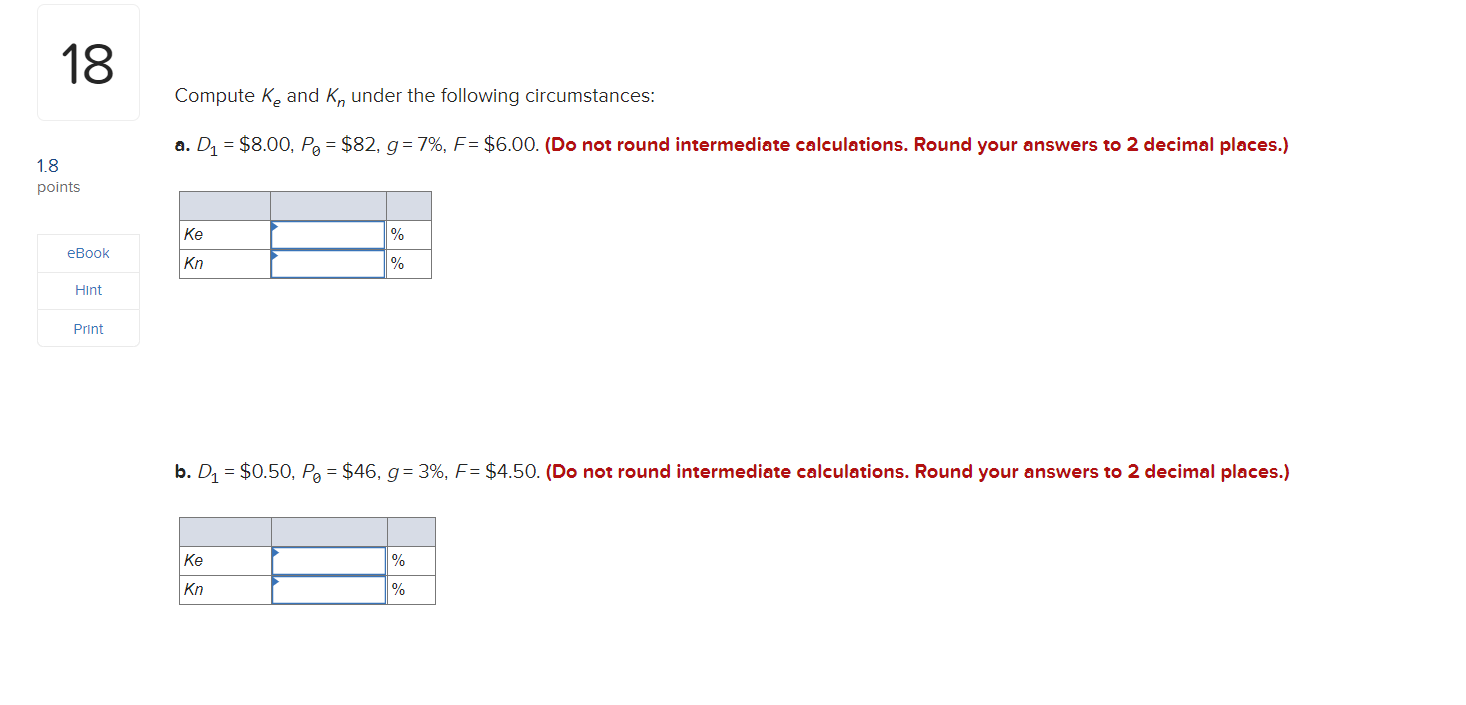

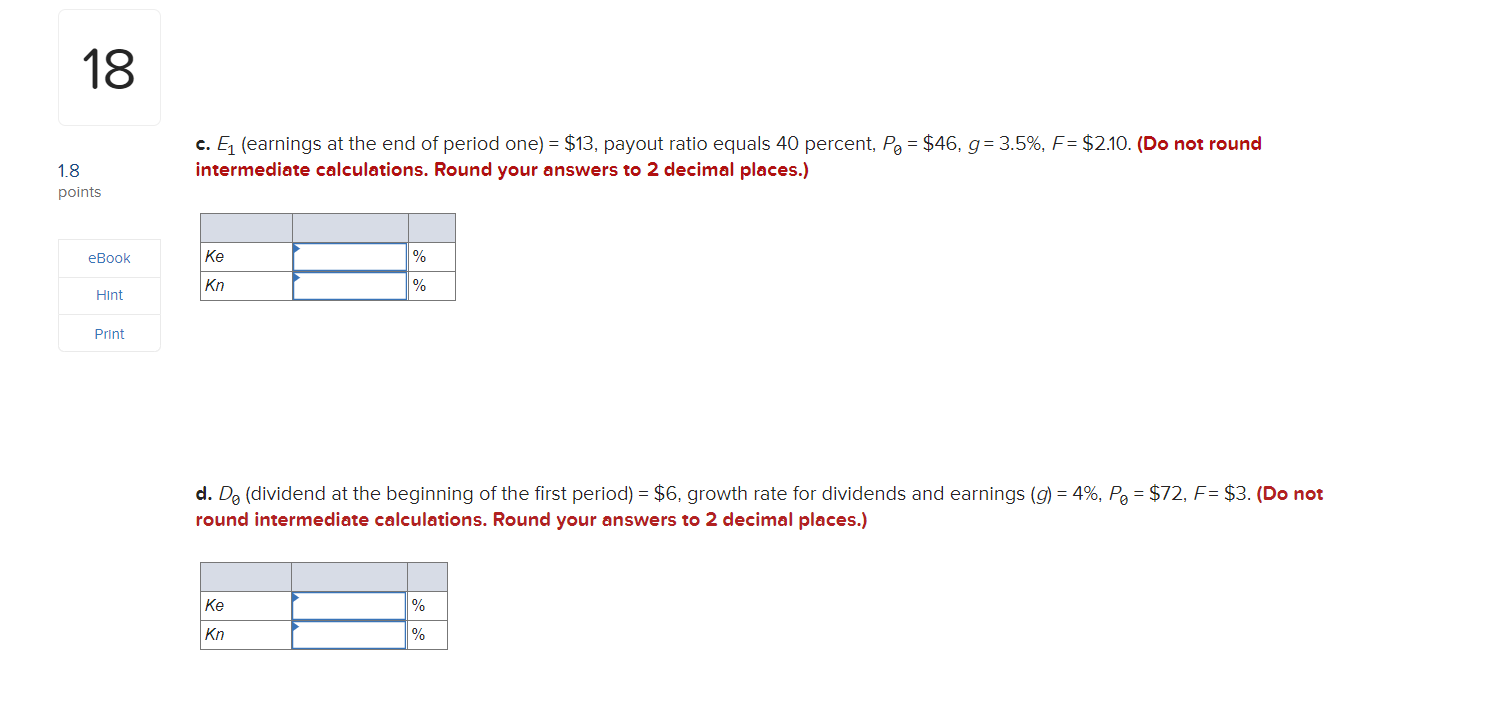

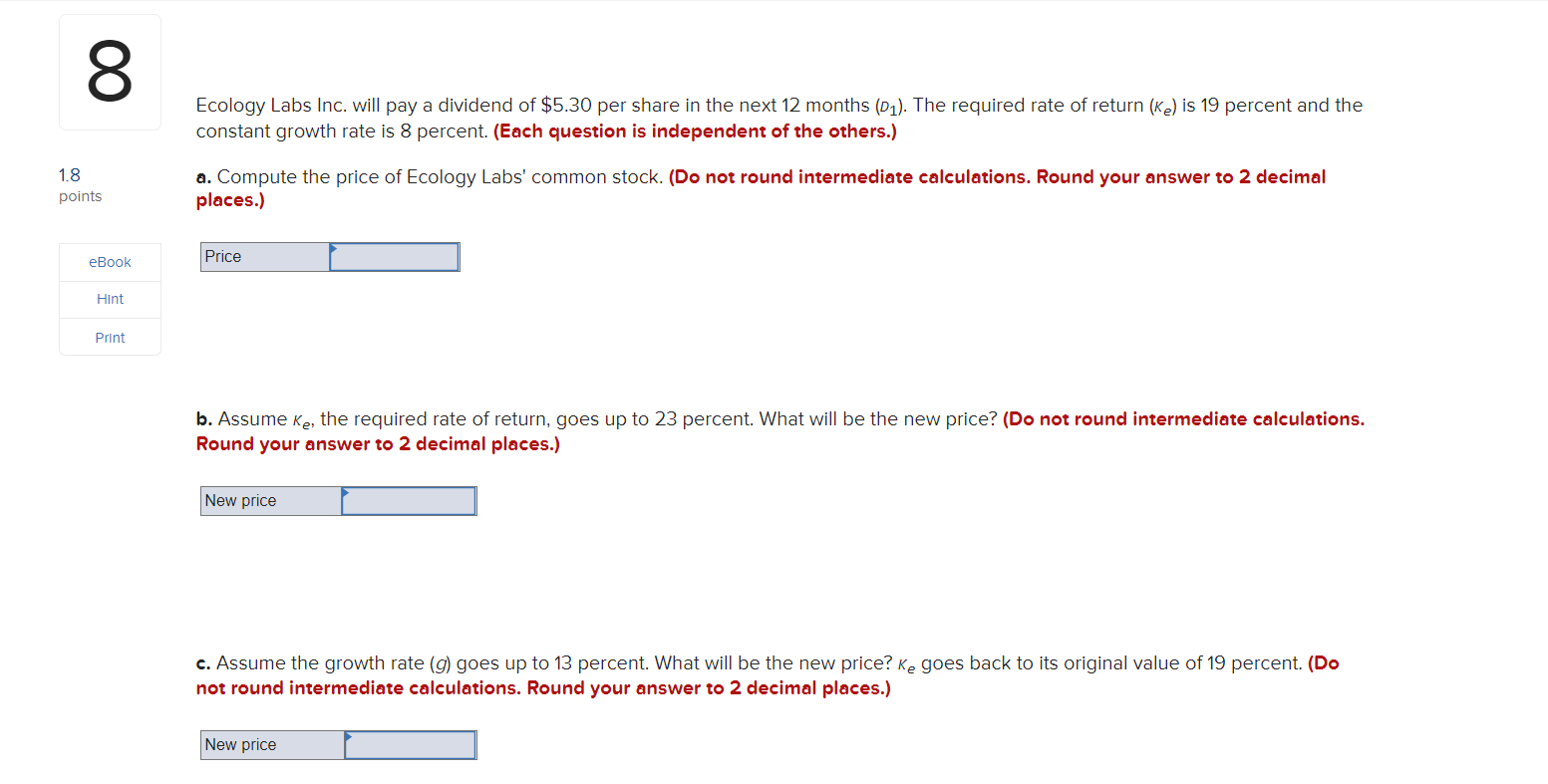

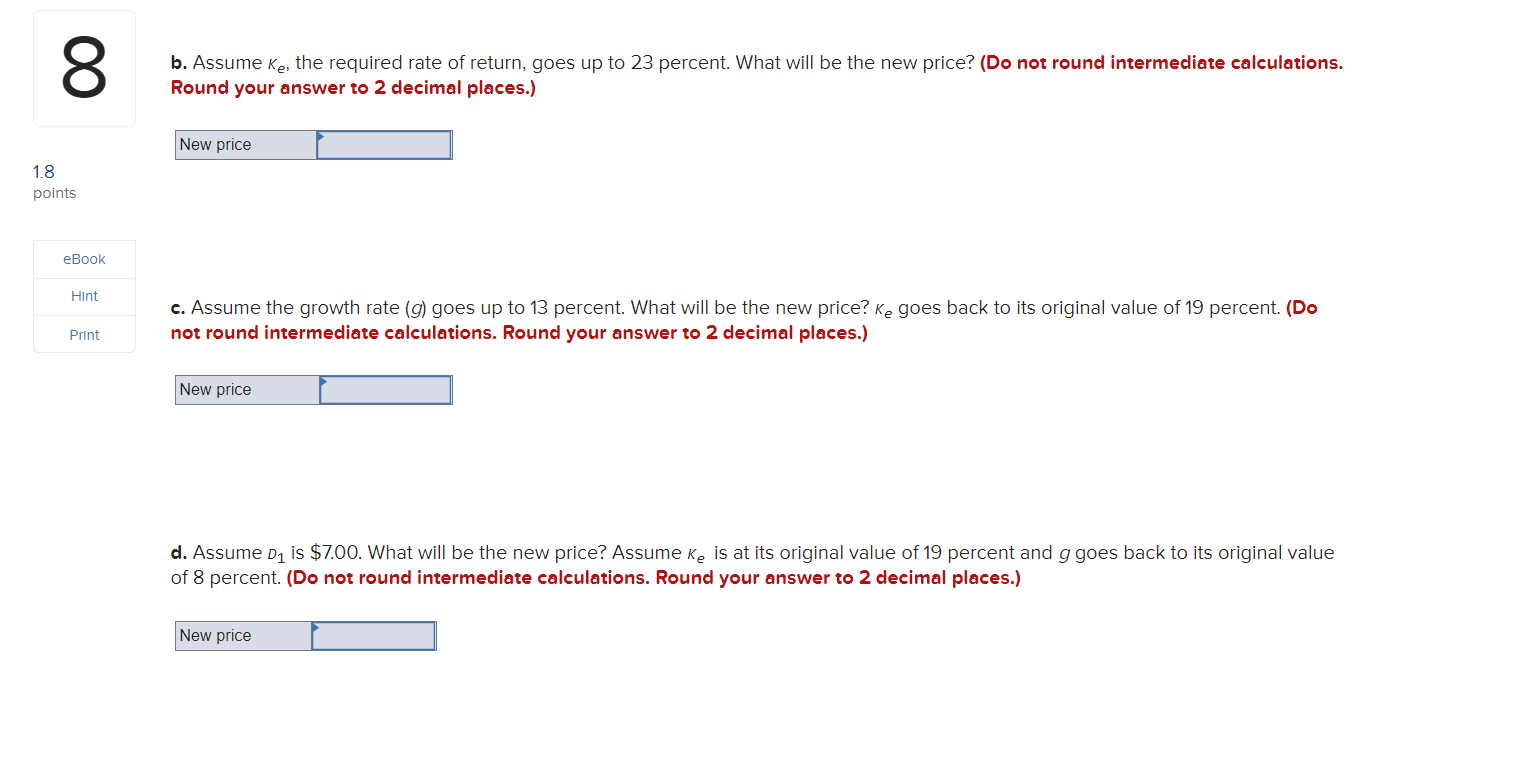

15 Keyspan corp. is planning to issue debt that will mature in 2033. In many respects, the issue is similar to the currently outstanding debt of the corporation. Use Table 113. 1.8 :1. Calculate the yield to maturity 0n similarly outstanding debt for the firm in terms of maturity. (Input your answer as a percent Poin'fs rounded to 2 decimal places.) eBook Yield I 9" Hint Print Assume that because the new debt will be issued at par, the required yield to maturity will be 0.20 percent higher than the value determined in part a. b. What is the new yield to maturity? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) 'eld I 'M: 15 1.8 points Assume that because the new debt will be issued at par, the required yield to maturity will be 0.20 percent higher than the value determined in part a. eBook b. What is the new yield to maturity? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal Hint places.) Print Yield % c. If the firm is in a 25 percent tax bracket, what is the aftertax cost of debt for the yield determined in part b? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aftertax cost of debt %17 1.8 points eEook Hint an The treasurer of Riley Coal Co. is asked to compute the cost of fixed income securities for her corporation. Even before making the calculations, she assumes the aftertax cost of debt is at least 4 percent less than that for preferred stock. Debt can be issued at a yield of 12.0 percent. and the corporate tax rate is 25 percent. Preferred stock will be priced at $62 and pay a dividend of $7.40. The flotation cost on the preferred stock is $7. a. Compute the aftertax cost of debt. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aerlax Dost of debt I % b. Compute the aftertax cost of preferred stock. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aerlax oost of preferred stock '36 18 Compute KE and Kn under the following circumstances: a. D1 : $8.00, Pa : $82, 9 : 7%, F: $6.00. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 1.8 points K9 % eBooK Kn % le'lt Print b. D1 2 $0.50, P9 2 $46, 9': 3%, F: $4.50. {Do not round intermediate calculations. Round your answers to 2 decimal places.) K9 \".4: Kn % 18 c. E1 (earnings at the end of period one) = $13, payout ratio equals 40 percent, P9 = $46. 9: 3.5%, F: $2.10. (Do not round 18 intermediate calculations. Round your answers to 2 decimal places.) points eEook K9 \"ti: o Hint K\" '4' Prlnt d. De (dividend at the beginning of the first period) = $6, growth rate for dividends and earnings (9) = 4%, P9 = $72, F: $3. (Do not round intermediate calculations. Round your answers to 2 decimal places.) K9 \"xi: Kn \"A: 1.8 points EEDOk Hint Print Ecology Labs Inc. will pay a dividend of $5.30 per share in the next 12 months (01). The required rate of return [1(9) is 19 percent and the constant growth rate is 8 percent. (Each question is independent of the others.) a. Compute the price of Ecology Labs' common stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Assume K9. the required rate of return, goes up to 23 percent. What will be the new price':I (Do not round intermediate calculations. Round your answer to 2 decimal places.) New price I c. Assume the growth rate (9) goes up to 13 percent. What will be the new price? Ke goes back to its original value of 19 percent. (Do not round intermediate calculations. Round your answer to 2 decimal places.) New price I 1.8 points eBook Hint Print b. Assume K9. the required rate of return, goes up to 23 percent. What will be the new price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) New price I c. Assume the growth rate (9) goes up to 13 percent. What will be the new price? Ke goes back to its original value of 19 percent. (Do not round intermediate calculations. Round your answer to 2 decimal places.) New price I d. Assume 01 is $7.00. What will be the new price? Assume ice. is at its original value 0f19 percent and g goes back to its original value of 8 percent. (Do not round intermediate calculations. Round your answer to 2 decimal places.) New price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts