Question: Saved Help Save & Exit N is employed as a salesperson and received $70,000 in commissions in the current year. N spends most of the

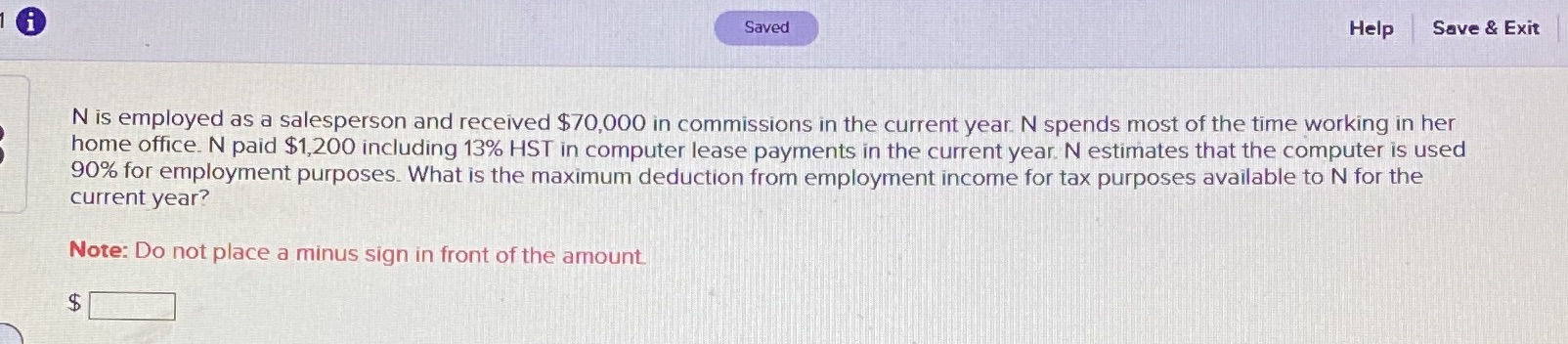

Saved Help Save & Exit N is employed as a salesperson and received $70,000 in commissions in the current year. N spends most of the time working in her home office. N paid $1,200 including 13% HST in computer lease payments in the current year. N estimates that the computer is used 90% for employment purposes. What is the maximum deduction from employment income for tax purposes available to N for the current year? Note: Do not place a minus sign in front of the amount $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts