Question: Help with the Optimal Weights! Consider the performance of a stock fund, a bond fund, and Treasury bills. Measurement Mean Standard Deviation Stock Fund 13.00%

Help with the Optimal Weights!

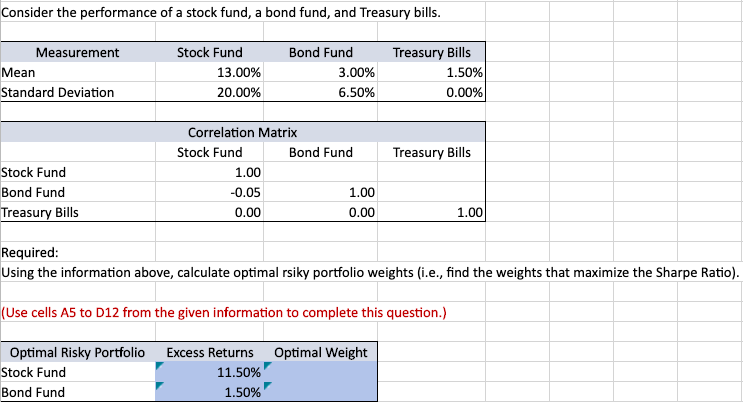

Consider the performance of a stock fund, a bond fund, and Treasury bills. Measurement Mean Standard Deviation Stock Fund 13.00% 20.00% Bond Fund 3.00% 6.50% Treasury Bills 1.50% 0.00% Treasury Bills Stock Fund Bond Fund Treasury Bills Correlation Matrix Stock Fund Bond Fund 1.00 -0.05 1.00 0.00 0.00 1.00 Required: Using the information above, calculate optimal rsiky portfolio weights (i.e., find the weights that maximize the Sharpe Ratio). (Use cells A5 to D12 from the given information to complete this question.) Optimal Risky Portfolio Excess Returns Optimal Weight Stock Fund 11.50% Bond Fund 1.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts