Question: I do not need a answer on excel sheet explain it properly QUESTION 21 The insurance company INTAC must make a payment of $14,172.488 in

I do not need a answer on excel sheet

I do not need a answer on excel sheet

explain it properly

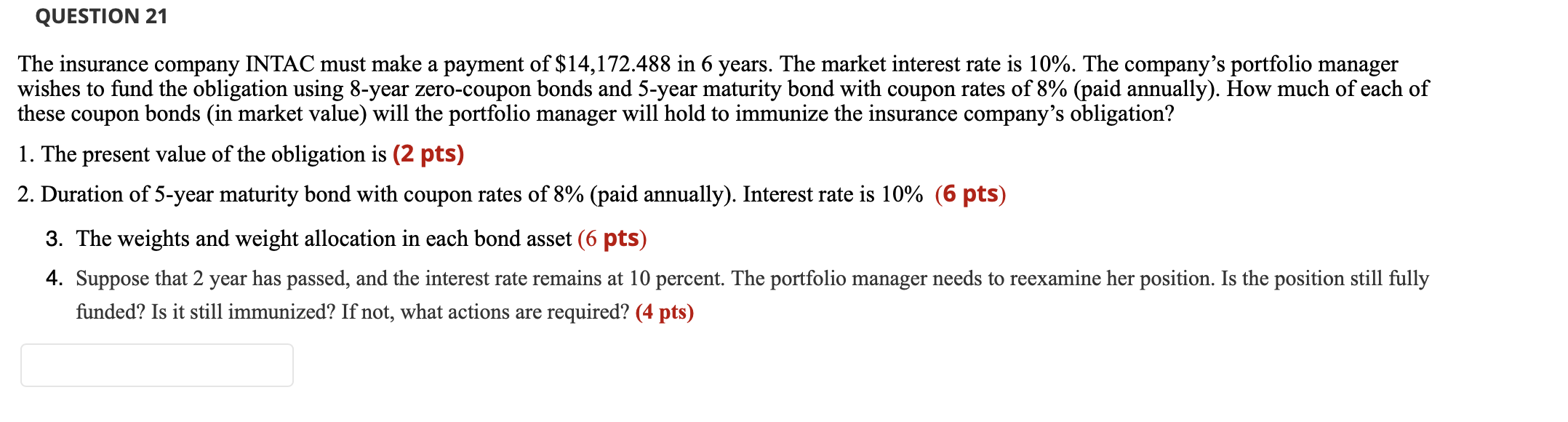

QUESTION 21 The insurance company INTAC must make a payment of $14,172.488 in 6 years. The market interest rate is 10%. The company's portfolio manager wishes to fund the obligation using 8-year zero-coupon bonds and 5-year maturity bond with coupon rates of 8% (paid annually). How much of each of these coupon bonds (in market value) will the portfolio manager will hold to immunize the insurance company's obligation? 1. The present value of the obligation is (2 pts) 2. Duration of 5-year maturity bond with coupon rates of 8% (paid annually). Interest rate is 10% (6 pts) 3. The weights and weight allocation in each bond asset (6 pts) 4. Suppose that 2 year has passed, and the interest rate remains at 10 percent. The portfolio manager needs to reexamine her position. Is the position still fully funded? Is it still immunized? If not, what actions are required? (4 pts) QUESTION 21 The insurance company INTAC must make a payment of $14,172.488 in 6 years. The market interest rate is 10%. The company's portfolio manager wishes to fund the obligation using 8-year zero-coupon bonds and 5-year maturity bond with coupon rates of 8% (paid annually). How much of each of these coupon bonds (in market value) will the portfolio manager will hold to immunize the insurance company's obligation? 1. The present value of the obligation is (2 pts) 2. Duration of 5-year maturity bond with coupon rates of 8% (paid annually). Interest rate is 10% (6 pts) 3. The weights and weight allocation in each bond asset (6 pts) 4. Suppose that 2 year has passed, and the interest rate remains at 10 percent. The portfolio manager needs to reexamine her position. Is the position still fully funded? Is it still immunized? If not, what actions are required? (4 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts