Question: helpppppppppppp please QUESTION S 12 points On 1 July 2019, Frankie Itd acquired 80% of the issued shares of Sinatra Lid for $250,000. At that

helpppppppppppp please

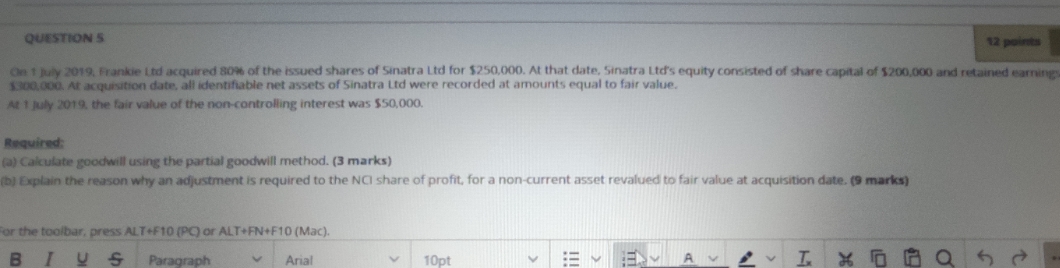

QUESTION S 12 points On 1 July 2019, Frankie Itd acquired 80% of the issued shares of Sinatra Lid for $250,000. At that date, Sinatra Ltd's equity consisted of share capital of $200,000 and retained earnings 1300.000. At acquisition date, all identifiable net assets of Sinatra Lid were recorded at amounts equal to fair value. At 1 july 2019. the fair value of the non-controlling interest was $50,000. Required: (a) Calculate goodwill using the partial goodwill method. (3 marks) (b) Explain the reason why an adjustment is required to the NCI share of profit, for a non-current asset revalued to fair value at acquisition date. (9 marks) for the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B Arial 10pt A V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts