Question: Helps solving with steps 15. A firm is considering two alternatives that have no salvage value, and a useful life of 10 years. A B

Helps solving with steps

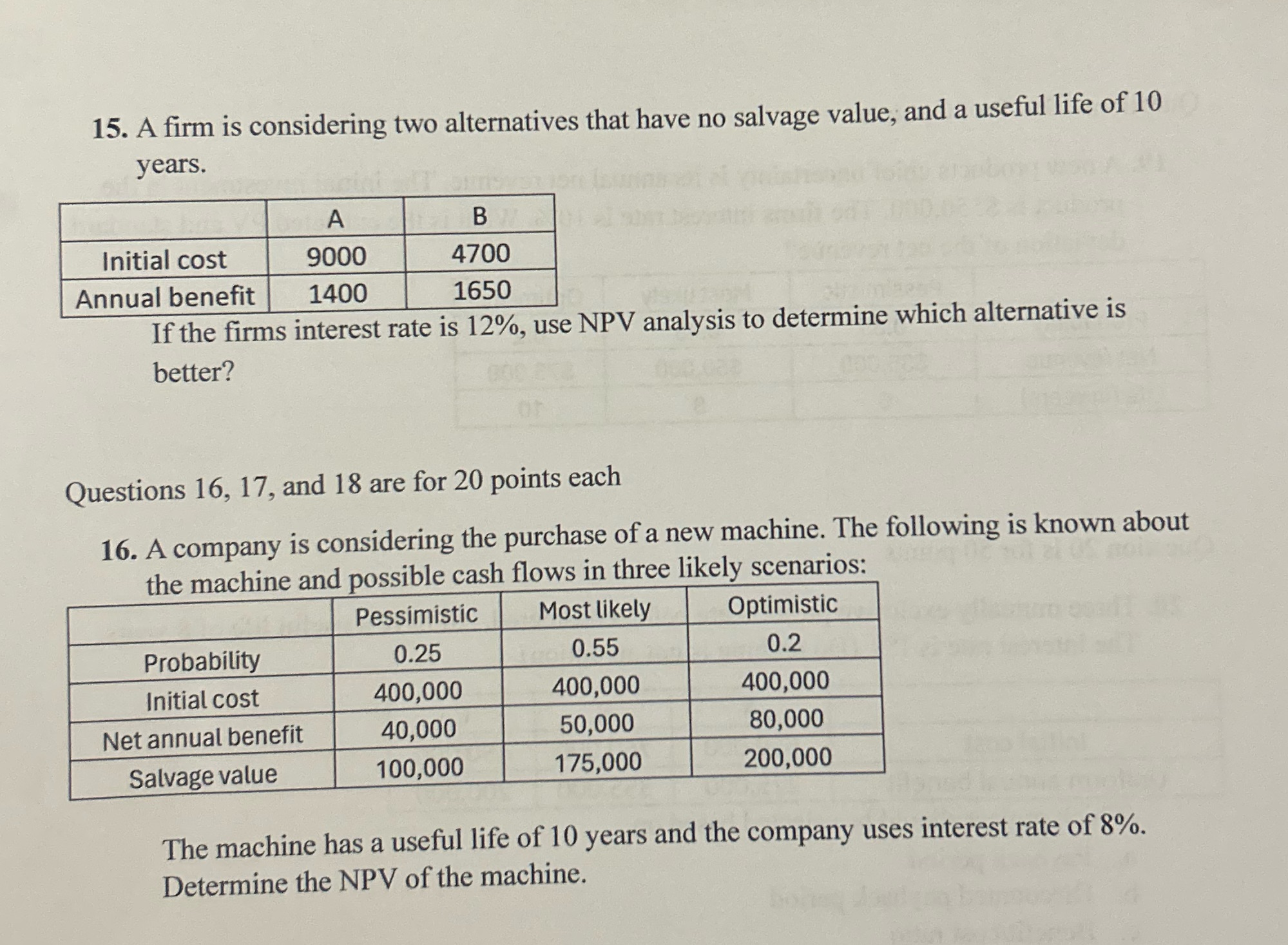

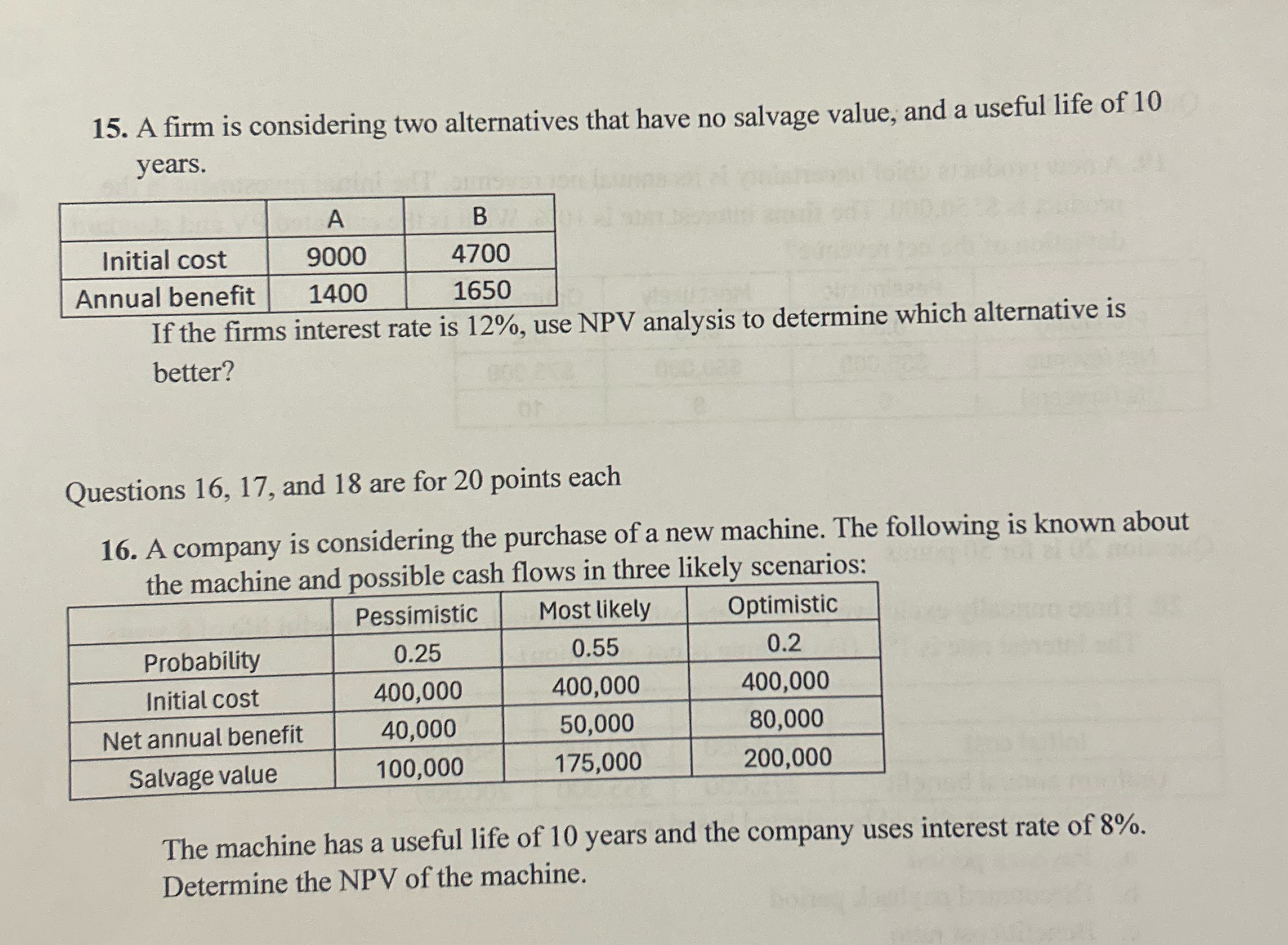

15. A firm is considering two alternatives that have no salvage value, and a useful life of 10 years. A B Initial cost 9000 4700 Annual benefit 1400 1650 If the firms interest rate is 12%, use NPV analysis to determine which alternative is better? Questions 16, 17, and 18 are for 20 points each 16. A company is considering the purchase of a new machine. The following is known about the machine and possible cash flows in three likely scenarios: Pessimistic Most likely Optimistic Probability 0.25 0.55 0.2 Initial cost 400,000 400,000 400,000 Net annual benefit 40,000 50,000 80,000 Salvage value 100,000 175,000 200,000 The machine has a useful life of 10 years and the company uses interest rate of 8%. Determine the NPV of the machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts