Question: > Here are comparative financial statement data for Sandhill Company and Whispering Company, two competitors. All data are as of December 31, 2025, and December

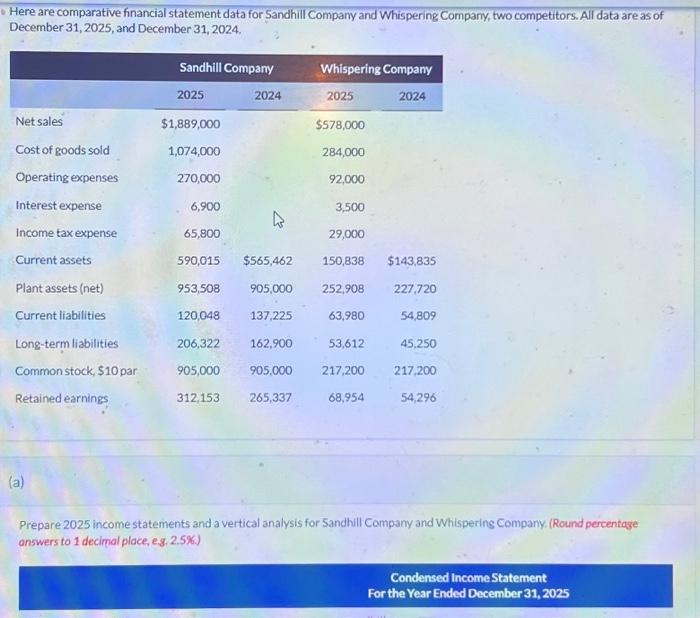

Here are comparative financial statement data for Sandhill Company and Whispering Company, two competitors. All data are as of December 31,2025, and December 31,2024. (a) Prepare 2025 income statements and a vertical analysis for Sandhill Company and Whispering Company, (Round percentage answers to 1 decimal place, e. 3.2.5%. Condensed Income Statement For the Year Ended December 31, 2025

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts