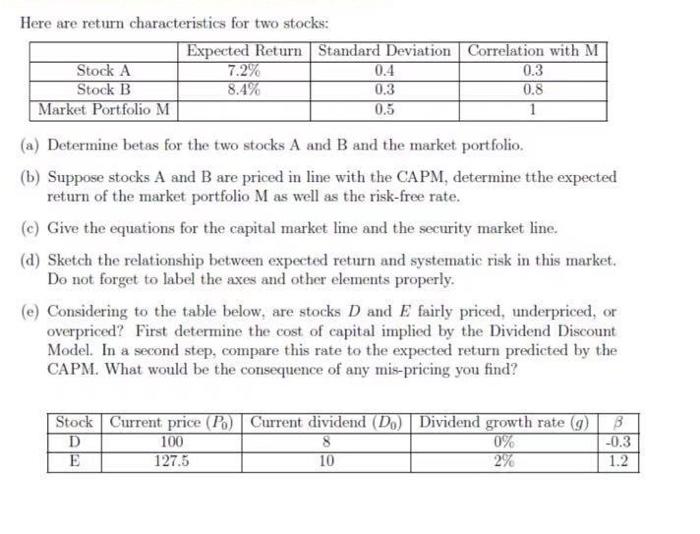

Question: Here are return characteristics for two stocks: Expected Return Standard Deviation Correlation with M Stock A 7.2% 0.4 0.3 Stock B 8.4% 0.3 0.8 Market

Here are return characteristics for two stocks: Expected Return Standard Deviation Correlation with M Stock A 7.2% 0.4 0.3 Stock B 8.4% 0.3 0.8 Market Portfolio M 0.5 1 (a) Determine betas for the two stocks A and B and the market portfolio (b) Suppose stocks A and B are priced in line with the CAPM, determine tthe expected return of the market portfolio M as well as the risk-free rate. (e) Give the equations for the capital market line and the security market line. (d) Sketch the relationship between expected return and systematic risk in this market. Do not forget to label the axes and other elements properly. (e) Considering to the table below, are stocks D and E fairly priced, underpriced, or overpriced? First determine the cost of capital implied by the Dividend Discount Model. In a second step, compare this rate to the expected return predicted by the CAPM. What would be the consequence of any mis-pricing you find? Stock Current price (P) Current dividend (D.) Dividend growth rate (g) 3 D 100 8 0% -0.3 E 127.5 10 2% 1.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts