Question: Investment Portfolio Optimization Using Mean-Variance Analysis Question 1. Let's first consider investment portfolios that include only two risky assets: VINIX (a Vanguard institutional mutual fund

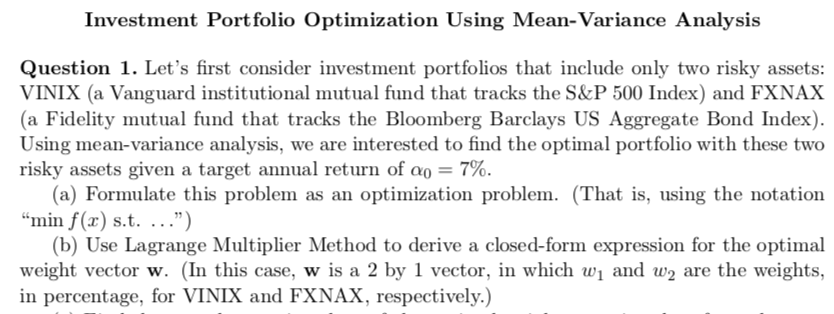

Investment Portfolio Optimization Using Mean-Variance Analysis Question 1. Let's first consider investment portfolios that include only two risky assets: VINIX (a Vanguard institutional mutual fund that tracks the S&P 500 Index) and FXNAX (a Fidelity mutual fund that tracks the Bloomberg Barclays US Aggregate Bond Index). Using mean-variance analysis, we are interested to find the optimal portfolio with these two risky assets given a target annual return of a = 7%. (a) Formulate this problem as an optimization problem. (That is, using the notation min f(2) s.t. ...") (b) Use Lagrange Multiplier Method to derive a closed-form expression for the optimal weight vector w. (In this case, w is a 2 by 1 vector, in which wi and W2 are the weights, in percentage, for VINIX and FXNAX, respectively.) Investment Portfolio Optimization Using Mean-Variance Analysis Question 1. Let's first consider investment portfolios that include only two risky assets: VINIX (a Vanguard institutional mutual fund that tracks the S&P 500 Index) and FXNAX (a Fidelity mutual fund that tracks the Bloomberg Barclays US Aggregate Bond Index). Using mean-variance analysis, we are interested to find the optimal portfolio with these two risky assets given a target annual return of a = 7%. (a) Formulate this problem as an optimization problem. (That is, using the notation min f(2) s.t. ...") (b) Use Lagrange Multiplier Method to derive a closed-form expression for the optimal weight vector w. (In this case, w is a 2 by 1 vector, in which wi and W2 are the weights, in percentage, for VINIX and FXNAX, respectively.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts