Question: Hey im having troubles with this problem. can someone show me A through C with work shown so i can understand how it was done.

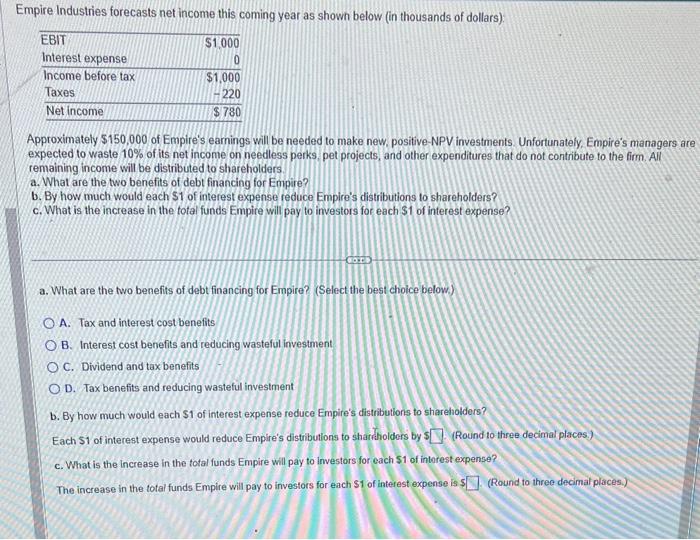

Empire Industries forecasts net income this coming year as shown below (in thousands of dollars): Approximately $150,000 of Empire's earnings will be needed to make new, positive-NPV investments. Unfortunately, Empire's managers are expected to waste 10% of its net income on needless perks pet projects, and other expenditures that do not contribute to the fim. All remaining income will be distributed to shareholders. a. What are the two benefits of debt financing for Empire? b. By how much would each $1 of interest expense reduce Empire's distributions to shareholders? c. What is the increase in the total funds Empire will pay to investors for each $1 of interest expense? a. What are the two benefits of debt financing for Empire? (Select the best choice below.) A. Tax and interest cost benefits B. Interest cost benefits and reducing wasteful investment C. Dividend and tax benefits D. Tax benefits and reducing wasteful investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts