Question: Hey im having troubles with this problem. can someone show me A through C with work shown so i can understand how it was done.

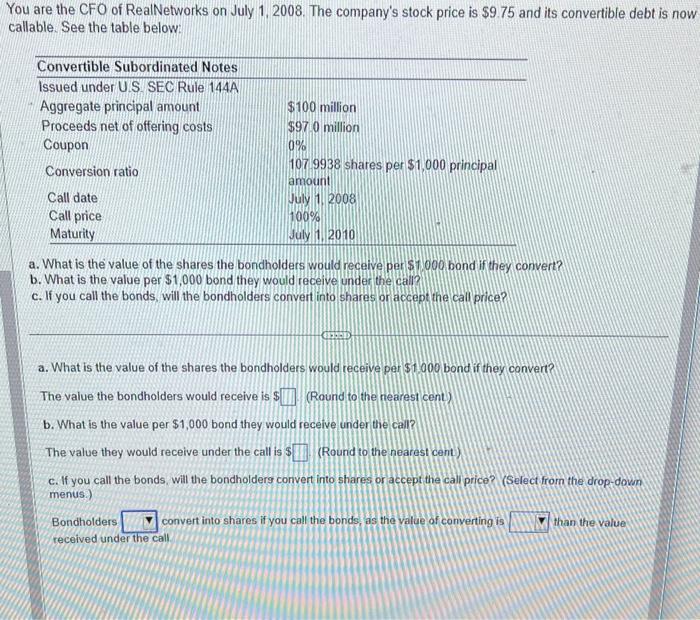

fou are the CFO of RealNetworks on July 1, 2008. The company's stock price is $9.75 and its convertible debt is now callable. See the table below: a. What is the value of the shares the bondholders would receive per \$1,000 bond if they convert? b. What is the value per $1,000 bond they would receive under the call? c. If you call the bonds, will the bondholders convert into shares or accept the call price? a. What is the value of the shares the bondholders would receive per $1.000 bond if they convert? The value the bondholders would receive is $ (Round to the nearest cent) b. What is the value per $1,000 bond they would receive under tile call? The value they would receive under the call is \& (Round to the nearest cent) c. If you call the bonds, will the bondholders convert into shares or accept the call price? (Select from the drop-dovm menus.) Bondholders convert into shares if you call the bonds, as the value of converting is than the value received under the call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts