Question: Hey im having troubles with this problem. can someone show me A through B with work shown so i can understand how it was done.

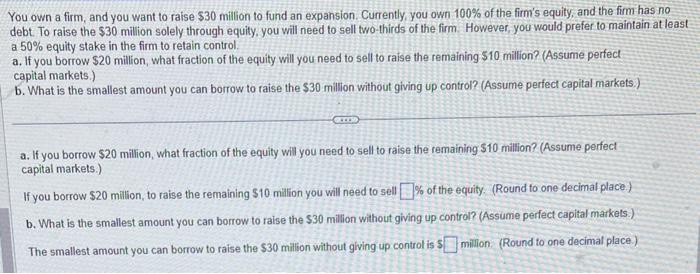

You own a firm, and you want to raise $30 million to fund an expansion. Currently, you own 100% of the firm's equity, and the firm has no debt. To raise the $30 million solely through equity, you will need to sell two-thirds of the firm. However, you would prefer to maintain at least a 50% equity stake in the firm to retain control. a. If you borrow $20 million, what fraction of the equity will you need to sell to raise the remaining $10 million? (Assume perfect capital markets.) b. What is the smallest amount you can borrow to raise the $30 million without giving up control? (Assume perfect capital markets.) a. If you borrow $20 million, what fraction of the equity will you need to sell to raise the remaining $10 million? (Assume perfect capital markets.) If you borrow $20 million, to raise the remaining $10 million you will need to sell \% of the equity. (Round to one decimal place.) b. What is the smallest amount you can borrow to raise the $30 milion without giving up control? (Assume perfect capital markets.) The smallest amount you can borrow to raise the $30 million without giving up control is 5 million. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts