Question: hi can i have help with this two part question? Lightwood Ltd has investments in two subsidiary companies. It is preparing its consolidated statement of

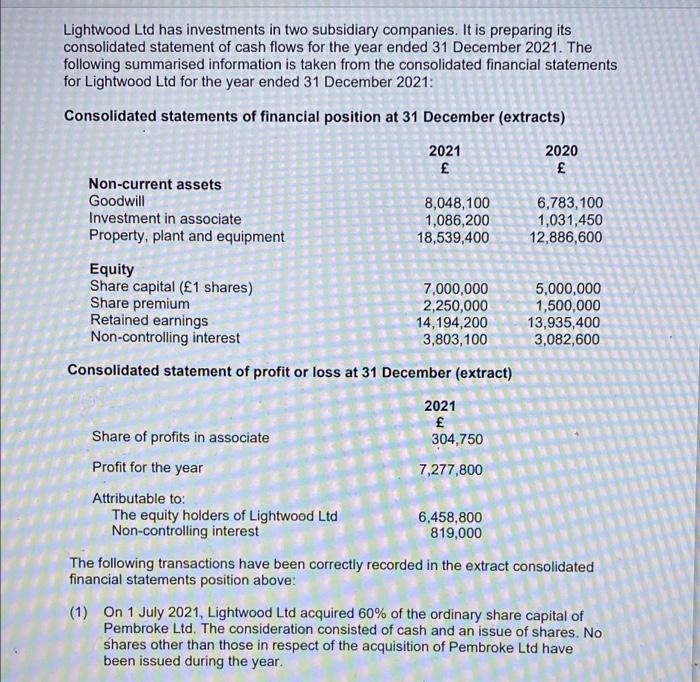

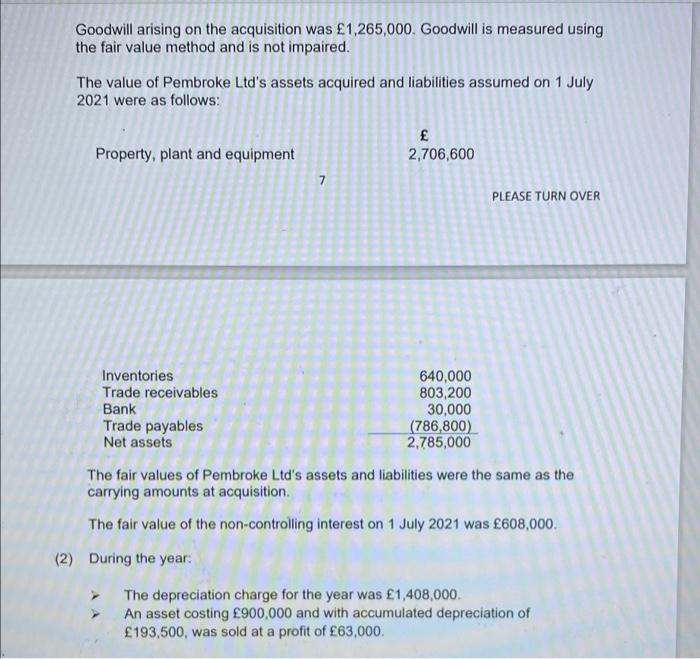

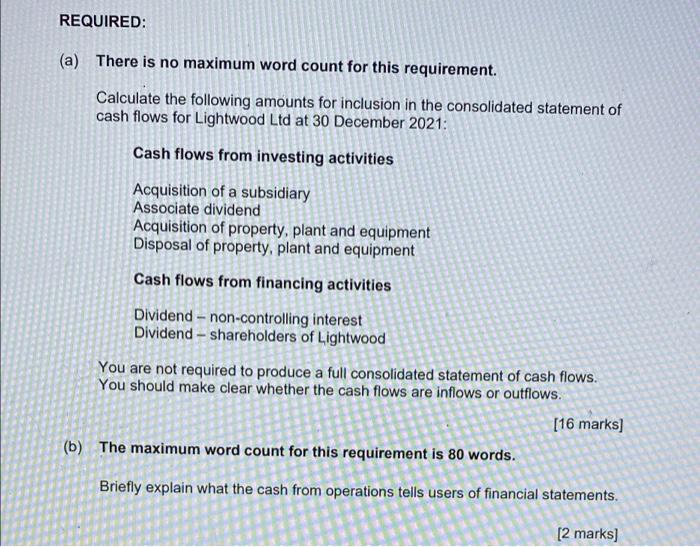

Lightwood Ltd has investments in two subsidiary companies. It is preparing its consolidated statement of cash flows for the year ended 31 December 2021. The following summarised information is taken from the consolidated financial statements for Lightwood Ltd for the year ended 31 December 2021: Consolidated statements of financial position at 31 December (extracts) 2021 2020 Non-current assets Goodwill 8,048,100 6,783,100 Investment in associate 1,086,200 1,031,450 Property, plant and equipment 18,539,400 12,886,600 Equity Share capital (1 shares) 7,000,000 5,000,000 Share premium 2,250,000 1,500,000 Retained earnings 14,194,200 13,935,400 Non-controlling interest 3,803,100 3,082,600 Consolidated statement of profit or loss at 31 December (extract) 2021 Share of profits in associate 304,750 Profit for the year 7,277,800 Attributable to: The equity holders of Lightwood Ltd 6,458,800 Non-controlling interest 819,000 The following transactions have been correctly recorded in the extract consolidated financial statements position above: (1) On 1 July 2021, Lightwood Ltd acquired 60% of the ordinary share capital of Pembroke Ltd. The consideration consisted of cash and an issue of shares. No shares other than those in respect of the acquisition of Pembroke Ltd have been issued during the year. Goodwill arising on the acquisition was 1,265,000. Goodwill is measured using the fair value method and is not impaired. The value of Pembroke Ltd's assets acquired and liabilities assumed on 1 July 2021 were as follows: 2,706,600 Property, plant and equipment 7 PLEASE TURN OVER Inventories Trade receivables Bank Trade payables Net assets 640,000 803,200 30,000 (786,800) 2,785,000 The fair values of Pembroke Ltd's assets and liabilities were the same as the carrying amounts at acquisition The fair value of the non-controlling interest on 1 July 2021 was 608,000. (2) During the year The depreciation charge for the year was 1,408,000. An asset costing 900,000 and with accumulated depreciation of 193,500, was sold at a profit of 63,000. REQUIRED: (a) There is no maximum word count for this requirement. Calculate the following amounts for inclusion in the consolidated statement of cash flows for Lightwood Ltd at 30 December 2021: Cash flows from investing activities Acquisition of a subsidiary Associate dividend Acquisition of property, plant and equipment Disposal of property, plant and equipment Cash flows from financing activities Dividend - non-controlling interest Dividend - shareholders of Lightwood You are not required to produce a full consolidated statement of cash flows. You should make clear whether the cash flows are inflows or outflows. [16 marks) (6) The maximum word count for this requirement is 80 words. Briefly explain what the cash from operations tells users of financial statements. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts