Question: How Do you work out the following GST Code and Tax Input Credit for the following: Only use a motor vehicle for 65% business purpose

How Do you work out the following GST Code and Tax Input Credit for the following:

Only use a motor vehicle for 65% business purpose and 80% mobile phone for business use.

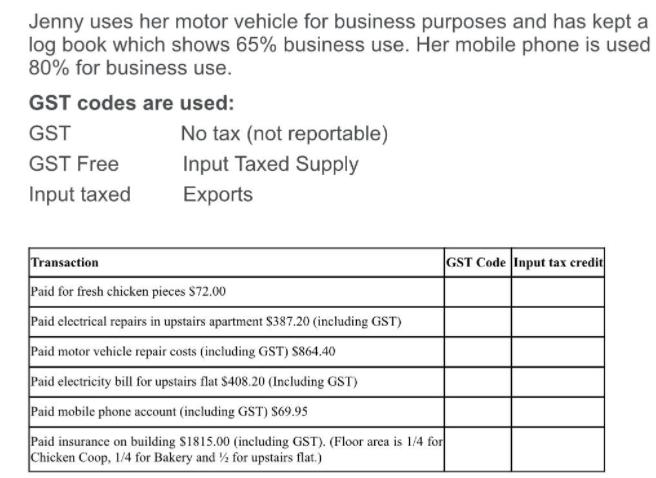

Jenny uses her motor vehicle for business purposes and has kept a log book which shows 65% business use. Her mobile phone is used 80% for business use. GST codes are used: GST No tax (not reportable) GST Free Input Taxed Supply Input taxed Exports Transaction GST Code Input tax credit Paid for fresh chicken pieces $72.00 Paid electrical repairs in upstairs apartment S387.20 (including GST) Paid motor vehicle repair costs (including GST) S864.40 Paid electricity bill for upstairs flat $408.20 (Including GST) Paid mobile phone account (including GST) S69.95 Paid insurance on building S1815.00 (including GST). (Floor area is 1/4 for Chicken Coop, 1/4 for Bakery and % for upstairs flat.)

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

00 Transactions GST Code TIC 1 paid for fresh chicken pieces 7200 GST Fr... View full answer

Get step-by-step solutions from verified subject matter experts