Question: Hi friends! Please show your work and if answer is correct, I will give a thumbs-up! Having a hard time finding the NPV for Project

Hi friends! Please show your work and if answer is correct, I will give a thumbs-up! Having a hard time finding the NPV for Project Bono so this helps a lot! THANK YOU! :)

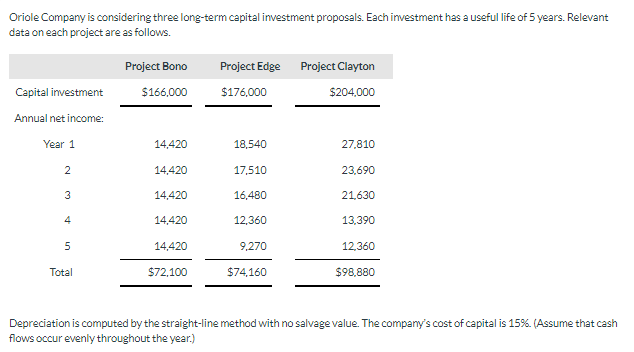

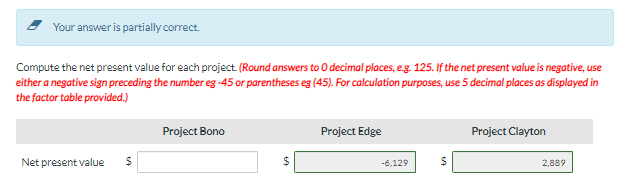

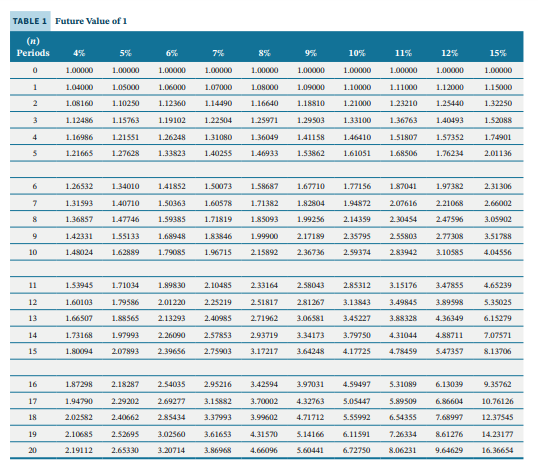

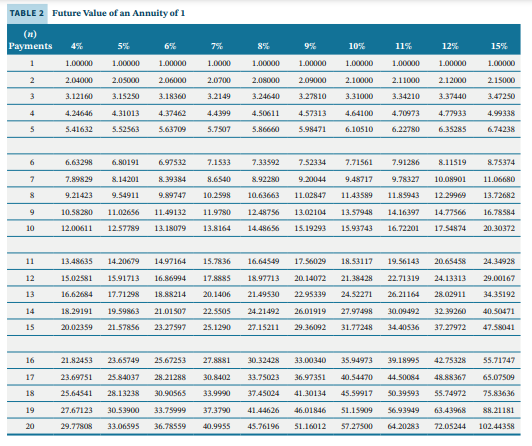

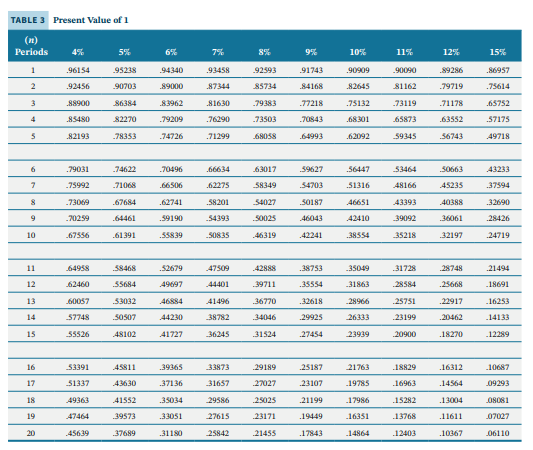

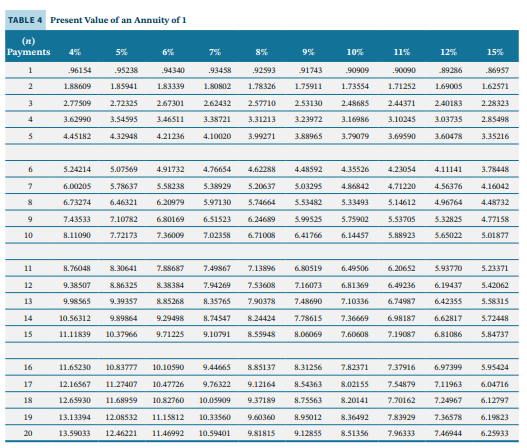

Oriole Company is considering three long-term capital investment proposals. Each imvestment has a useful life of 5 years. Relevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Your answer is partially correct. Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125 . If the net present value is negative, use either a negative sign preceding the number eg 45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) TABLE 1 Future Value of 1 TABLE 2 Future Value of an Annuity of 1 TABLE 3 Present Value of 1 \begin{tabular}{cccccccccccc} (n) & & & & & & & & & & \\ Periods & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 11% & 12% & 15% \\ \hline 1 & .96154 & .95238 & .94340 & .93458 & .92593 & .91743 & .90909 & .90090 & .89286 & .86957 \\ \hline 2 & .92456 & .90703 & .89000 & .87344 & .85734 & .84168 & .82645 & .81162 & .79719 & .75614 \\ \hline 3 & .88900 & .86384 & .83962 & .81630 & .79383 & .77218 & .75132 & .73119 & .71178 & .65752 \\ \hline 4 & .8440 & .82270 & .79209 & .76290 & .73503 & .70843 & .68301 & .65873 & .63552 & .57175 \\ \hline 5 & .82193 & .78353 & .74726 & .71299 & .68058 & .64993 & .62092 & .59345 & .56743 & .49718 \\ \hline \end{tabular} Present Value of an Annuity of 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts