Question: hi guys im really lost what do i do here please explain to someone who have almost no clue thanks watch these videos early enough

hi guys im really lost what do i do here please explain to someone who have almost no clue thanks

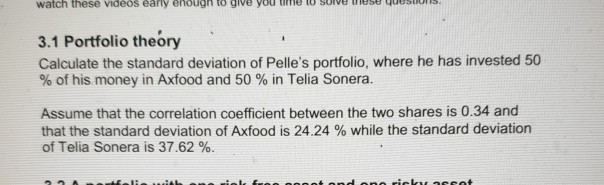

watch these videos early enough to give you time to sove tmese uesio 3.1 Portfolio theory Calculate the standard deviation of Pelle's portfolio, where he has invested 50 % of his money in Axfood and 50 % in Telia Sonera. Assume that the correlation coefficient between the two shares is 0.34 and that the standard deviation of Axfood is 24.24 % while the standard deviation of Telia Sonera is 37.62 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts