Question: Hi - on a time crunch and need some help! Thank you so much in advance, I really really appreciate it!! Question 1 Match the

Hi - on a time crunch and need some help! Thank you so much in advance, I really really appreciate it!!

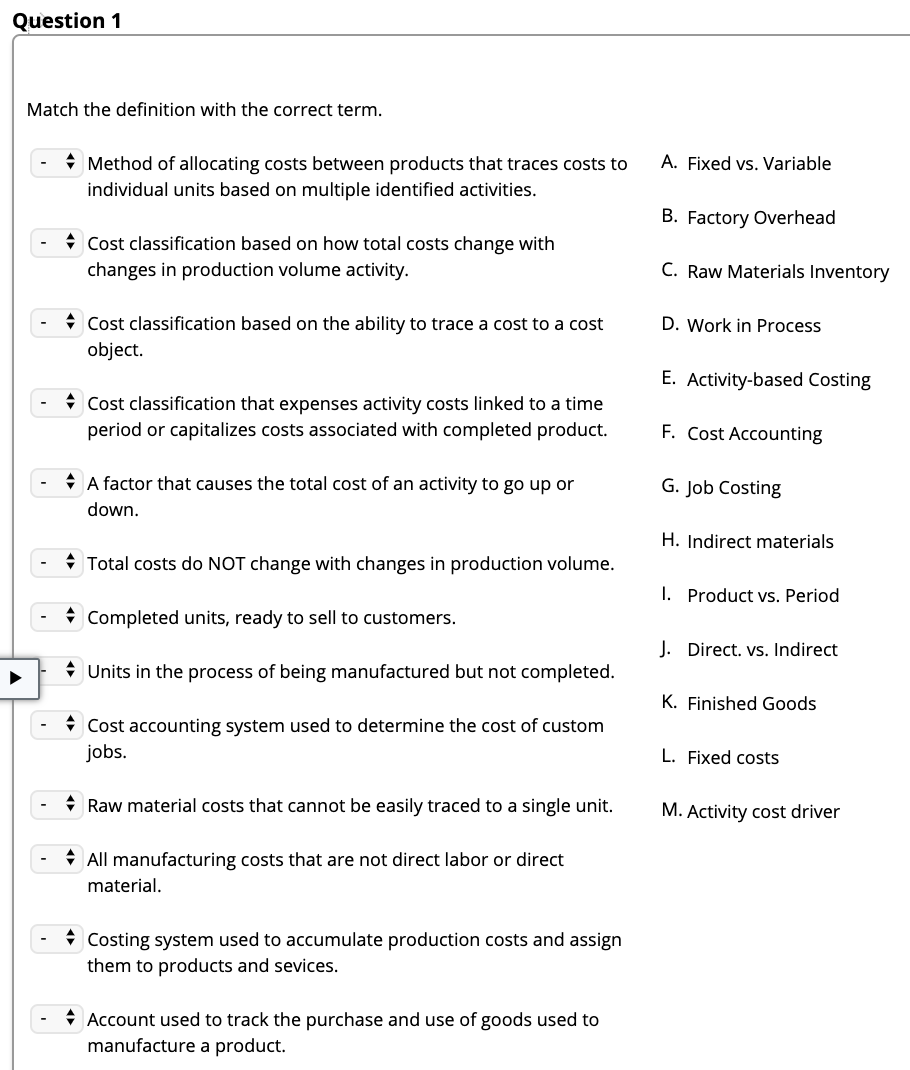

Question 1 Match the definition with the correct term. A. Fixed vs. Variable Method of allocating costs between products that traces costs to individual units based on multiple identified activities. B. Factory Overhead Cost classification based on how total costs change with changes in production volume activity. C. Raw Materials Inventory D. Work in Process Cost classification based on the ability to trace a cost to a cost object. E. Activity-based Costing Cost classification that expenses activity costs linked to a time period or capitalizes costs associated with completed product. F. Cost Accounting A factor that causes the total cost of an activity to go up or down. G. Job Costing H. Indirect materials Total costs do NOT change with changes in production volume. I. Product vs. Period Completed units, ready to sell to customers. J. Direct. vs. Indirect Units in the process of being manufactured but not completed. K. Finished Goods Cost accounting system used to determine the cost of custom jobs. L. Fixed costs Raw material costs that cannot be easily traced to a single unit. M. Activity cost driver All manufacturing costs that are not direct labor or direct material. Costing system used to accumulate production costs and assign them to products and sevices. Account used to track the purchase and use of goods used to manufacture a product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts