Question: Hi! Please answer and show work when necessary :) Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia,

Hi! Please answer and show work when necessary :)

Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (A$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10-year period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over 10 years. Salina Ranchings trial balance on December 31, 20X3, in Australian dollars is as follows:

| Debits | Credits | |

|---|---|---|

| Cash | A$ 44,100 | |

| Accounts Receivable (net) | 72,000 | |

| Inventory | 86,000 | |

| Plant and Equipment | 240,000 | |

| Accumulated Depreciation | A$ 60,000 | |

| Accounts Payable | 53,800 | |

| Payable to Palermo Incorporated | 10,800 | |

| Interest Payable | 3,000 | |

| 12% Bonds Payable | 100,000 | |

| Premium on Bonds | 5,700 | |

| Common Stock | 90,000 | |

| Retained Earnings | 40,000 | |

| Sales | 579,000 | |

| Cost of Goods Sold | 330,000 | |

| Depreciation Expense | 24,000 | |

| Operating Expenses | 131,500 | |

| Interest Expense | 5,700 | |

| Dividends Paid | 9,000 | |

| Total | A$ 942,300 | A$ 942,300 |

Additional Information:

- Salina Ranching uses average cost for cost of goods sold. Inventory increased by A$20,000 during the year. Purchases were made uniformly during 20X3. The ending inventory was acquired at the average exchange rate for the year.

- Plant and equipment were acquired as follows:

| Date | Cost |

|---|---|

| January 20X1 | A$ 180,000 |

| January 1, 20X3 | 60,000 |

- Plant and equipment are depreciated using the straight-line method and a 10-year life with no residual value.

- The payable to Palermo is in Australian dollars. Palermos books show a receivable from Salina Ranching of $6,480.

- The 10-year bonds were issued on July 1, 20X3, for A$106,000. The premium is amortized on a straight-line basis. The interest is paid on April 1 and October 1.

- The dividends were declared and paid on April 1.

- Exchange rates were as follows:

| January 20X1 | A$ 1 = $ 0.93 |

|---|---|

| August 20X1 | A$ 1 = $ 0.88 |

| January 1, 20X3 | A$ 1 = $ 0.70 |

| April 1, 20X3 | A$ 1 = $ 0.67 |

| July 1, 20X3 | A$ 1 = $ 0.64 |

| December 31, 20X3 | A$ 1 = $ 0.60 |

| 20X3 average | A$ 1 = $ 0.65 |

Required:

b.) Correct the chart

c.) Create the following journal entries:

- Record the acquisition of the foreign investment.

- Record the dividend received.

- Record the equity accrual for the percentage of the subsidiary's income.

- Record the amortization of the differential.

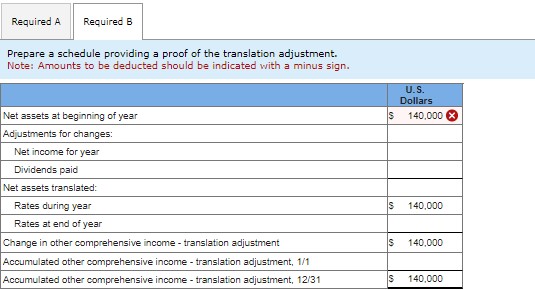

Prepare a schedule providing a proof of the translation adjustment. Note: Amounts to be deducted should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts