Question: Hi! Please answer this question as soon as possible (Prefer within 2 hours). I will make sure to give good rating. Thank you so much

Hi! Please answer this question as soon as possible (Prefer within 2 hours). I will make sure to give good rating. Thank you so much !!

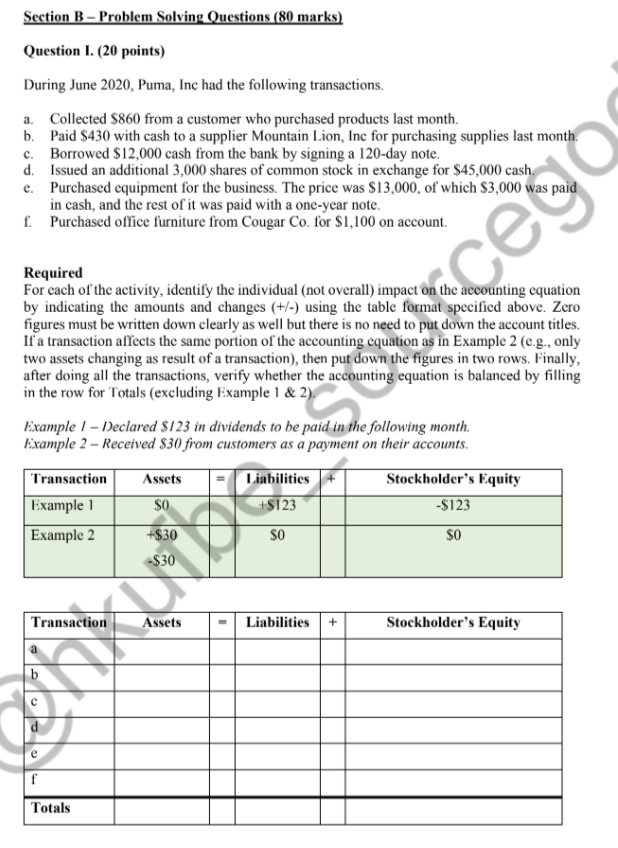

During June 2020, Puma, Inc had the following transactions. a. Collected $860 from a customer who purchased products last month. b. Paid $430 with cash to a supplier Mountain Lion, Inc for purchasing supplies last month. c. Borrowed $12,000 cash from the bank by signing a 120-day note. d. Issued an additional 3,000 shares of common stock in exchange for $45,000 cash. e. Purchased equipment for the business. The price was $13,000, of which $3,000 was paid in cash, and the rest of it was paid with a one-year note. f. Purchased office furniture from Cougar Co. for $1,100 on account. Required For each of the activity, identify the individual (not overall) impact on the accounting equation by indicating the amounts and changes (+/-) using the table format specified above. Zero figures must be written down clearly as well but there is no need to put down the account titles. If a transaction affects the same portion of the accounting equation as in Example 2 (e.g., only two assets changing as result of a transaction), then put down the figures in two rows. Finally, after doing all the transactions, verify whether the accounting equation is balanced by filling in the row for Totals (excluding Example 1 \& 2). Example I- Declared $123 in dividends to be paid in the following month. Example 2 - Received $30 from customers as a payment on their accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts