Question: Hi there, Please answer all the questions; please don't skip any subparts. May you explain all the formulas needed and the theories behind them first.

Hi there,

Please answer all the questions; please don't skip any subparts. May you explain all the formulas needed and the theories behind them first. Feel free to make any reference links that may potentially help me to study. If you don't know any part or subpart, may you not take the question. Please provide an excellent formatted answer, and I strongly prefer typing rather than handwritten. If you provide a bad answer in any form that is badly formatted, or wrong, etc., I am afraid I will need to downvote you and possibly flag it. The answer needs to be. very logical, easy to understand , clear and cover all the necessary theories. I believe you are able to do a good job.Thank you.

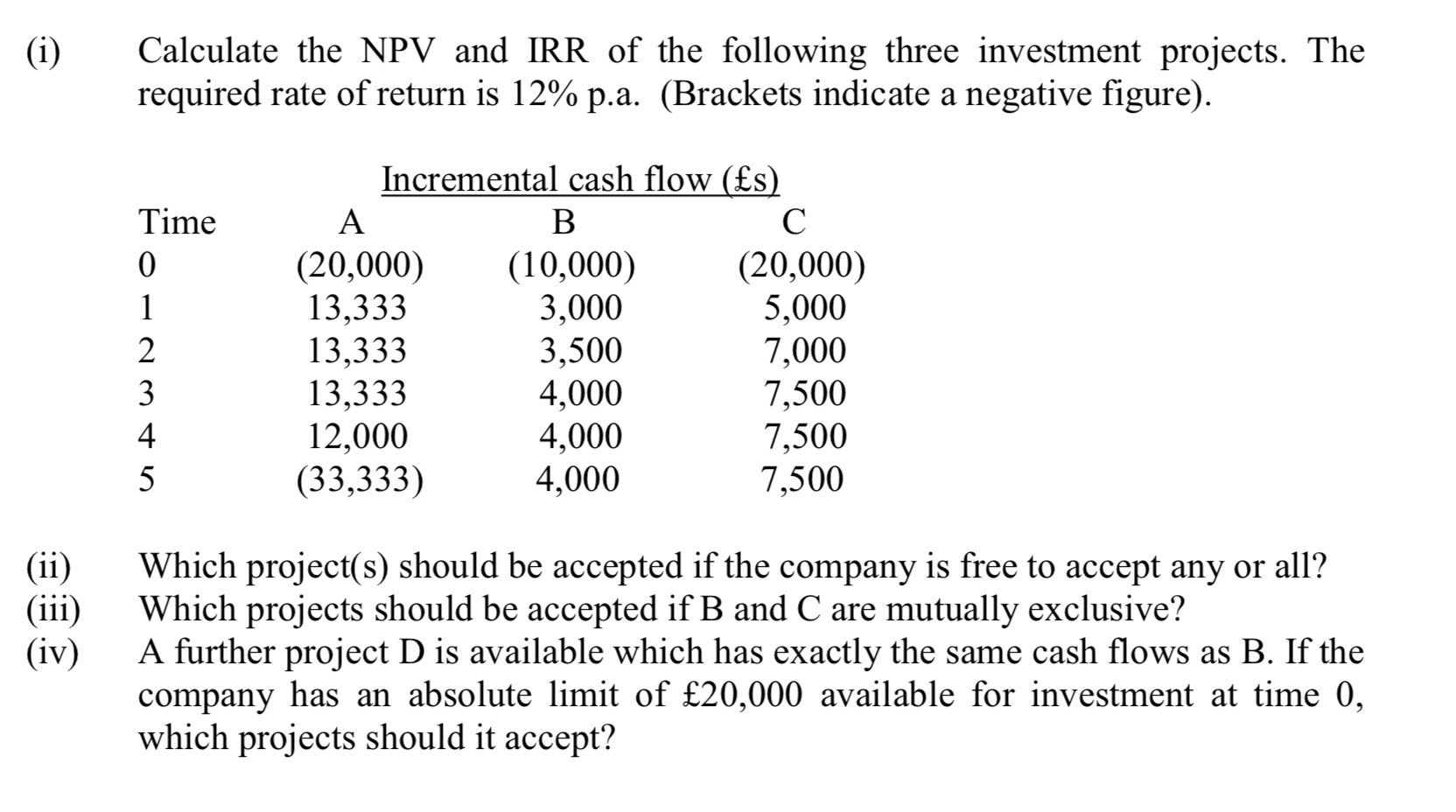

(i) Calculate the NPV and IRR of the following three investment projects. The required rate of return is 12% p.a. (Brackets indicate a negative figure). Time 0 1 2 3 4 5 Incremental cash flow (s) A B (20,000) (10,000) (20,000) 13,333 3,000 5,000 13,333 3,500 7,000 13,333 4,000 7,500 12,000 4,000 7,500 (33,333) 4,000 7,500 (ii) (iii) (iv) Which project(s) should be accepted if the company is free to accept any or all? Which projects should be accepted if B and C are mutually exclusive? A further project D is available which has exactly the same cash flows as B. If the company has an absolute limit of 20,000 available for investment at time 0, which projects should it accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts