Question: Hi Tutor, I am looking for the answer for these following question. It would be great if you could answer these questions and post it

Hi Tutor,

I am looking for the answer for these following question. It would be great if you could answer these questions and post it in screenshot format like I posted the question for you (screenshot). I hope you understand and thank you so much for the help.

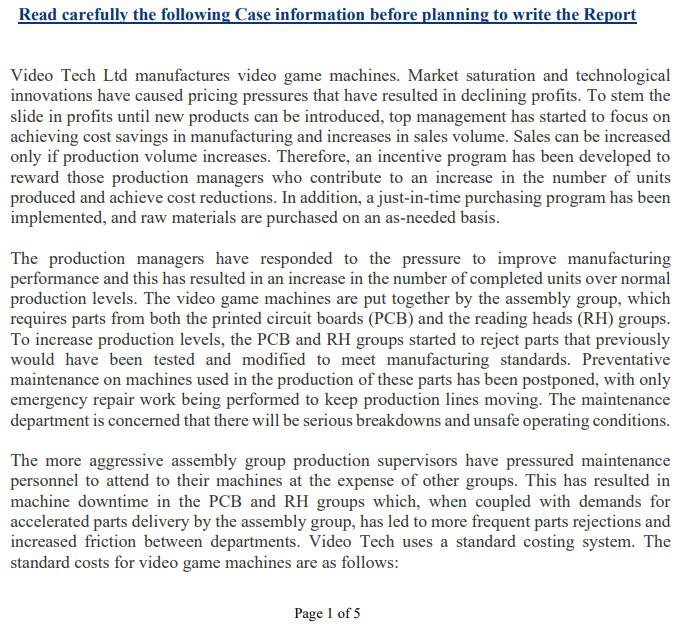

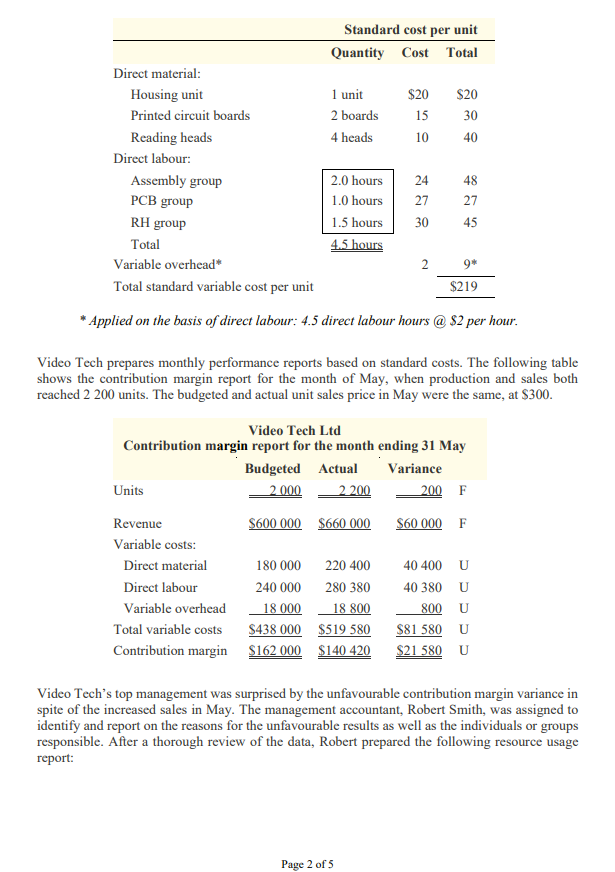

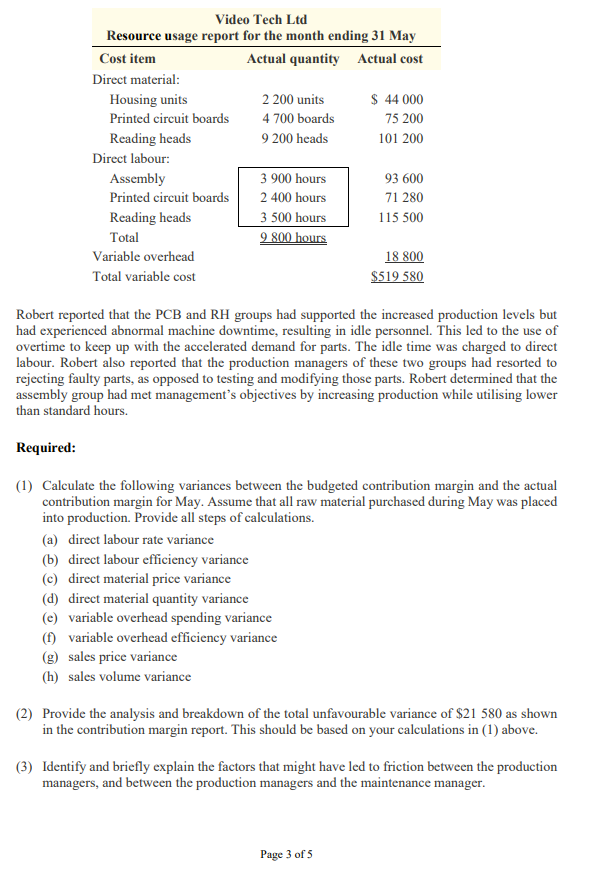

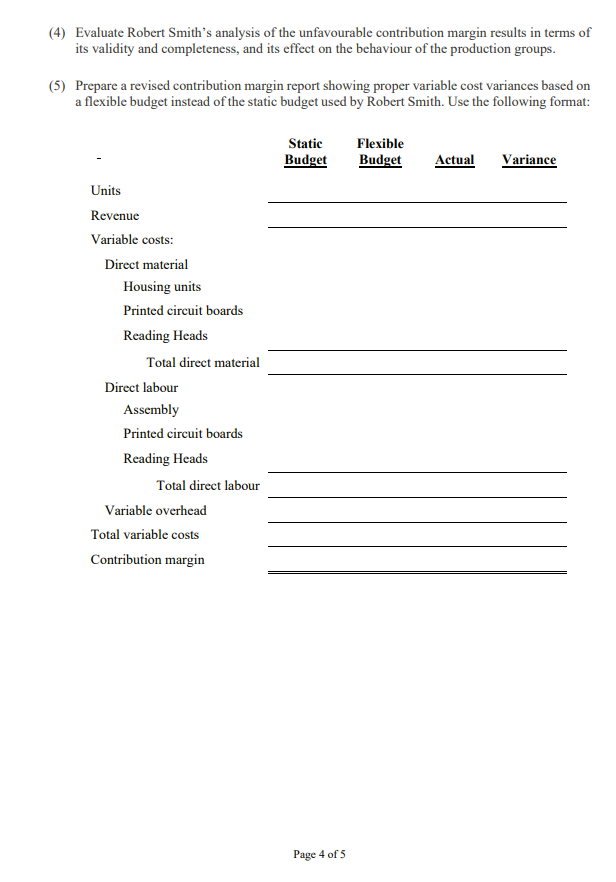

Read carefully the following Case information before planning to write the Report Video Tech Ltd manufactures video game machines. Market saturation and technological innovations have caused pricing pressures that have resulted in declining profits. To stem the slide in profits until new products can be introduced, top management has started to focus on achieving cost savings in manufacturing and increases in sales volume. Sales can be increased only if production volume increases. Therefore, an incentive program has been developed to reward those production managers who contribute to an increase in the number of units produced and achieve cost reductions. In addition, a just-in-time purchasing program has been implemented, and raw materials are purchased on an as-needed basis. The production managers have responded to the pressure to improve manufacturing performance and this has resulted in an increase in the number of completed units over normal production levels. The video game machines are put together by the assembly group, which requires parts from both the printed circuit boards (PCB) and the reading heads (RH) groups. To increase production levels, the PCB and RH groups started to reject parts that previously would have been tested and modified to meet manufacturing standards. Preventative maintenance on machines used in the production of these parts has been postponed, with only emergency repair work being performed to keep production lines moving. The maintenance department is concerned that there will be serious breakdowns and unsafe operating conditions. The more aggressive assembly group production supervisors have pressured maintenance personnel to attend to their machines at the expense of other groups. This has resulted in machine downtime in the PCB and RH groups which, when coupled with demands for accelerated parts delivery by the assembly group, has led to more frequent parts rejections and increased friction between departments. Video Tech uses a standard costing system. The standard costs for video game machines are as follows: Page 1 of 5 Standard cost per unit Quantity Cost Total 1 unit 2 boards 4 heads $20 15 10 $20 30 40 Direct material: Housing unit Printed circuit boards Reading heads Direct labour: Assembly group PCB group RH group Total Variable overhead* Total standard variable cost per unit 2.0 hours 1.0 hours 1.5 hours 4.5 hours 24 27 30 48 27 45 2 9* $219 Applied on the basis of direct labour: 4.5 direct labour hours @ $2 per hour. Video Tech prepares monthly performance reports based on standard costs. The following table shows the contribution margin report for the month of May, when production and sales both reached 2 200 units. The budgeted and actual unit sales price in May were the same, at $300. Video Tech Ltd Contribution margin report for the month ending 31 May Budgeted Actual Variance Units 2.000 2 200 200 F $60 000 F Revenue $600 000 $660 000 Variable costs: Direct material 180 000 220 400 Direct labour 240 000 280 380 Variable overhead 18 000 18 800 Total variable costs $438 000 $519 580 Contribution margin $162 000 $140 420 40 400 U 40 380 V 800 U $81 580 U $21 580 U Video Tech's top management was surprised by the unfavourable contribution margin variance in spite of the increased sales in May. The management accountant, Robert Smith, was assigned to identify and report on the reasons for the unfavourable results as well as the individuals or groups responsible. After a thorough review of the data, Robert prepared the following resource usage report: Page 2 of 5 Video Tech Ltd Resource usage report for the month ending 31 May Cost item Actual quantity Actual cost Direct material: Housing units 2 200 units $ 44 000 Printed circuit boards 4 700 boards 75 200 Reading heads 9 200 heads 101 200 Direct labour: Assembly 3 900 hours 93 600 Printed circuit boards 2 400 hours 71 280 Reading heads 3 500 hours 115 500 Total 9 800 hours Variable overhead 18 800 Total variable cost $519 580 Robert reported that the PCB and RH groups had supported the increased production levels but had experienced abnormal machine downtime, resulting in idle personnel. This led to the use of overtime to keep up with the accelerated demand for parts. The idle time was charged to direct labour. Robert also reported that the production managers of these two groups had resorted to rejecting faulty parts, as opposed to testing and modifying those parts. Robert determined that the assembly group had met management's objectives by increasing production while utilising lower than standard hours. Required: (1) Calculate the following variances between the budgeted contribution margin and the actual contribution margin for May. Assume that all raw material purchased during May was placed into production. Provide all steps of calculations. (a) direct labour rate variance (b) direct labour efficiency variance (c) direct material price variance (d) direct material quantity variance (e) variable overhead spending variance (1) variable overhead efficiency variance (g) sales price variance (h) sales volume variance (2) Provide the analysis and breakdown of the total unfavourable variance of $21 580 as shown in the contribution margin report. This should be based on your calculations in (1) above. (3) Identify and briefly explain the factors that might have led to friction between the production managers, and between the production managers and the maintenance manager. Page 3 of 5 (4) Evaluate Robert Smith's analysis of the unfavourable contribution margin results in terms of its validity and completeness, and its effect on the behaviour of the production groups. (5) Prepare a revised contribution margin report showing proper variable cost variances based on a flexible budget instead of the static budget used by Robert Smith. Use the following format: Static Budget Flexible Budget Actual Variance Units Revenue Variable costs: Direct material Housing units Printed circuit boards Reading Heads Total direct material Direct labour Assembly Printed circuit boards Reading Heads Total direct labour Variable overhead Total variable costs Contribution margin Page 4 of 5 Read carefully the following Case information before planning to write the Report Video Tech Ltd manufactures video game machines. Market saturation and technological innovations have caused pricing pressures that have resulted in declining profits. To stem the slide in profits until new products can be introduced, top management has started to focus on achieving cost savings in manufacturing and increases in sales volume. Sales can be increased only if production volume increases. Therefore, an incentive program has been developed to reward those production managers who contribute to an increase in the number of units produced and achieve cost reductions. In addition, a just-in-time purchasing program has been implemented, and raw materials are purchased on an as-needed basis. The production managers have responded to the pressure to improve manufacturing performance and this has resulted in an increase in the number of completed units over normal production levels. The video game machines are put together by the assembly group, which requires parts from both the printed circuit boards (PCB) and the reading heads (RH) groups. To increase production levels, the PCB and RH groups started to reject parts that previously would have been tested and modified to meet manufacturing standards. Preventative maintenance on machines used in the production of these parts has been postponed, with only emergency repair work being performed to keep production lines moving. The maintenance department is concerned that there will be serious breakdowns and unsafe operating conditions. The more aggressive assembly group production supervisors have pressured maintenance personnel to attend to their machines at the expense of other groups. This has resulted in machine downtime in the PCB and RH groups which, when coupled with demands for accelerated parts delivery by the assembly group, has led to more frequent parts rejections and increased friction between departments. Video Tech uses a standard costing system. The standard costs for video game machines are as follows: Page 1 of 5 Standard cost per unit Quantity Cost Total 1 unit 2 boards 4 heads $20 15 10 $20 30 40 Direct material: Housing unit Printed circuit boards Reading heads Direct labour: Assembly group PCB group RH group Total Variable overhead* Total standard variable cost per unit 2.0 hours 1.0 hours 1.5 hours 4.5 hours 24 27 30 48 27 45 2 9* $219 Applied on the basis of direct labour: 4.5 direct labour hours @ $2 per hour. Video Tech prepares monthly performance reports based on standard costs. The following table shows the contribution margin report for the month of May, when production and sales both reached 2 200 units. The budgeted and actual unit sales price in May were the same, at $300. Video Tech Ltd Contribution margin report for the month ending 31 May Budgeted Actual Variance Units 2.000 2 200 200 F $60 000 F Revenue $600 000 $660 000 Variable costs: Direct material 180 000 220 400 Direct labour 240 000 280 380 Variable overhead 18 000 18 800 Total variable costs $438 000 $519 580 Contribution margin $162 000 $140 420 40 400 U 40 380 V 800 U $81 580 U $21 580 U Video Tech's top management was surprised by the unfavourable contribution margin variance in spite of the increased sales in May. The management accountant, Robert Smith, was assigned to identify and report on the reasons for the unfavourable results as well as the individuals or groups responsible. After a thorough review of the data, Robert prepared the following resource usage report: Page 2 of 5 Video Tech Ltd Resource usage report for the month ending 31 May Cost item Actual quantity Actual cost Direct material: Housing units 2 200 units $ 44 000 Printed circuit boards 4 700 boards 75 200 Reading heads 9 200 heads 101 200 Direct labour: Assembly 3 900 hours 93 600 Printed circuit boards 2 400 hours 71 280 Reading heads 3 500 hours 115 500 Total 9 800 hours Variable overhead 18 800 Total variable cost $519 580 Robert reported that the PCB and RH groups had supported the increased production levels but had experienced abnormal machine downtime, resulting in idle personnel. This led to the use of overtime to keep up with the accelerated demand for parts. The idle time was charged to direct labour. Robert also reported that the production managers of these two groups had resorted to rejecting faulty parts, as opposed to testing and modifying those parts. Robert determined that the assembly group had met management's objectives by increasing production while utilising lower than standard hours. Required: (1) Calculate the following variances between the budgeted contribution margin and the actual contribution margin for May. Assume that all raw material purchased during May was placed into production. Provide all steps of calculations. (a) direct labour rate variance (b) direct labour efficiency variance (c) direct material price variance (d) direct material quantity variance (e) variable overhead spending variance (1) variable overhead efficiency variance (g) sales price variance (h) sales volume variance (2) Provide the analysis and breakdown of the total unfavourable variance of $21 580 as shown in the contribution margin report. This should be based on your calculations in (1) above. (3) Identify and briefly explain the factors that might have led to friction between the production managers, and between the production managers and the maintenance manager. Page 3 of 5 (4) Evaluate Robert Smith's analysis of the unfavourable contribution margin results in terms of its validity and completeness, and its effect on the behaviour of the production groups. (5) Prepare a revised contribution margin report showing proper variable cost variances based on a flexible budget instead of the static budget used by Robert Smith. Use the following format: Static Budget Flexible Budget Actual Variance Units Revenue Variable costs: Direct material Housing units Printed circuit boards Reading Heads Total direct material Direct labour Assembly Printed circuit boards Reading Heads Total direct labour Variable overhead Total variable costs Contribution margin Page 4 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts