Question: HOMEWORK # 1 PROJECT SELECTION MODELS AND DECISION TREE ANALYSIS A project manager is working on justification of a project. Since very little information is

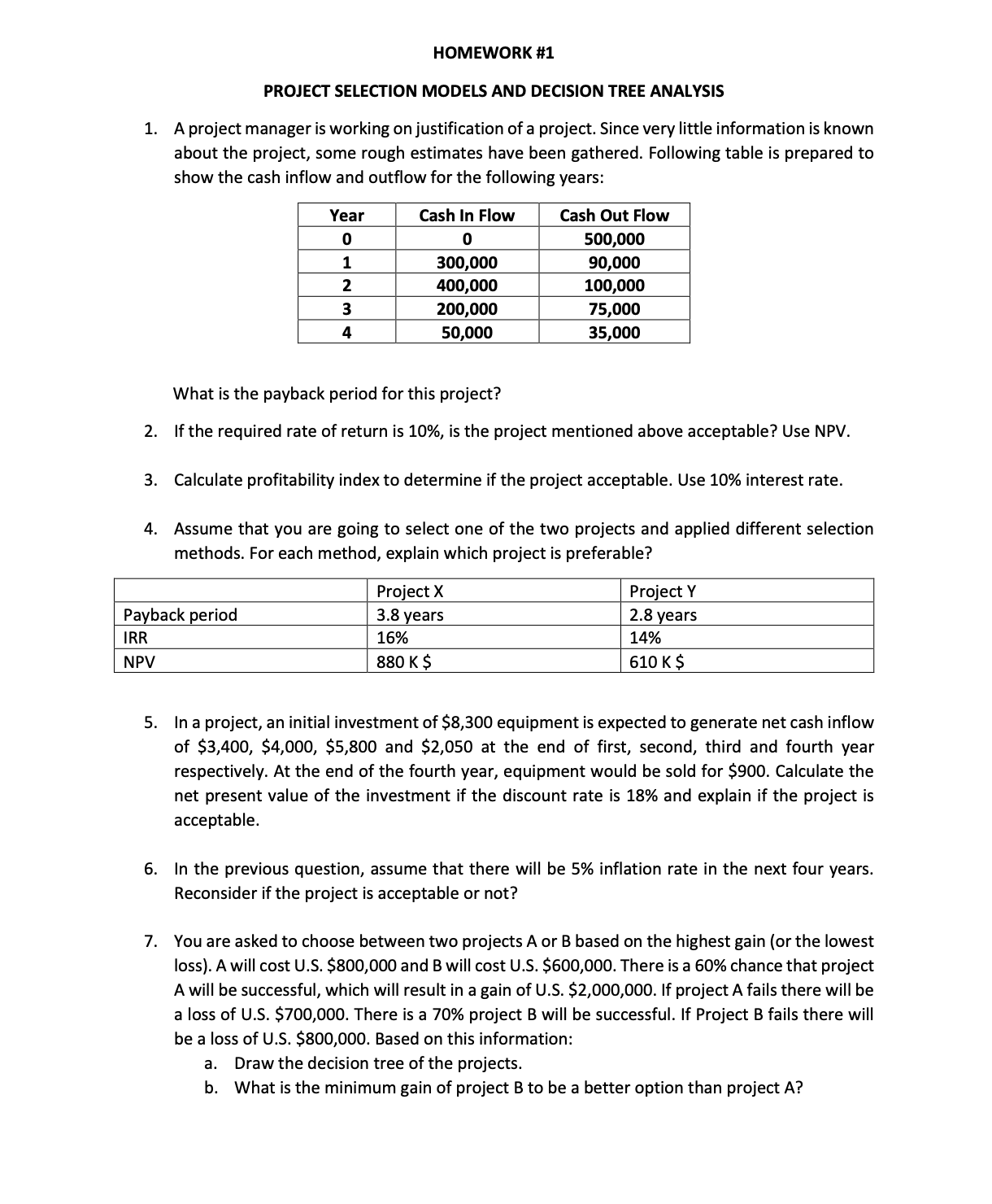

HOMEWORK # PROJECT SELECTION MODELS AND DECISION TREE ANALYSIS A project manager is working on justification of a project. Since very little information is known about the project, some rough estimates have been gathered. Following table is prepared to show the cash inflow and outflow for the following years: What is the payback period for this project? If the required rate of return is is the project mentioned above acceptable? Use NPV Calculate profitability index to determine if the project acceptable. Use interest rate. Assume that you are going to select one of the two projects and applied different selection methods. For each method, explain which project is preferable? In a project, an initial investment of $ equipment is expected to generate net cash inflow of $$$ and $ at the end of first, second, third and fourth year respectively. At the end of the fourth year, equipment would be sold for $ Calculate the net present value of the investment if the discount rate is and explain if the project is acceptable. In the previous question, assume that there will be inflation rate in the next four years. Reconsider if the project is acceptable or not? You are asked to choose between two projects A or B based on the highest gain or the lowest loss A will cost US $ and B will cost US $ There is a chance that project A will be successful, which will result in a gain of US $ If project A fails there will be a loss of US $ There is a project B will be successful. If Project B fails there will be a loss of US $ Based on this information: a Draw the decision tree of the projects. b What is the minimum gain of project B to be a better option than project A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock