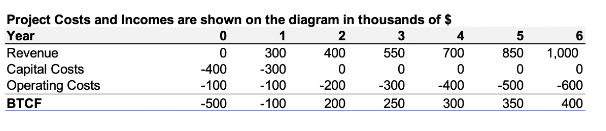

Question: Economic consideration is being given for a proposal to build out a new business. All capital and operating costs are in thousands of dollars. Revenue

Economic consideration is being given for a proposal to build out a new business. All capital and operating costs are in thousands of dollars. Revenue is forecasted for six years and is also in thousands of dollars. Use a 15% minimum discount rate to evaluate the given proposal. Calculate the Net Present Value (NPV), Rate of Return (ROR), Growth Rate of Return (GROR), Present Value Ratio (PVR), and Benefit Cost Ratio (B/C Ratio). Please interpret all your findings. Finally, what time zero capital cost would give you exactly a 15% rate of return?

Project Costs and Incomes are shown on the diagram in thousands of $ Year Revenue 0 1 2 3 4 5 6 0 300 400 550 700 850 1,000 Capital Costs -400 -300 0 0 0 0 Operating Costs -100 -100 -200 -300 -400 -500 -600 BTCF -500 -100 200 250 300 350 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts