Question: Homework: Chapter 11 Homework (Copy) Question 11, P 11-25 (book/static) Part 1 of 7 HW Score: 46.75%, 5.14 of 11 points O Points: 0 of

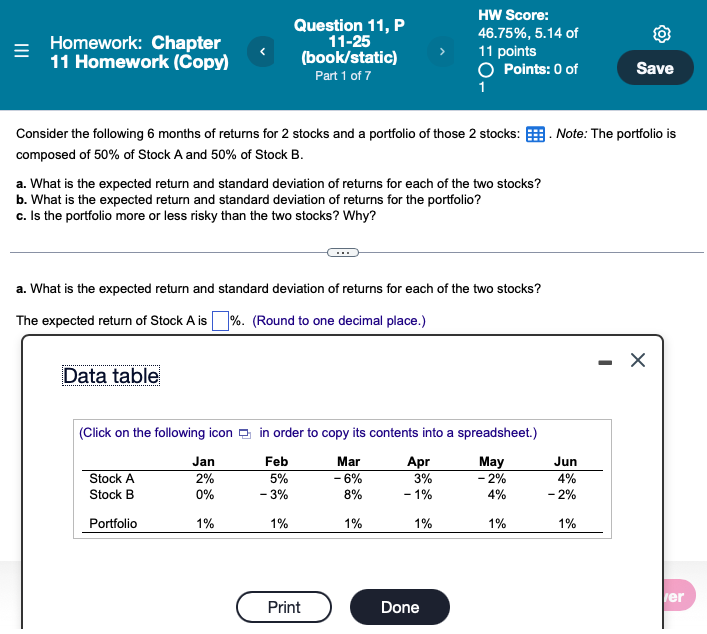

Homework: Chapter 11 Homework (Copy) Question 11, P 11-25 (book/static) Part 1 of 7 HW Score: 46.75%, 5.14 of 11 points O Points: 0 of 1 Save Consider the following 6 months of returns for 2 stocks and a portfolio of those 2 stocks: E. Note: The portfolio is composed of 50% of Stock A and 50% of Stock B. a. What is the expected return and standard deviation of returns for each of the two stocks? b. What is the expected return and standard deviation of returns for the portfolio? C. Is the portfolio more or less risky than the two stocks? Why? a. What is the expected return and standard deviation of returns for each of the two stocks? The expected return of Stock A is %. (Round to one decimal place.) - Data table (Click on the following icon 2 in order to copy its contents into a spreadsheet.) Jan Feb Mar Apr May Stock A 2% 5% - 6% 3% - 2% Stock B 0% - 3% 8% - 1% 4% Portfolio 1% 1% 1% 1% 1% Jun 4% - 2% 1% fer Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts