Question: M Homework: Chapter 8. Risk and Return Question 7, P8-15 (book/static) Part 1 of 3 HW Score: 096, 0 of 20 points O Points: 0

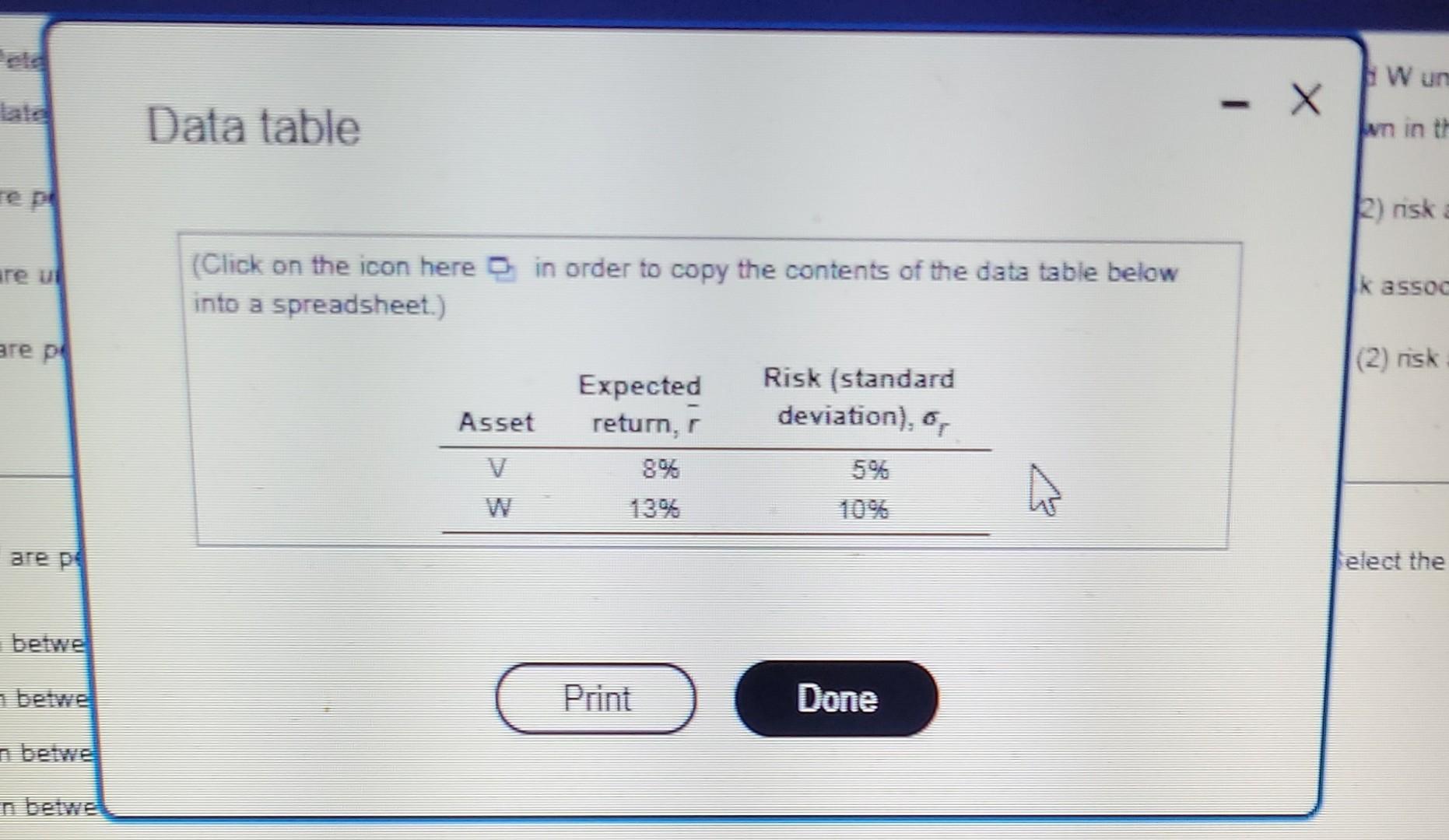

M Homework: Chapter 8. Risk and Return Question 7, P8-15 (book/static) Part 1 of 3 HW Score: 096, 0 of 20 points O Points: 0 of 1 Save Next question Correlation, risk, and return Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and W under three assumed degrees of correlation, perfectly positive uncorrelated and perfectly negative. The expected return and risk values calculated for each of the assets are shown in the following table, a. the returns of assets and w are perfectly positively correlated (correlation coefficient = +1). describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations 6. Mf the returns of assets v ana w are uncorrelated (correlation coefficient = 0), describe the approximate range of (1) expected return and (2) risk associated with all possible portfolio combinations of the returns of assets and are perfectly negatively correlated (correlation coefficient =-1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations, a. the returns of assets V and W are perfectly positively correlated (correlation coefficient = +1). all possible portfolio combinations will have: (Select the best answer below.) KWA a range of expected return between 596 and 10% and risk between 896 and 13%. e a range of expected return between 8% and 13% and risk between 10% and less than 5% but greater than 096. G. a range of expected return between 896 and 12% and risk between 109 and 0% WILSD a range of expected return between 81% and 13% and risk between 5% and 10%. Wun - Data table un in the 2) nisk re ui (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) k assoc are pe (2) risk Risk (standard deviation), o, Asset Expected return, r 8% 1303 v 5% W are pe Jelect the Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts