Question: Homework: HW 4a - NPV and Inv. decision rules Save Score: 0 of 2 pts 5 of 9 (6 completo) HW Score: 48.26%, 11.1 of

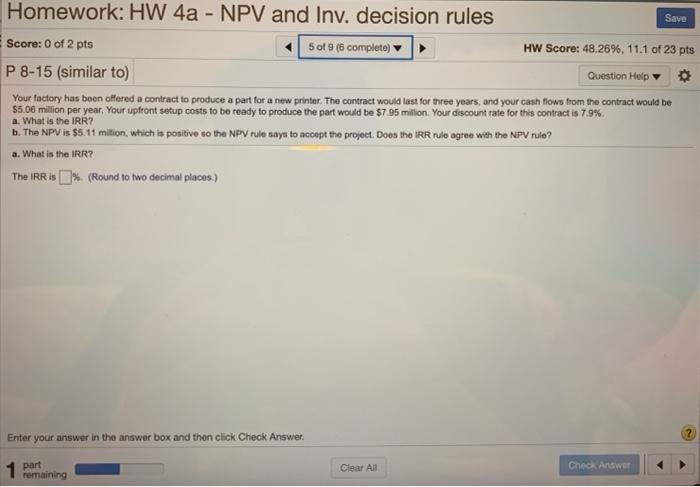

Homework: HW 4a - NPV and Inv. decision rules Save Score: 0 of 2 pts 5 of 9 (6 completo) HW Score: 48.26%, 11.1 of 23 pts P 8-15 (similar to) Question Help Your factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.06 million per year. Your upfront setup costs to be ready to produce the part would be $7.95 milion. Your discount rate for this contract is 7.9% b. The NPV is $5.11 milion, which is positive to the NPV rule says to accept the project. Does the IRR rulo agree with the NPV rule? a. What is the IRR? The IRR IS % (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer 1 part Clear All Check Answer remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts