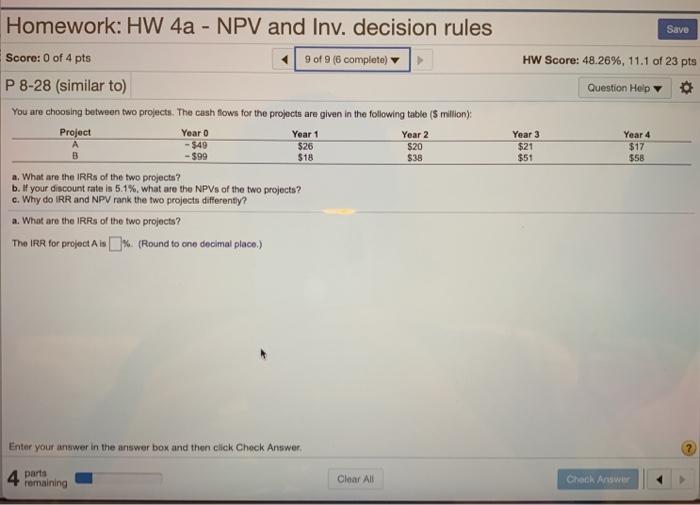

Question: Homework: HW 4a - NPV and Inv. decision rules Save HW Score: 48.26%, 11.1 of 23 pts Question Help Score: 0 of 4 pts 19

Homework: HW 4a - NPV and Inv. decision rules Save HW Score: 48.26%, 11.1 of 23 pts Question Help Score: 0 of 4 pts 19 of 9 (6 complete) P 8-28 (similar to) You are choosing between two projects. The cash lows for the projects are given in the following table (5 million) Project Year 0 Year 1 Year 2 - $49 $26 $20 $99 $18 $38 a. What are the IRRs of the two projects? b. If your discount rate is 5.1%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRR of the two projects? The IRR for project is % (Round to ono decimal place.) Year 3 $21 $51 Year 4 $17 $58 Enter your answer in the answer box and then click Chock Answer. 4 porta remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts