Question: = Homework: Lab 11 Question 1, Problem 18-2 (algorithmic) Part 1 of 5 HW Score: 0%, of 5 points O Points: 0 of 1 Save

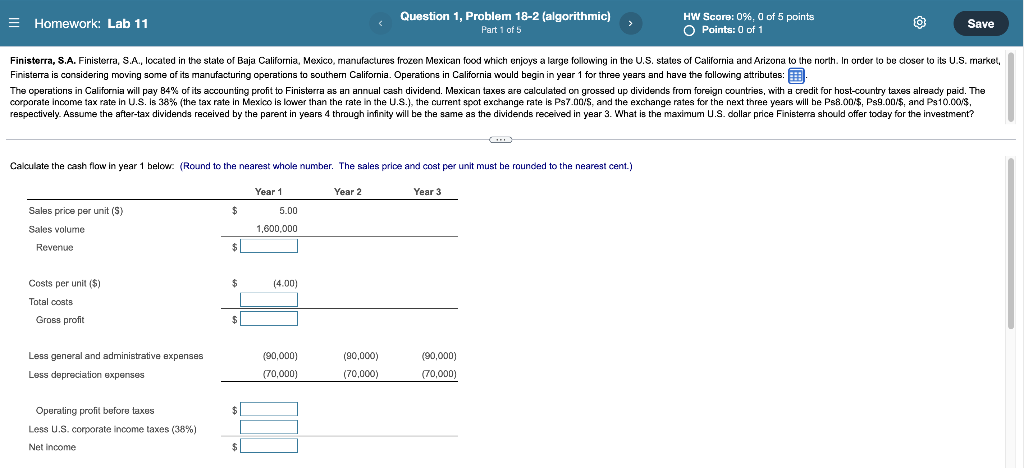

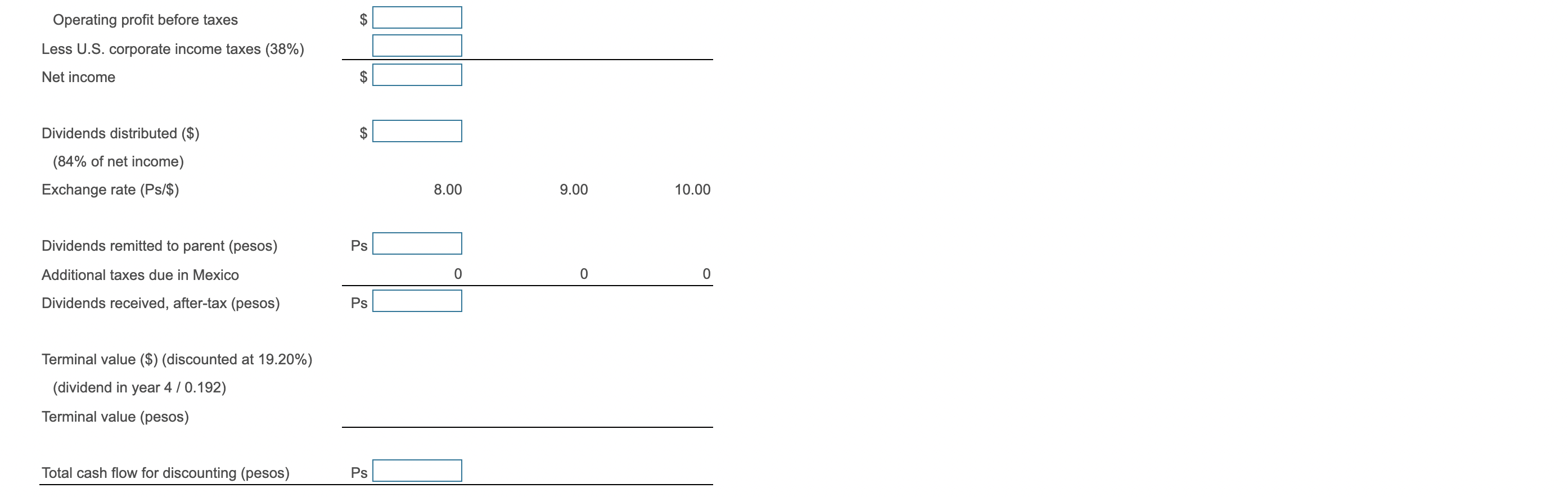

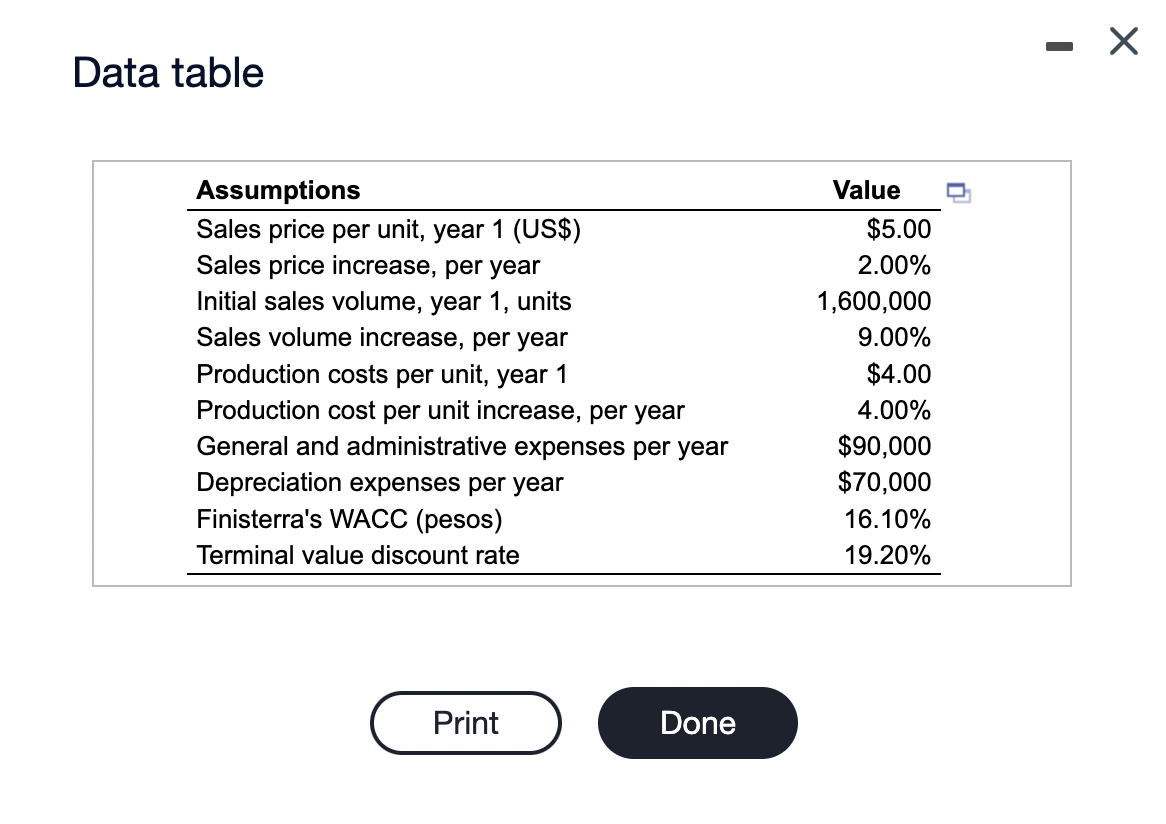

= Homework: Lab 11 Question 1, Problem 18-2 (algorithmic) Part 1 of 5 HW Score: 0%, of 5 points O Points: 0 of 1 Save Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexican food which enjoys a large following in the U.S. states of California and Arizona lo the north. In order to be closer to its U.S. market Finisterra is considering moving some of its manufacturing operations to southern California. Operations in California would begin in year 1 for three years and have the following attributes: 2 The operations in California will pay 84% of its accounting profit to Finisterra as an annual cash dividend. Mexican taxes are calculated on grossed up dividends from foreign countries, with a credit for host-country taxes already paid. The corporate income tax rate in U.S. Is 38% (the tax rate in Mexico is lower than the rate in the U.S.), the current spot exchange rate is P87.0075, and the exchange rates for the next three years will be Ps8.00/$, P89.00/$, and P310.00$. respectively. Assume the after-tax dividends received by the parent in years 4 through infinity will be the same as the dividends received in year 3. What is the maximum U.S. dollar price Finisterra should offer today for the investment? Calculate the cash flow in year 1 below. (Round to the nearest whole number. The sales price and cost per unit must be rounded to the nearest cent.) Year 1 Year 2 Year 3 Sales price per unit (S) $ 5.00 1,600,000 Sales volume Revenue $ $ (4.00) Costs per unit ($) Total costs Gross profit $ Less general and administrative expenses Less depreciation expenses (90,000) (70,000 (90,000) (70,000) (90,000) (70,000) $ 1 Operating profit before taxes Less U.S. corporate income taxes (38%) Net income $ Operating profit before taxes $ Less U.S. corporate income taxes (38%) Net income $ III $ Dividends distributed ($) (84% of net income) Exchange rate (Ps/$) 8.00 9.00 10.00 Dividends remitted to parent (pesos) Ps Additional taxes due in Mexico 0 0 0 Dividends received, after-tax (pesos) Ps Terminal value ($) (discounted at 19.20%) (dividend in year 4 / 0.192) Terminal value (pesos) Total cash flow for discounting (pesos) Ps Data table Assumptions Sales price per unit, year 1 (US$) Sales price increase, per year Initial sales volume, year 1, units Sales volume increase, per year Production costs per unit, year 1 Production cost per unit increase, per year General and administrative expenses per year Depreciation expenses per year Finisterra's WACC (pesos) Terminal value discount rate Value $5.00 2.00% 1,600,000 9.00% $4.00 4.00% $90,000 $70,000 16.10% 19.20% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts