Question: Homework: Week 5 Homework (Ch 17, 20) O Part 1 of 2 Question 16 > Score: 0 of 1 point Save In mid-February 2016, European-style

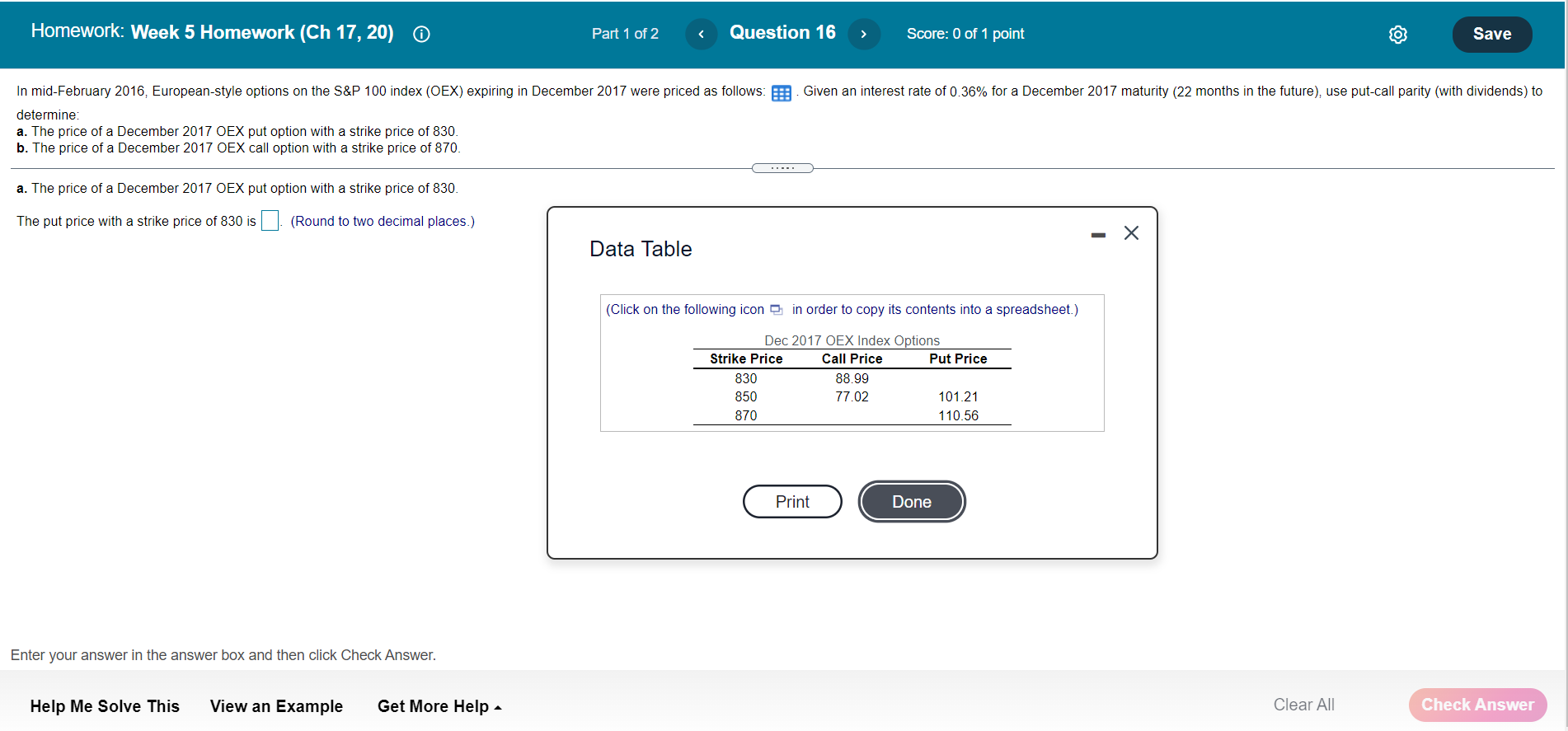

Homework: Week 5 Homework (Ch 17, 20) O Part 1 of 2 Question 16 > Score: 0 of 1 point Save In mid-February 2016, European-style options on the S&P 100 index (OEX) expiring in December 2017 were priced as follows: Given an interest rate of 0.36% for a December 2017 maturity (22 months in the future), use put-call parity (with dividends) to determine: a. The price of a December 2017 OEX put option with a strike price of 830. b. The price of a December 2017 OEX call option with a strike price of 870. a. The price of a December 2017 OEX put option with a strike price of 830. The put price with a strike price of 830 is (Round to two decimal places.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Dec 2017 OEX Index Options Strike Price Call Price Put Price 830 88.99 850 77.02 101.21 870 110.56 Print Done Enter your answer in the answer box and then click Check Answer. Help Me Solve This View an Example Get More Help Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts