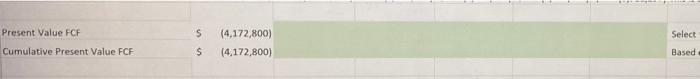

Question: how do I solve for present value FCF and cumulative presemt value FCF thank you in advance! Present Value FCF $ Select (4,172,800) (4,172,800) Cumulative

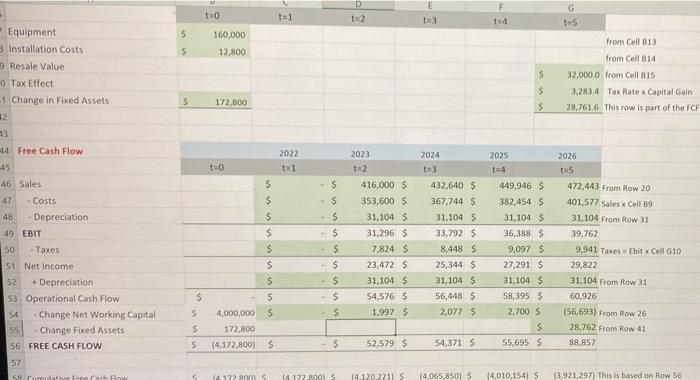

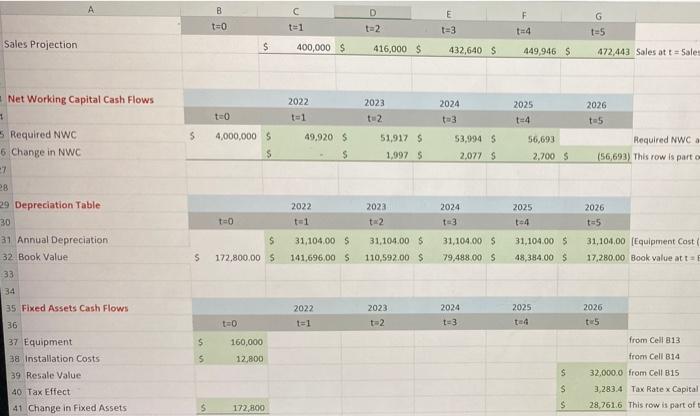

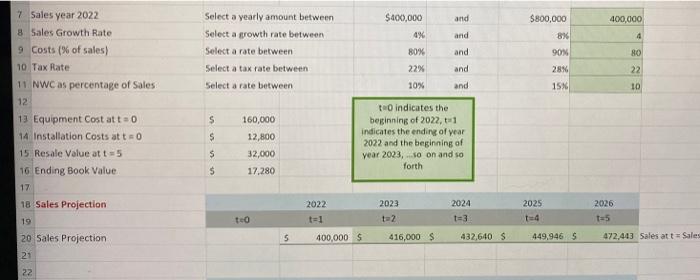

Present Value FCF $ Select (4,172,800) (4,172,800) Cumulative Present Value FCF S Based F to ta1 te2 G t5 5 160,000 12,800 S S from Cell B13 from Cell 814 32,000.0 from cell 015 3,283.4 Tax Ratex Capital Gain 28,7616 This row is part of the FCF 5 172.800 5 5 2022 2025 t=0 2024 te3 t1 4 $ Equipment Installation Costs 9 Resale Value 0 Tax Effect 1 Change in Fixed Assets 2 13 14 Free Cash Flow 45 46 Sales 47 Costs 48 Depreciation 49 EBIT 50 - Taxes 51 Net Income 52 + Depreciation 53 Operational Cash Flow 54 - Change Net Working Capital 55 Change Fixed Assets 56 FREE CASH FLOW 57 $ $ $ $ $ $ $ 4,000,000 $ 172,800 (4,172,800) 5 $ - $ . $ S $ $ S $ - 5 2023 t2 416,000 $ 353,600 $ 31,104 $ 31,296 $ 7.824 $ 23,472 S 31,104 5 54,576 S 1,997 $ 432,640 $ 367,744 $ 31,104 5 33,792 $ 8,448 $ 25,344 $ 31.104 $ 56,448 $ 2,077 $ 449,946 S 382,454 $ 31,104 $ 36,388 $ 9,097 $ 27,291 $ 31.104 $ 58,395 $ 2,700 $ $ 55,695 $ 2026 tes 472,443 From Row 20 401,577 Sales x Cell 89 31,104 From Row 31 39,762 9.941 Taxes Ehitx Cell G10 29,822 31.104 From Row 31 60,926 (56,693) From Row 26 28,762 From Row 41 88,857 $ $ S S - S 52,579S 54,371 $ SA Free Cash 172 2001 14 172 ROOLS 14.120,221) 5 (4,065 850) 5 14,010,154) S (3,921,297) This is based on Row 56 C D B t=0 E F te1 G t=5 ta2 t=3 14 Sales Projection $ 400,000 $ 416,000 $ 432,640 S 449,9465 472,443 Sales at t = Sale! 2024 2022 t=1 2023 t2 teo 2025 t24 Net Working Capital Cash Flows 1 Required NWC 6 Change in NWC 5 4,000,000 $ $ 49.920 S $ 2026 t5 Required NWC a (56,693) This row is parto 51,917 S 1,997 S 53,994 S 2,077 S 56,693 2.700S -7 2022 to1 2023 t2 2024 13 2025 1-4 2026 t=5 TO 28 29 Depreciation Table 30 31 Annual Depreciation 32 Book Value 33 $ 31,104.00 $ 141,696,00 $ 31.104.00 $ 110,592,00 $ 31.104.00 S 79.488.00 S 31,104.00 $ 48,384.00 $ 31,104,00 Equipment Cost 17,280,00 Book value att s 172,800.00 S 34 2024 2025 2022 t=1 2023 t2 2026 tu5 t=0 13 4 160,000 from Cell 313 35 Fixed Assets Cash Flows 36 37 Equipment 38 Installation Costs 39 Resale Value 40 Tax Effect 41 Change in Fixed Assets $ s 12.800 s from Cell 814 32,000.0 from Cell 15 3,283.4 Tax Ratex Capital 28,761,6 This row is part of U 172 800 S and 400,000 $400,000 4% and 4 Select a yearly amount between Select a growth rate between Select a rate between Select a tax rate between Select a rate between 80% 22% and and and $800,000 8% 90% 28% 15% 80 22 10% 10 7 Sales year 2022 8 Sales Growth Rate 9 Costs (% of sales) 10 Tax Rate 11 NWC as percentage of Sales 12 13 Equipment Cost att = 0 14 Installation Costs atto 15. Resale Value at t=5 16 Ending Book Value 17 18 Sales Projection s $ 160,000 12,800 32,000 17,280 to indicates the beginning of 2022, indicates the ending of year 2022 and the beginning of year 2023,...so on and so forth $ 5 2025 2022 t=1 too 2023 2 2024 t=3 2026 1=5 19 4 20 Sales Projection 5 400,000 $ 416,000 $ 432,640 S 449,946 5 472.443 Sales att Sales 21 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts