Question: How do tax credits differ from tax deductions? The benefit of tax deductions is capped by the taxpayer's available standard Tax credits and tax deductions

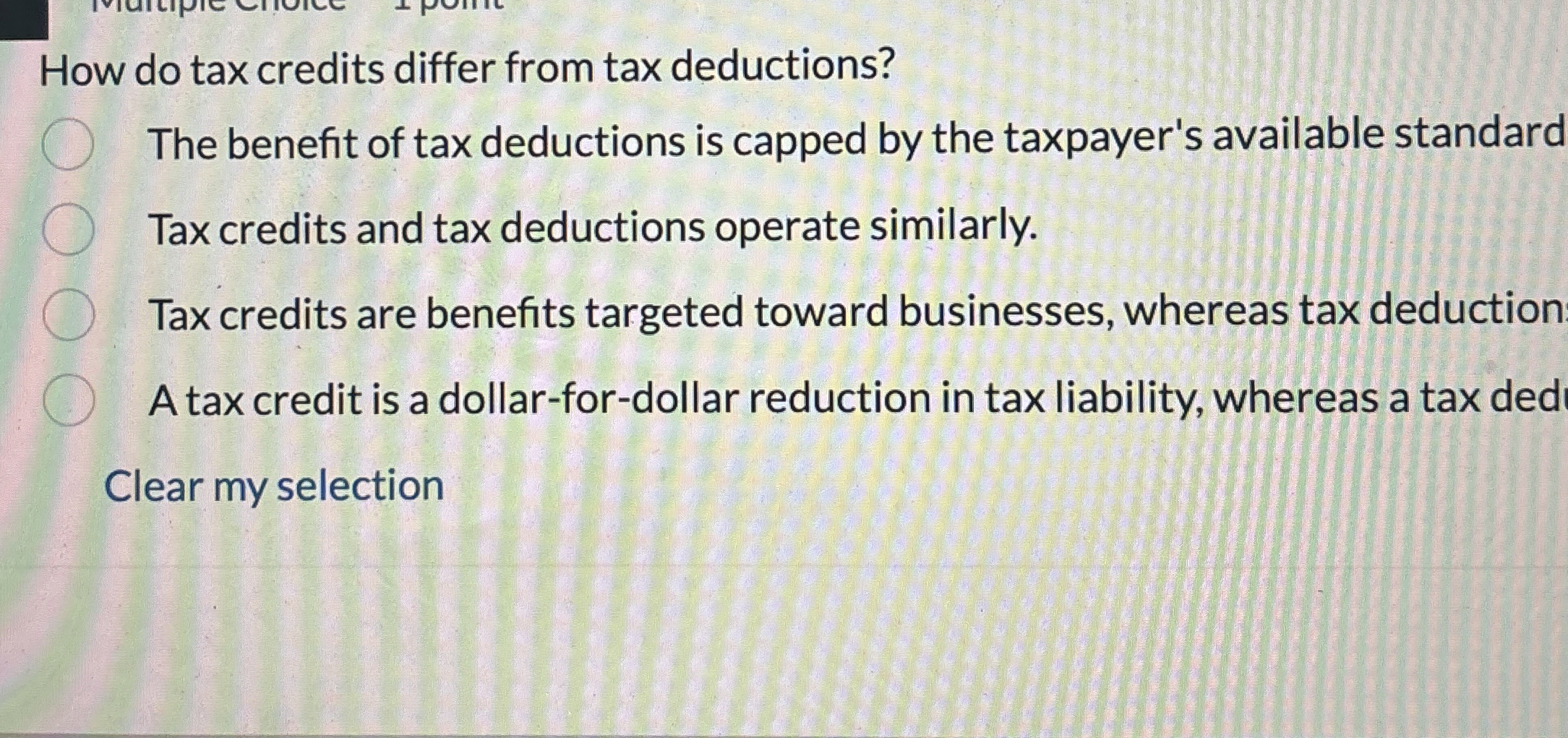

How do tax credits differ from tax deductions?

The benefit of tax deductions is capped by the taxpayer's available standard

Tax credits and tax deductions operate similarly.

Tax credits are benefits targeted toward businesses, whereas tax deduction

A tax credit is a dollarfordollar reduction in tax liability, whereas a tax ded

Clear my selection

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock