Question: How do you get the correct amount for interest? LO 2, 3, 4, 5,7,8 Bart and Elizabeth Forrest are married and have no dependents. jointly

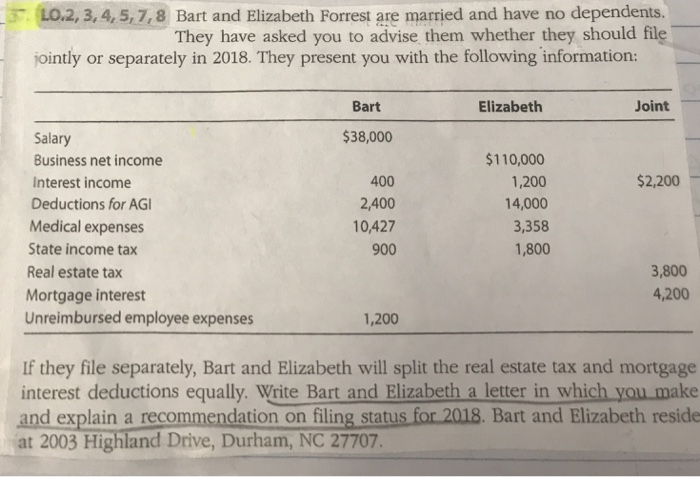

LO 2, 3, 4, 5,7,8 Bart and Elizabeth Forrest are married and have no dependents. jointly or separately in 2018. They present you with the following information: They have asked you to advise them whether they should file Bart Elizabeth Joint $38,000 Salary Business net income Interest income Deductions for AG Medical expenses State income tax Real estate tax Mortgage interest Unreimbursed employee expenses $110,000 1,200 14,000 3,358 1,800 $2,200 400 2,400 10,427 900 3,800 4,200 1,200 If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2018. Bart and Elizabeth reside at 2003 Highland Drive, Durham, NC 27707

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts