Question: How do you get unrealized amount and if it is a gain or loss? Please show explanation Problem 15-1A (Algo) Recording and adjusting trading debt

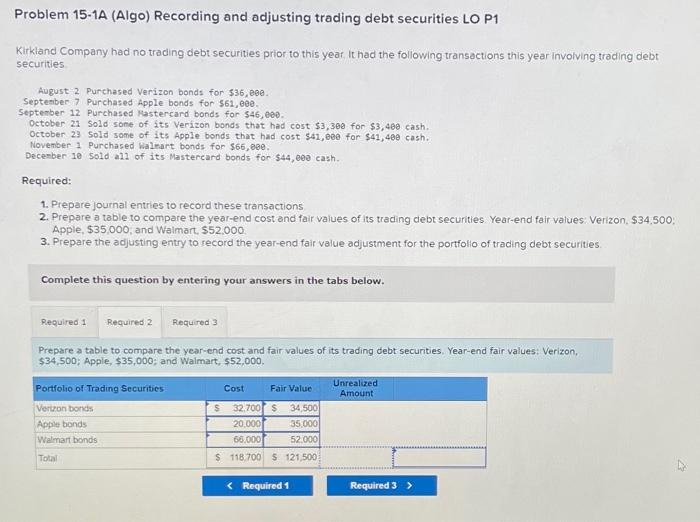

Problem 15-1A (Algo) Recording and adjusting trading debt securities LO P1 Kirkland Company had no trading debt securities prior to this year It had the following transactions this year involving trading debt securities August 2 Purchased Verizon bonds for $36, 000 . Septeaber 7 Purchased Apple bonds for $61,000. September 12 Purchased Rastercard bonds for $46,0e0. October 21 sold some of its Verizon bonds that had cost $3,300 for $3,400 cash. October 23 Sold some of its Apple bonds that had cost $41,000 for $41,400 cash. November 1 Purchased Walrart bonds for $66,000. Decesber 10 Sold all of its Mastereard bonds for 544,600 cash. Required: 1. Prepare journal entries to record these transactions 2. Prepare a table to compare the year-end cost and fair values of its trading debt securities. Year-end fair values: Verizon, $34.500 : Apple, $35,000, and Waimart, $52,000 3. Prepare the adjusting entry to record the year-end fair value adjustment for the portfolio of trading debt securities. Complete this question by entering your answers in the tabs below. Prepare a table to compare the year-end cost and fair values of its trading debt securities. Year-end fair values: Verizon, $34,500; Apple, $35,000; and Waimart, $52,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts