Question: How do you solve these questions using excel? 1. Using the following data from Sept. 2, 2021, plot (graph) the corporate A-rated yield and Treasury

How do you solve these questions using excel?

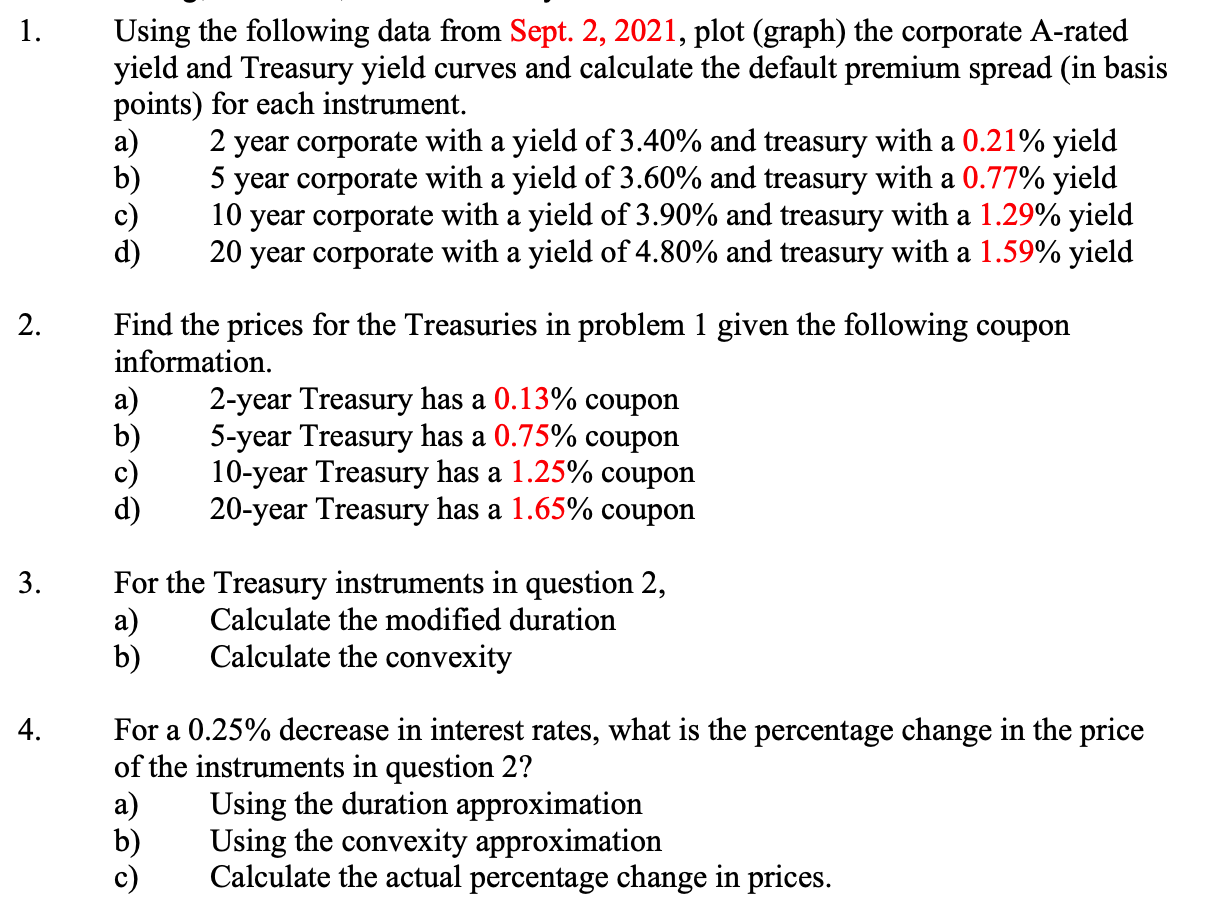

1. Using the following data from Sept. 2, 2021, plot (graph) the corporate A-rated yield and Treasury yield curves and calculate the default premium spread (in basis points) for each instrument. a) 2 year corporate with a yield of 3.40% and treasury with a 0.21% yield b) 5 year corporate with a yield of 3.60% and treasury with a 0.77% yield c) 10 year corporate with a yield of 3.90% and treasury with a 1.29% yield 20 year corporate with a yield of 4.80% and treasury with a 1.59% yield 2. Find the prices for the Treasuries in problem 1 given the following coupon information. a) 2-year Treasury has a 0.13% coupon b) 5-year Treasury has a 0.75% coupon c) 10-year Treasury has a 1.25% coupon 20-year Treasury has a 1.65% coupon 3. For the Treasury instruments in question 2, a) Calculate the modified duration b) Calculate the convexity 4. a For a 0.25% decrease in interest rates, what is the percentage change in the price of the instruments in question 2? a) Using the duration approximation b) Using the convexity approximation c) Calculate the actual percentage change in prices. 1. Using the following data from Sept. 2, 2021, plot (graph) the corporate A-rated yield and Treasury yield curves and calculate the default premium spread (in basis points) for each instrument. a) 2 year corporate with a yield of 3.40% and treasury with a 0.21% yield b) 5 year corporate with a yield of 3.60% and treasury with a 0.77% yield c) 10 year corporate with a yield of 3.90% and treasury with a 1.29% yield 20 year corporate with a yield of 4.80% and treasury with a 1.59% yield 2. Find the prices for the Treasuries in problem 1 given the following coupon information. a) 2-year Treasury has a 0.13% coupon b) 5-year Treasury has a 0.75% coupon c) 10-year Treasury has a 1.25% coupon 20-year Treasury has a 1.65% coupon 3. For the Treasury instruments in question 2, a) Calculate the modified duration b) Calculate the convexity 4. a For a 0.25% decrease in interest rates, what is the percentage change in the price of the instruments in question 2? a) Using the duration approximation b) Using the convexity approximation c) Calculate the actual percentage change in prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts