Question: How do you solve this? St Germaine Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year

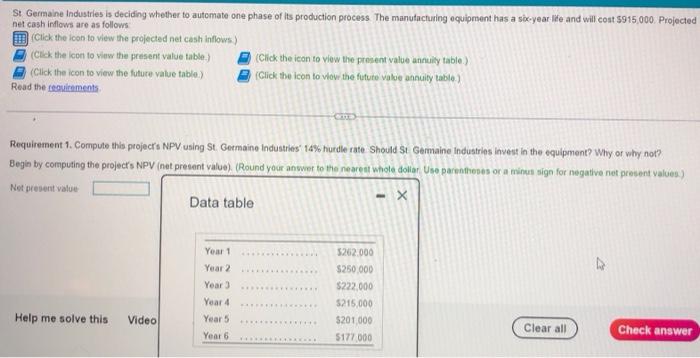

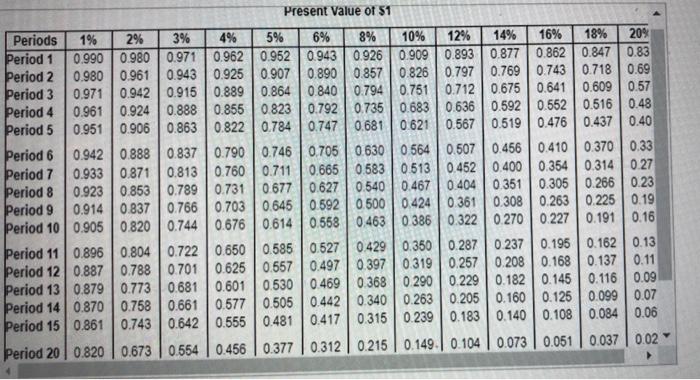

St Germaine Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $915,000. Projected net cash inflows are as follows (Click the icon to view the projected net cash inflows.) (Click the icon to view the present value table.) (Click the icon to view the present value annuity table.) (Click the icon to view the futute value annuity table.) (Click the icon to view the future value table.) Read the requirements CATE Requirement 1. Compute this project's NPV using St. Germaine Industries 14% hurdle rate Should St Germaine Industries invest in the equipment? Why or why not? Begin by computing the project's NPV (net present value). (Round your answer to the nearest whote dollar. Use parentheses or a minus sign for negative net present values.) Net present value - X Data table Year 1. $262.000 Year 2 $250,000 Year 3 $222,000 Year 4 $215,000 Help me solve this Video Year 5 $201,000 Clear all Check answer Year 6 $177,000 ********* *********Y *********** *********** Present Value of $1 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% 0.980 0.971 0.962 0.952 0.943 0.909 0.893 0.877 0.862 0.847 0.83 0.926 0.890 0.857 0.826 0.797 0.769 0.743 0.718 0.69 0.712 0.675 0.641 0.609 0.57 0.552 0.516 0.48 0.683 0.636 0.592 0.621 0.567 0.519 0.476 0.437 0.40 0.410 0.370 0.33 0.942 0.888 0.837 0.790 0.746 0.933 0.871 0.813 0.760 0.711 0.980 0.961 0.943 0.925 0.907 0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.705 0.630 0.564 0.507 0.456 0.665 0.583 0.513 0.452 0.731 0.677 0.627 0.540 0.467 0.404 0.500 0.424 0.361 0.463 0 386 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.13 0.11 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.09 0.870 0.758 0.661 0.577 0.205 0.160 0.125 0.099 0.07 0.923 0.853 0.789 0.400 0.354 0.314 0.27 0.351 0.305 0.266 0.23 0.308 0.263 0.225 0.19 0.270 0.227 0.191 0.16 0.914 0.837 0.766 0.703 0.744 0.645 0.592 0.676 0.614 0.558 0.905 0.820 0.322 0.896 0.804 0.722 0.887 0.788 0.701 0.879 0.505 0.442 0.340 0.263 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.239 0.183 0.140 0.108 0.084 0.06 0.820 0.673 0.554 0.456 0.377 0.312 0.215 0.149 0.104 0.073 0.051 0.037 0.02 Periods 1% Period 1 0.990 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts