Question: Need help finding the NPV ... St. Germaine Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a

Need help finding the NPV ...

Need help finding the NPV ...

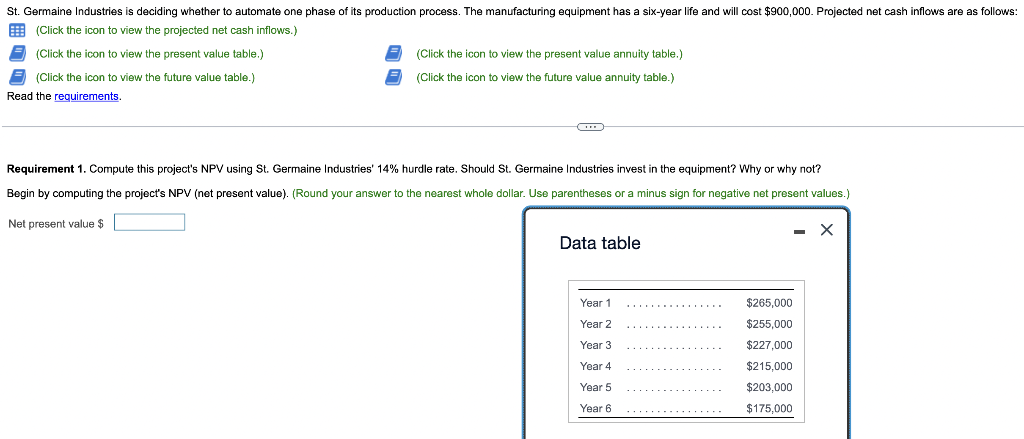

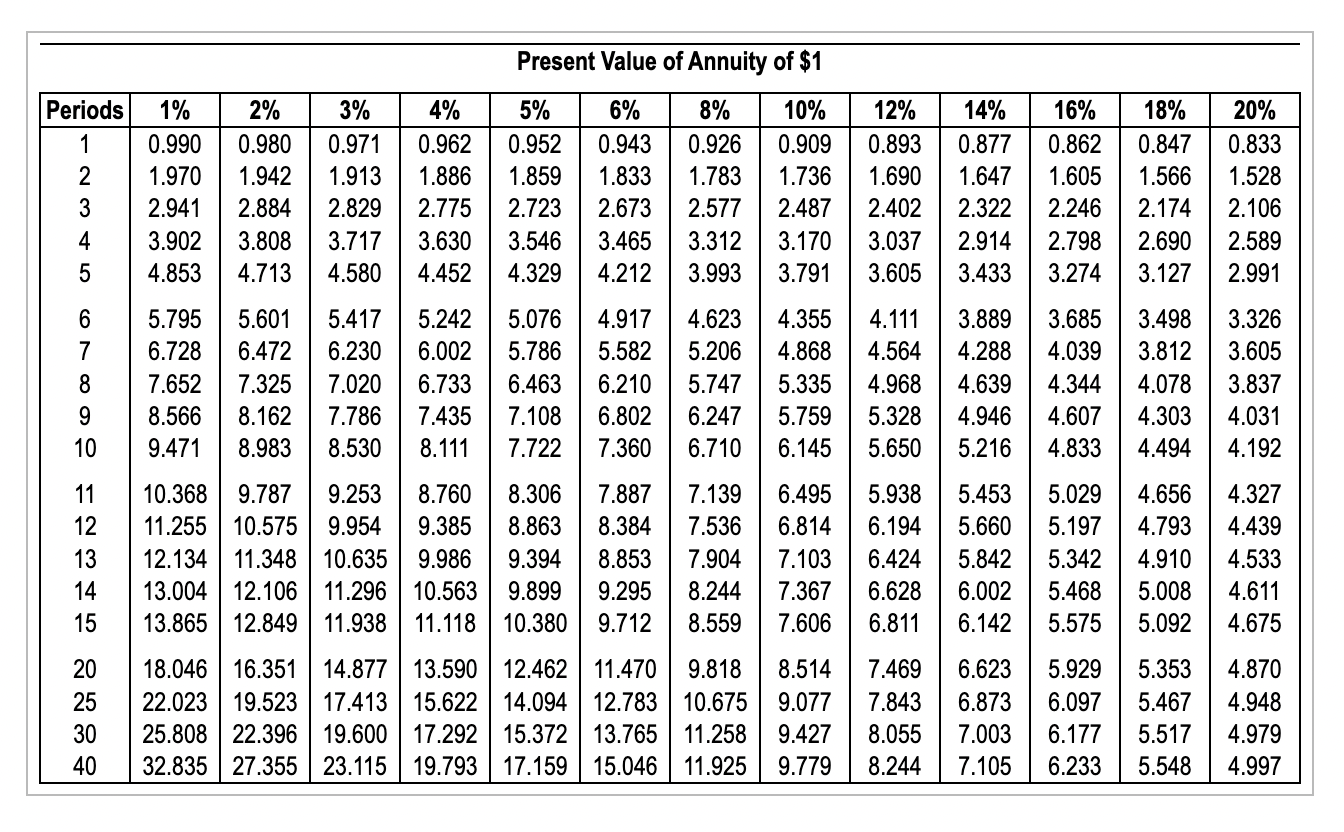

St. Germaine Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $900,000. Projected net cash inflows are as follows: E: (Click the icon to view the projected net cash inflows.) 3 (Click the icon to view the present value table.) - (Click the icon view the future value table.) Read the requirements. (Click the icon to view the present value annuity table.) (Click the icon to view the future value annuity table.) Requirement 1. Compute this project's NPV using St. Germaine Industries' 14% hurdle rate. Should St. Germaine Industries invest in the equipment? Why or why not? Begin by computing the project's NPV (net present value). (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) Net present value $ - X Data table $265,000 Year 1 Year 2 Year 3 $255,000 $227,000 Year 4 $215.000 Year 5 Year 6 $203,000 $175,000 ................ Present Value of Annuity of $1 Periods 1 2 3 4 5 1% 0.990 1.970 2.941 3.902 4.853 2% 0.980 1.942 2.884 3.808 4.713 3% 0.971 1.913 2.829 3.717 4.580 4% 0.962 1.886 2.775 3.630 4.452 5% 0.952 1.859 2.723 3.546 4.329 6% 0.943 1.833 2.673 3.465 4.212 8% 0.926 1.783 2.577 3.312 3.993 10% 0.909 1.736 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 14% 0.877 1.647 2.322 2.914 3.433 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 10 6 7 8 9 10 5.795 6.728 7.652 8.566 9.471 5.601 6.472 7.325 8.162 8.983 5.417 6.230 7.020 7.786 8.530 5.242 6.002 6.733 7.435 8.111 5.076 5.786 6.463 7.108 7.722 4.917 5.582 6.210 6.802 7.360 4.623 5.206 5.747 6.247 6.710 4.355 4.868 5.335 5.759 6.145 4.111 4.564 4.968 5.328 5.650 3.889 4.288 4.639 4.946 5.216 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 H2846 11 12 13 14 15 10.368 9.787 9.253 11.255 10.575 9.954 12.134 11.348 10.635 13.004 12.106 11.296 13.865 12.849 11.938 8.760 9.385 9.986 10.563 11.118 8.306 8.863 9.394 9.899 10.380 7.887 8.384 8.853 9.295 9.712 7.139 7.536 7.904 8.244 8.559 6.495 6.814 7.103 7.367 7.606 5.938 6.194 6.424 6.628 6.811 5.453 5.660 5.842 6.002 6.142 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 20 25 30 40 18.046 16.351 14.877 13.590 12.462 11.470 9.818 22.023 19.523 17.413 15.622 14.094 12.783 10.675 25.808 22.396 19.600 17.292 15.372 13.765 11.258 32.835 27.355 23.115 19.793 17.159 15.046 11.925 8.514 9.077 9.427 9.779 7.469 7.843 8.055 8.244 6.623 6.873 7.003 7.105 5.929 6.097 6.177 6.233 5.353 5.467 5.517 5.548 4.870 4.948 4.979 4.997

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts