Question: how is this calculated? Example 6.8 Tracking and Arbitrage with Pure Factor Portfolios Given a two-factor model, find the combination of a risk-free security with

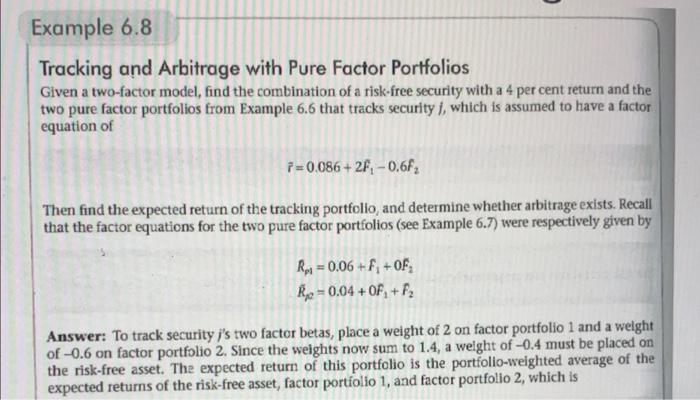

Example 6.8 Tracking and Arbitrage with Pure Factor Portfolios Given a two-factor model, find the combination of a risk-free security with a 4 per cent return and the two pure factor portfolios from Example 6.6 that tracks security I, which is assumed to have a factor equation of p=0.086+2F, -0.6F, Then find the expected return of the tracking portfolio, and determine whether arbitrage exists. Recall that the factor equations for the two pure factor portfolios (see Example 6.7) were respectively given by Rai = 0.06 + F + OF Ryz-0,04 +OF+F Answer: To track security j's two factor betas, place a weight of 2 on factor portfolio 1 and a weight of-0.6 on factor portfolio 2. Since the weights now sum to 1.4, a weight of -0.4 must be placed on the risk-free asset. The expected return of this portfolio is the portfolio-weighted average of the expected returns of the risk-free asset, factor portfolio 1, and factor portfolio 2, which is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts