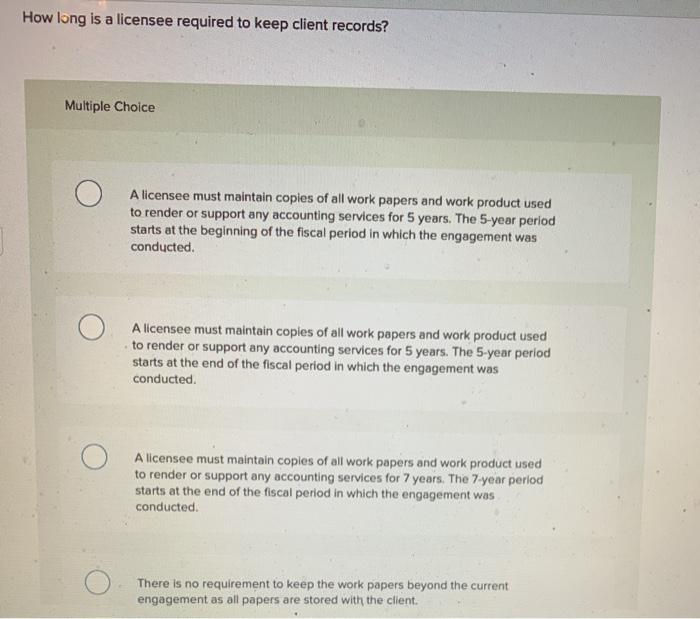

Question: How long is a licensee required to keep client records? Multiple Choice A licensee must maintain copies of all work papers and work product used

How long is a licensee required to keep client records? Multiple Choice A licensee must maintain copies of all work papers and work product used to render or support any accounting services for 5 years. The 5-year period starts at the beginning of the fiscal period in which the engagement was conducted A licensee must maintain copies of all work papers and work product used to render or support any accounting services for 5 years. The 5-year period starts at the end of the fiscal period in which the engagement was conducted A licensee must maintain copies of all work papers and work product used to render or support any accounting services for 7 years. The 7-year period starts at the end of the fiscal period in which the engagement was conducted There is no requirement to keep the work papers beyond the current engagement as all papers are stored with the client

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts