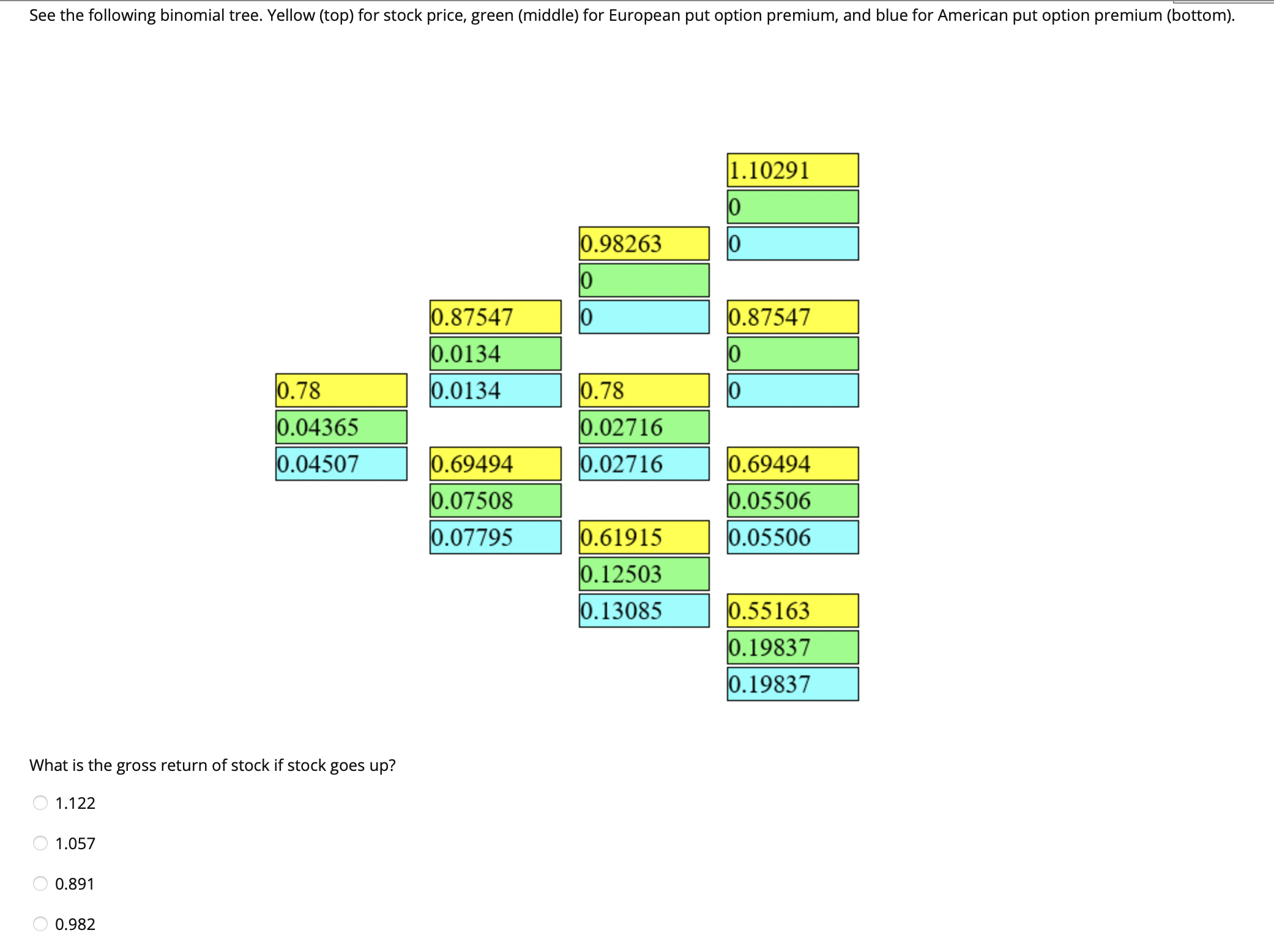

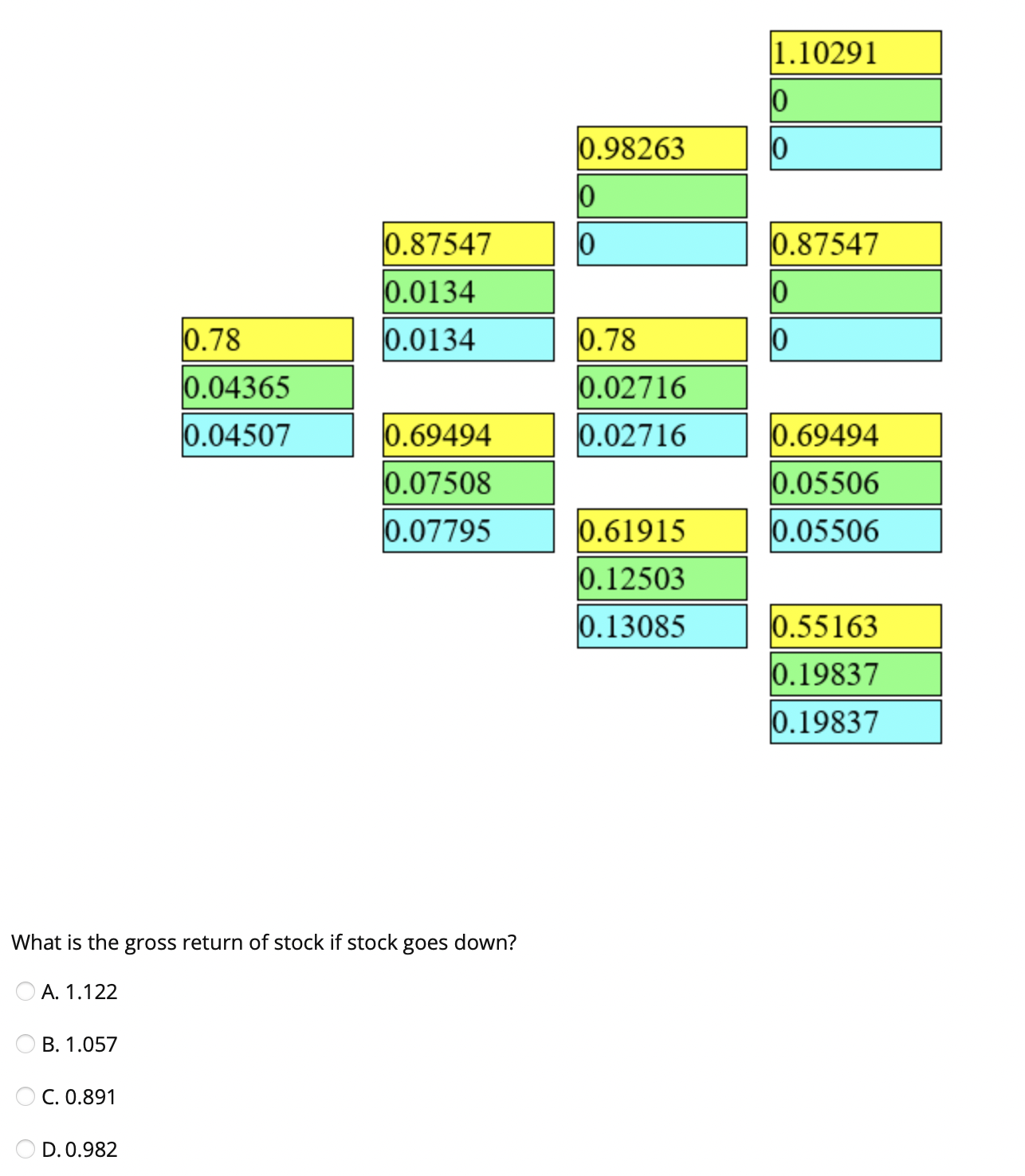

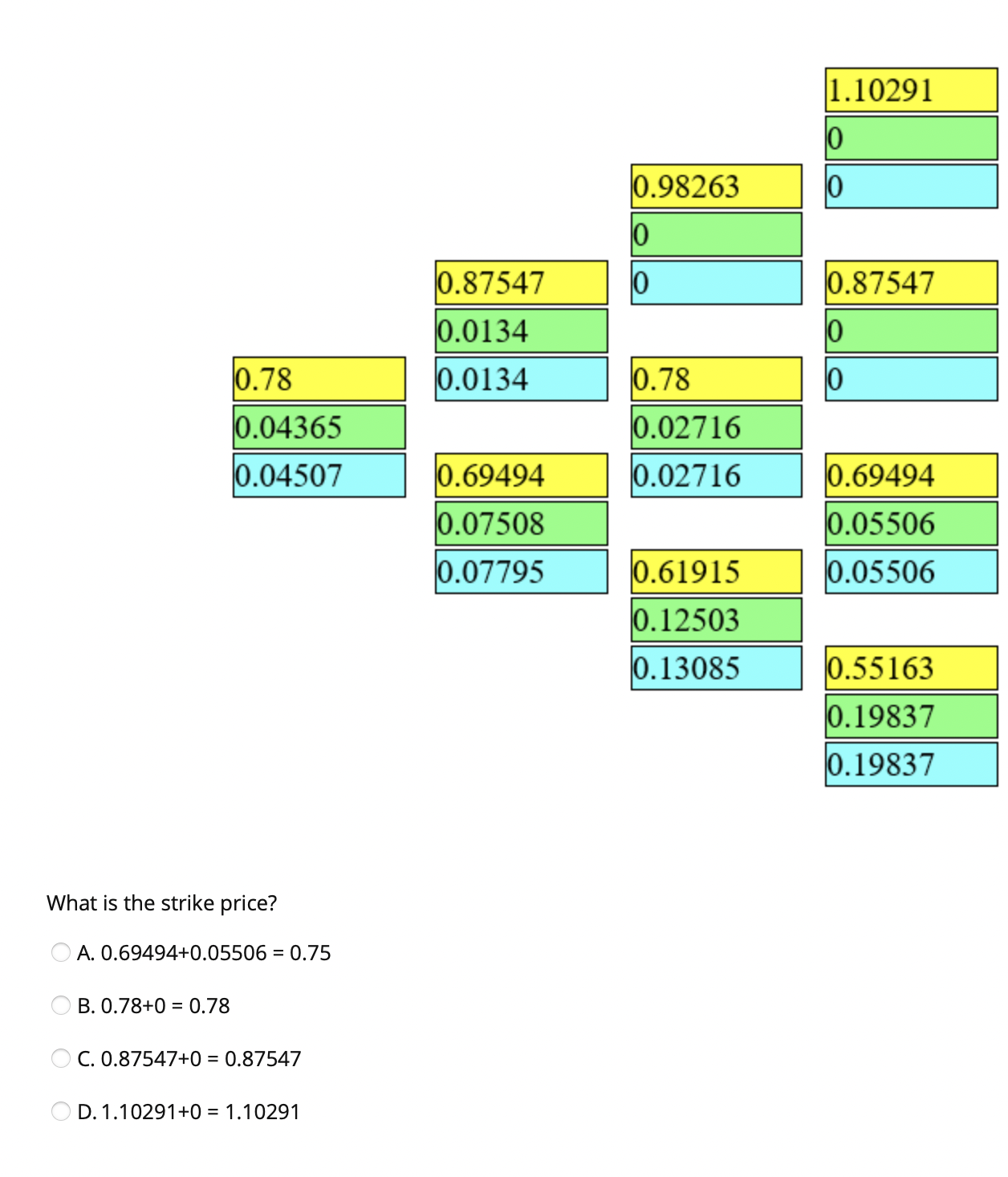

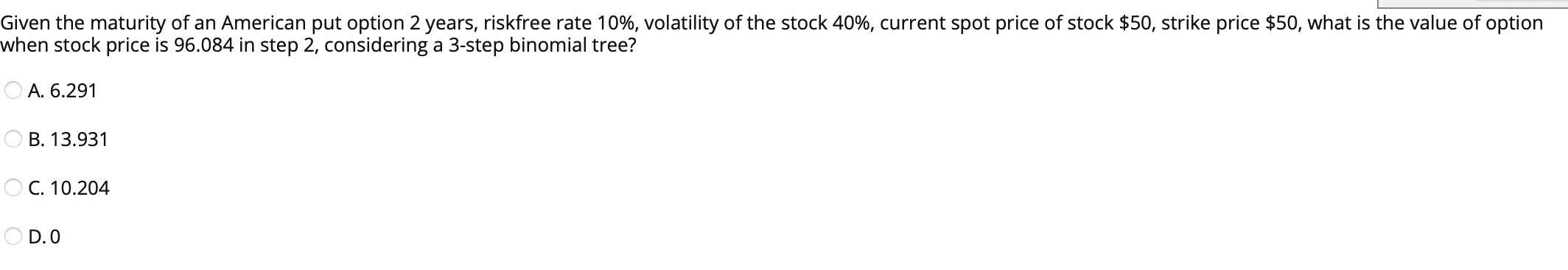

Question: How many terminal payoffs are there in a 2-step binomial tree? O A. 3 OB. 4 OC. 6 OD. 8See the following binomial tree. Yellow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts