Question: Consider a European-style lookback put option. Assume the current share price is $20, the standard deviation of the return on the share (o) is

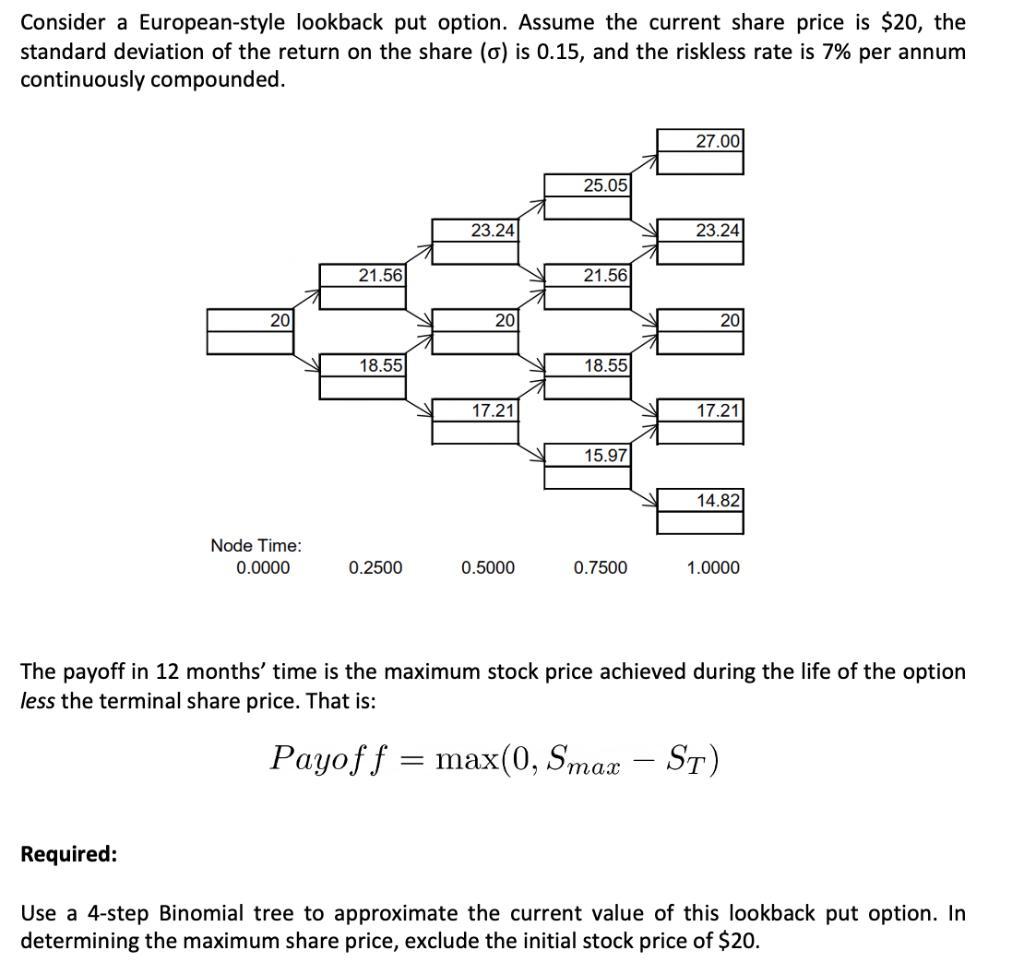

Consider a European-style lookback put option. Assume the current share price is $20, the standard deviation of the return on the share (o) is 0.15, and the riskless rate is 7% per annum continuously compounded. 20 Node Time: 0.0000 21.56 18.55 0.2500 23.24 20 17.21 0.5000 25.05 21.56 18.55 15.97 0.7500 27.00 23.24 20 17.21 14.82 1.0000 The payoff in 12 months' time is the maximum stock price achieved during the life of the option less the terminal share price. That is: Payoff = max(0, Smax - ST) Required: Use a 4-step Binomial tree to approximate the current value of this lookback put option. In determining the maximum share price, exclude the initial stock price of $20.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Question S16513 K170 t102365 r00348 sigma00571 d1I... View full answer

Get step-by-step solutions from verified subject matter experts