Question: How to project CY + 1 , 2 , 3 and Terminal year in the picture given the following information: 1 . The company s

How to project CY and Terminal year in the picture given the following information: The companys assets are cash $ inventory worth $ based on cost and accounts receivable $

aInventory can be sold back to manufacturers for of its cost.

bAccounts receivable can be sold to a collections agency for of its current level.

The companys liabilities are accounts payable of $ and accrued expenses of $

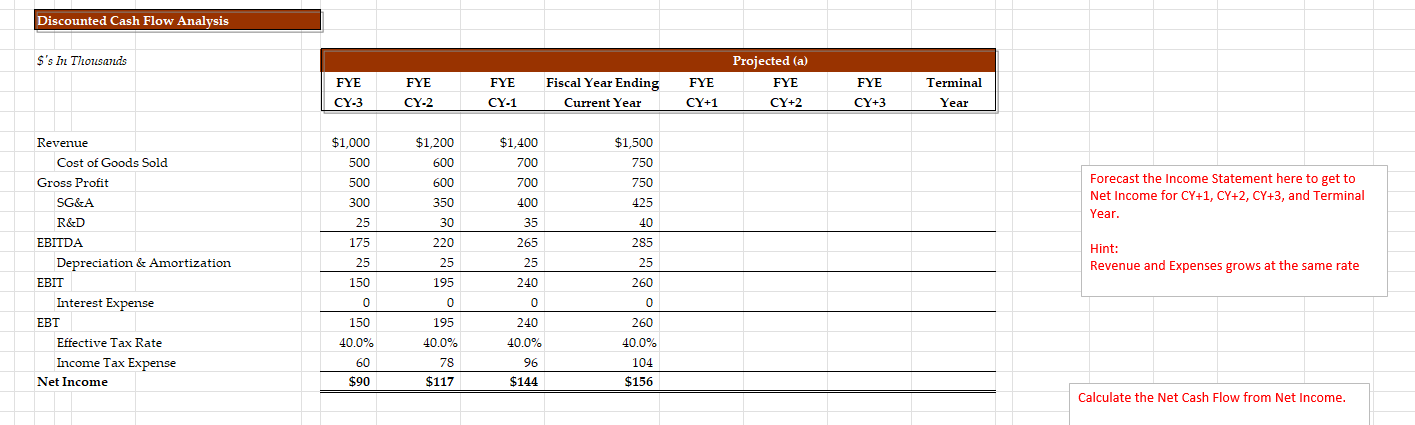

The Discounted Cash Flow Analysis spreadsheet shows the most recent three years income statements in simplified form.

Assume the company pays a corporate tax rate of

For the current year, depreciation and amortization is $ The company is using straightline depreciation. Thus, D&A is expected to be $ going forward.

The physical depreciation andor amortization of fixed assets is allowed to be booked as an expense, thus lowering the taxable income. Yet, it is not an actual decrease in dollars so it is not a decrease in cash flow. That is why it is added back in to net income on the way to calculating net cash flow. Net cash flow is actual physical dollars coming out of the business during the time period.

There is no interest expense.

For the current year, capital expenditure CAPEX is $ CAPEX refers to the current expenditure of money by the company to purchase equipment and other assets that will help the company earn more money in the future. It directly affects net cash flow because it is spent in the current year instead of being passed through to the owners as NCF

Discount Rate

Growth Rate

Perpetual Growth Rate

Using the facts above, complete the valuation for Duke's Sporting Goods Store using the provided template.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock