Question: how to solve part 2 Problem 9 D Intro The return statistics for two stocks and T-bills are given below: B 1 Stock A Stock

how to solve part 2

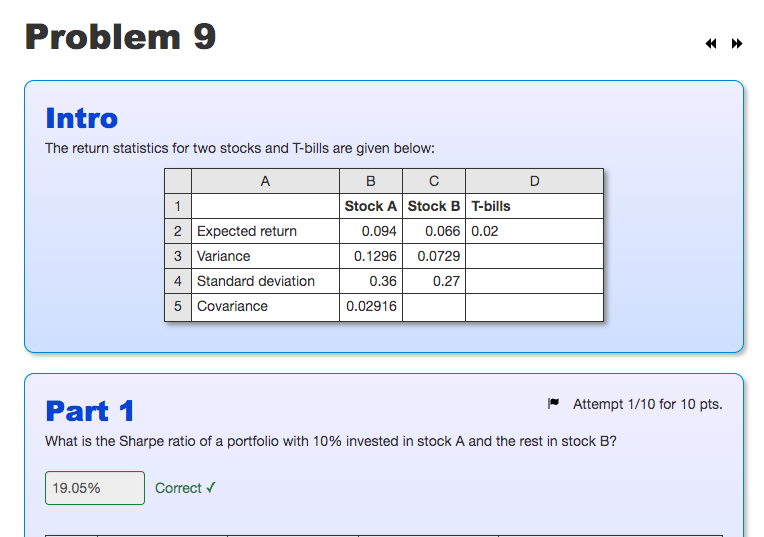

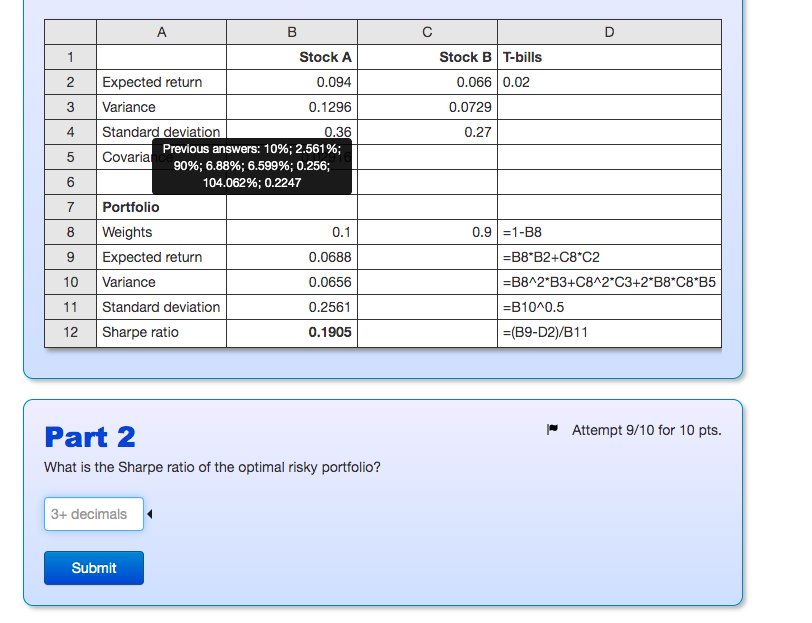

Problem 9 D Intro The return statistics for two stocks and T-bills are given below: B 1 Stock A Stock B T-bills 2 Expected return 0.094 0.066 0.02 3 Variance 0.1296 0.0729 4 Standard deviation 0.36 0.27 5 Covariance 0.02916 Part 1 Attempt 1/10 for 10 pts. What is the Sharpe ratio of a portfolio with 10% invested in stock A and the rest in stock B? 19.05% Correct D Stock B T-bills 0.066 0.02 3 0.0729 0.27 A B 1 Stock A 2 Expected return 0.094 Variance 0.1296 4 Standard deviation 0.36 5 Covaria Previous answers: 10%; 2.561%; 90%; 6.88%; 6.599%; 0.256; 6 104.062%; 0.2247 7 Portfolio 8 Weights 0.1 9 Expected return 0.0688 10 Variance 0.0656 11 Standard deviation 0.2561 12 Sharpe ratio 0.1905 0.9 =1-08 =B8*B2+C8*C2 =B8^2*B3+C8^2*C3+2*B8*C8*B5 =B10^0.5 =(B9-D2)/B11 | Attempt 9/10 for 10 pts. Part 2 What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts