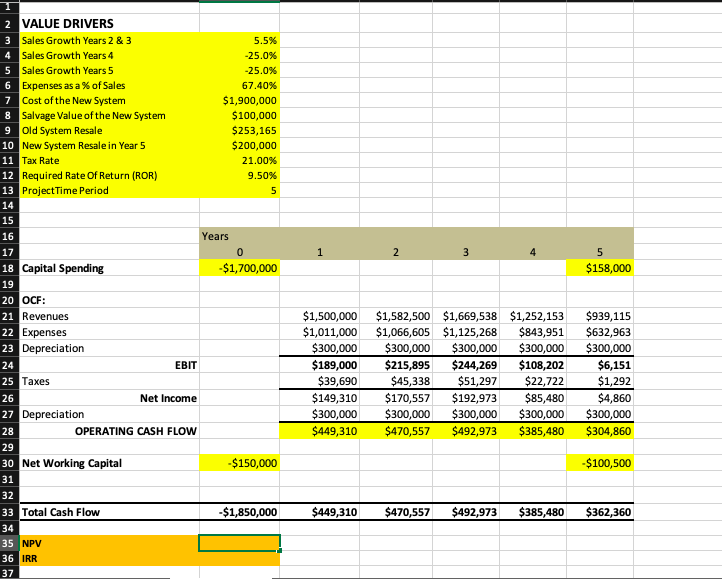

Question: How would I get NPV and IRR? 2 VALUE DRIVERS 3 Sales Growth Years 2 & 3 4 Sales Growth Years 4 5 Sales Growth

How would I get NPV and IRR?

2 VALUE DRIVERS 3 Sales Growth Years 2 & 3 4 Sales Growth Years 4 5 Sales Growth Years 5 6 Expenses as a % of Sales 7 Cost of the New System 8 Salvage Value of the New System 9 Old System Resale 10 New System Resale in Year 5 11 Tax Rate 12 Required Rate Of Return (ROR) 13 Project Time Period 14 5.5% -25.0% -25.09 67.40% $1,900,000 $100,000 $253,165 $200,000 21.00% 9.50% 5 15 1 2 3 4 5 $158,000 EBIT 16 Years 17 0 18 Capital Spending $1,700,000 19 20 OCF: 21 Revenues 22 Expenses 23 Depreciation 24 25 Taxes 26 Net Income 27 Depreciation 28 OPERATING CASH FLOW 29 30 Net Working Capital -$150,000 31 32 33 Total Cash Flow -$1,850,000 34 35 NPV 36 IRR 37 $1,500,000 $1,582,500 $1,669,538 $1,252,153 $1,011,000 $1,066,605 $1,125,268 $843,951 $300,000 $300,000 $300,000 $300,000 $189,000 $215,895 $244,269 $108,202 $39,690 $45,338 $51,297 $22,722 $149,310 $170,557 $192,973 $85,480 $300,000 $300,000 $300,000 $300,000 $449,310 $470,557 $492,973 $385,480 $939,115 $632,963 $300,000 $6,151 $1,292 $4,860 $300,000 $304,860 $100,500 $449,310 $470,557 $492,973 $385,480 $362,360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts