Question: How would I go about solving this problem? There are multiple answers and I cant figure out the right ones. I keep missing answers. multiple

How would I go about solving this problem? There are multiple answers and I cant figure out the right ones. I keep missing answers.

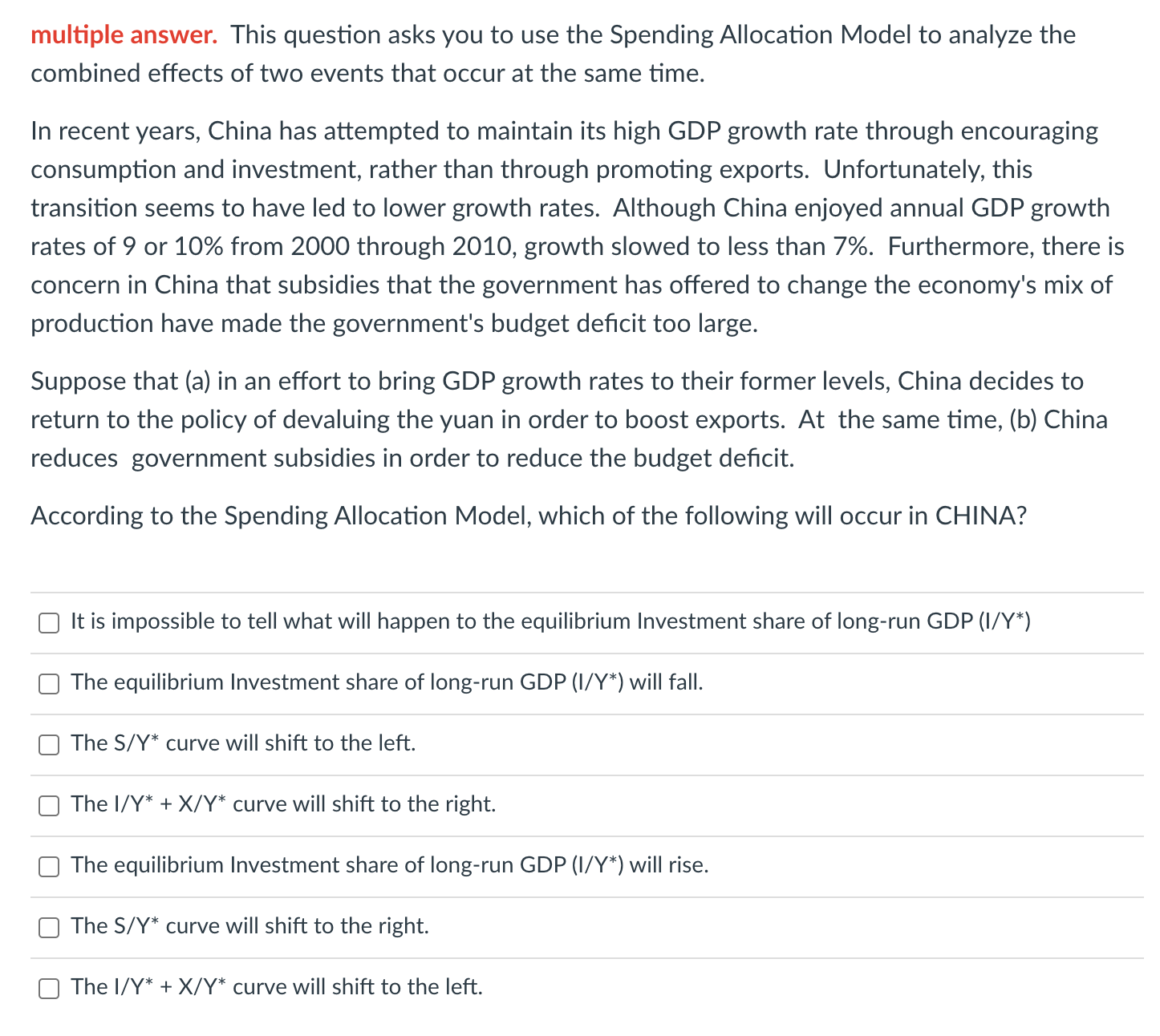

multiple answer. This question asks you to use the Spending Allocation Model to analyze the combined effects of two events that occur at the same time. In recent years, China has attempted to maintain its high GDP growth rate through encouraging consumption and investment, rather than through promoting exports. Unfortunately, this transition seems to have led to lower growth rates. Although China enjoyed annual GDP growth rates of 9 or 10% from 2000 through 2010, growth slowed to less than 7%. Furthermore, there is concern in China that subsidies that the government has offered to change the economy's mix of production have made the government's budget decit too large. Suppose that (a) in an effort to bring GDP growth rates to their former levels, China decides to return to the policy of devaluing the yuan in order to boost exports. At the same time, (b) China reduces government subsidies in order to reduce the budget deficit. According to the Spending Allocation Model, which of the following will occur in CHINA? C] It is impossible to tell what will happen to the equilibrium Investment share of long-run GDP (l/Y*) C] The equilibrium Investment share of long-run GDP (l/Y*) will fall. C] The S/Y* curve will shift to the left. C] The I/Y* + X/Y* curve will shift to the right. C] The equilibrium Investment share of long-run GDP (l/Y*) will rise. C] The S/Y* curve will shift to the right. C] The I/Y* + X/Y* curve will shift to the left

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts