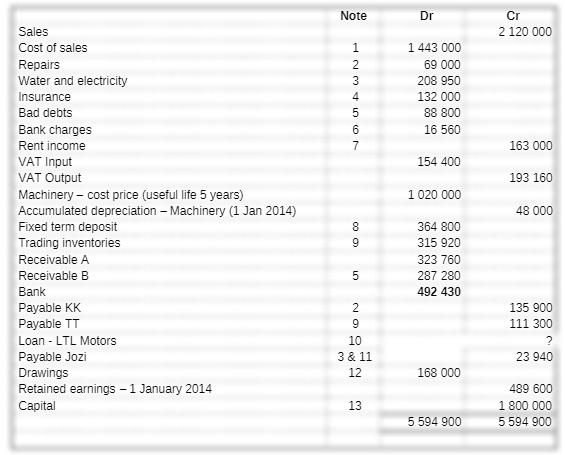

Question: HP Entitys current reporting date is 31 December 2014. On 1 December 2014 the following balances, among others, appeared in the records of HP Entity:

HP Entity’s current reporting date is 31 December 2014. On 1 December 2014 the following balances, among others, appeared in the records of HP Entity:

The following transactions/events still have to be recognised in the records of HP Entity:

1. Cash sale of trading inventories totalling R412 452 were made in December. The cost price of these inventories was R342 000.

2. Repairs were done by Payable KK and an invoice of R28 500 payable on or before 15 January 2015 was delivered.

3. Received statements from Payable Jozi for R20 520 in respect of the water- and electricity utilisation in December 2014. This amount is payable 30 days from statement date.

4. The insurance premium of R17 100 for December was paid to the insurance company on 3 December by means of an electronic transfer of funds.

5. The credit manager gave authorisation to write off Receivable B's debt as irrecoverable as he has been declared insolvent

6. On 4 January 2015 the bank statement was received from the Bank. The statement indicated bank charges of R13 680 and interest charge of R10 260 for the month of December 2014. The interest charge relates to a bank overdraft experience during the early part December 2014.

7. On 1 December HP Entity’s entered into another sub-letting agreement for a portion of the entity’s property to Hyatt for a period of 2 years. Lease payment of R21 660 for December,

25

was received from Lessee Hyatt on the same day. A deposit equivalent to one month rental was received on the same day.

8. The investment in the fixed term deposit was made on 15 September 2014 for a 5 year term and earns interest at a rate of 9% per annum. Interest, together with the initial amount invested, is repayable at the end of the term of the deposit. The interest earned during the current reporting period has not been recognised.

9. On 30 November 2014, ordered inventory which was delivered on 12 December 2014 by Payable TT, together with the invoice for R107 160. The invoice is payable on or before 20 January 2015. The entity uses the perpetual inventory system.

10. On 20 April 2014 a passenger vehicle was order from LTL Motors with an invoice price was R513 000. A 20% deposit was required and paid on the same day however the bookkeeper by accident omitted the payment of the deposit. The balance was financed through a supplier loan repayable on 30 April 2021, together with the interest at 10% per year. The vehicle was delivered and put into use on 1 May 2014. No entries have been made with respect to this transaction.

11. Paid an amount of R34 200 to Payable Jozi by means of an electronic funds transfer.

12. The owner took inventories with a cost price of R37 392 and a selling price of R74 784 for personal use.

13. The owner deposited a further R570 000 into the entity’s bank account as an additional capital contribution.

14. Depreciation still has to be recognised for the current reporting period. It is calculated on the straight-line method as follows:

Machinery - 5 years

Vehicles - 4 years

15. The entity uses the perpetual inventory system.

16. The Entity and all its trading partners are registered VAT-vendors.

REQUIRED:

a) Recognise, by means of journal entries, the transactions and events above in the records (general journal) of HP Entity for the reporting period ended 31 December 2014.

b) Post the abovementioned journal entries to the relevant Ledger accounts and where necessary, balance the accounts.

c) Prepare the Statement of profit or loss for HP Entity for the year ended 31 December 2014.

d) Prepare the Statement of changes in equity for HP Entity for the year ended 31 December 2014.

e) Prepare a Statement of financial position for HP Entity as at 31 December 2014..

Note Dr Cr 2 120 000 Sales Cost of sales 1 443 000 1 Repairs Water and electricity 69 000 208 950 Insurance 4 132 000 Bad debts 88 800 Bank charges 16 560 Rent income 7 163 000 VAT Input VAT Output 154 400 193 160 1 020 000 Machinery cost price (useful life 5 years) Accumulated depreciation Machinery (1 Jan 2014) Fixed term deposit Trading inventories 48 000 8 364 800 315 920 Receivable A 323 760 Receivable B Bank 287 280 492 430 Payable KK Payable TT Loan - LTL Motors 2 135 900 9 111 300 10 Payable Jozi Drawings Retained earnings - 1 January 2014 3 & 11 23 940 12 168 000 489 600 1 800 000 5 594 900 Capital 13 5 594 900

Step by Step Solution

There are 3 Steps involved in it

SUGGESTED SOLUTION a Journal Entries Dr Cr J1 412 452 Bank VAT output SFP 412 452 x 14114 Sales PL 4... View full answer

Get step-by-step solutions from verified subject matter experts