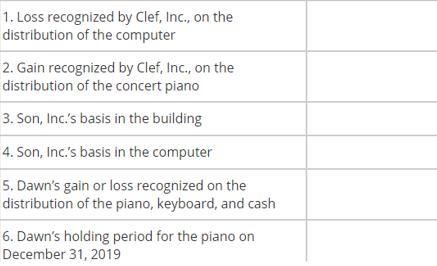

Question: Son, Inc., and Clef, Inc., are both taxable domestic C corporations. Using the information in the exhibits, enter either the correct amount or holding period

Son, Inc., and Clef, Inc., are both taxable domestic C corporations. Using the information in the exhibits, enter either the correct amount or holding period (in a number of months) for each item below. For each item, enter the appropriate amounts in the associated cells. If the amount is zero, enter a zero (0).

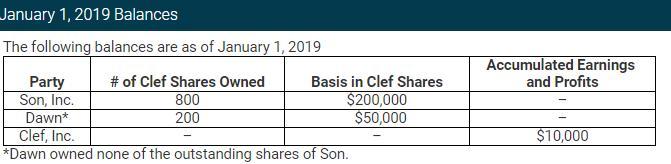

January 1, 2019 Balances The following balances are as of January 1, 2019 Accumulated Earnings and Profits # of Clef Shares Owned 800 200 Basis in Clef Shares Party Son, Inc. $200,000 $50,000 Dawn* $10,000 Clef, Inc. *Dawn owned none of the outstanding shares of Son.

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

January 1 2019 Balances The following balances are as of January 1 2019 Accumul... View full answer

Get step-by-step solutions from verified subject matter experts