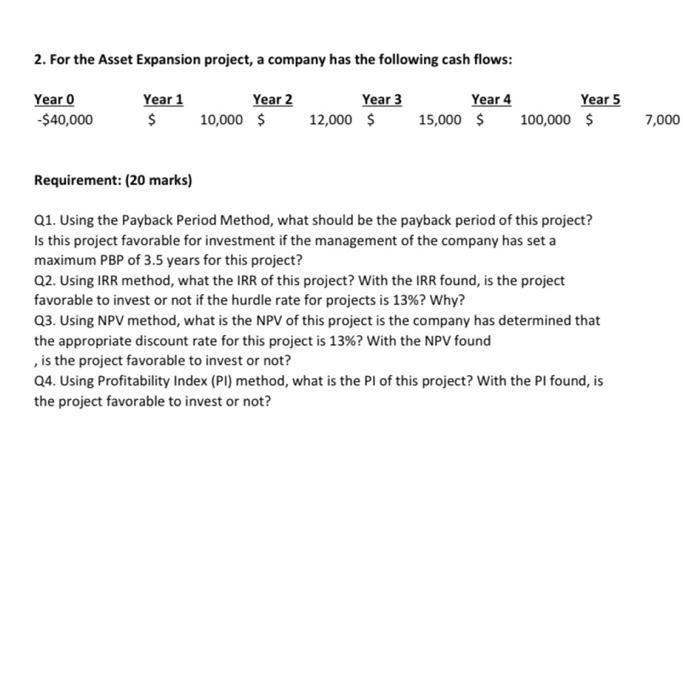

Question: 2. For the Asset Expansion project, a company has the following cash flows: Year 1 Year 0 -$40,000 $ Year 2 10,000 $ Year

2. For the Asset Expansion project, a company has the following cash flows: Year 1 Year 0 -$40,000 $ Year 2 10,000 $ Year 3 Year 4 Year 5 12,000 $ 15,000 $ 100,000 $ Requirement: (20 marks) Q1. Using the Payback Period Method, what should be the payback period of this project? Is this project favorable for investment if the management of the company has set a maximum PBP of 3.5 years for this project? Q2. Using IRR method, what the IRR of this project? With the IRR found, is the project favorable to invest or not if the hurdle rate for projects is 13%? Why? Q3. Using NPV method, what is the NPV of this project is the company has determined that the appropriate discount rate for this project is 13% ? With the NPV found , is the project favorable to invest or not? Q4. Using Profitability Index (PI) method, what is the PI of this project? With the PI found, is the project favorable to invest or not? 7,000

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Formulae 01 Ans d S... View full answer

Get step-by-step solutions from verified subject matter experts