Question: HW QUESTION 1-4 Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $9,200 of its accounts receivable from Leer

HW QUESTION 1-4

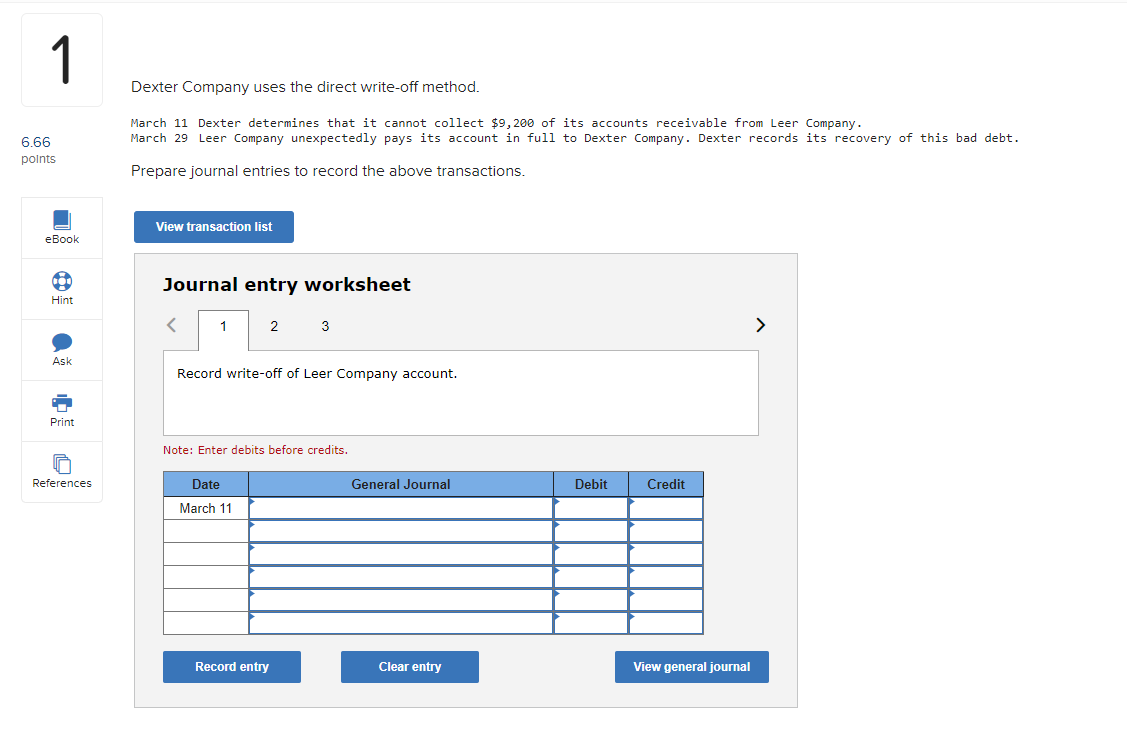

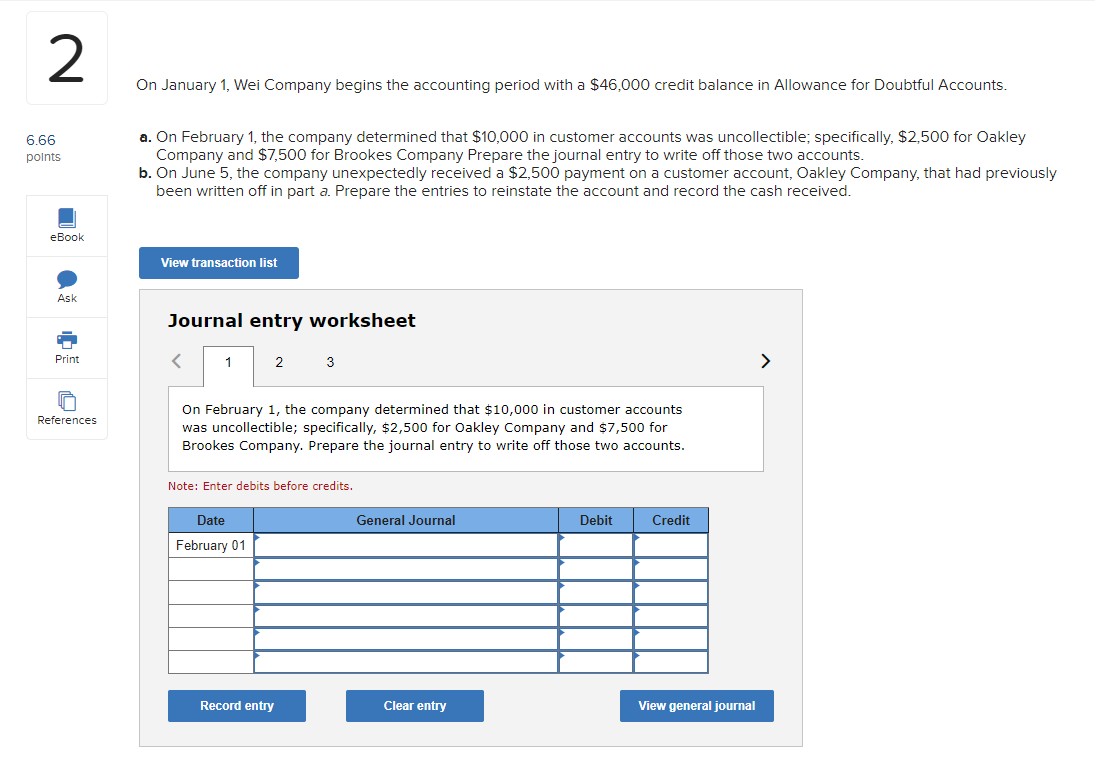

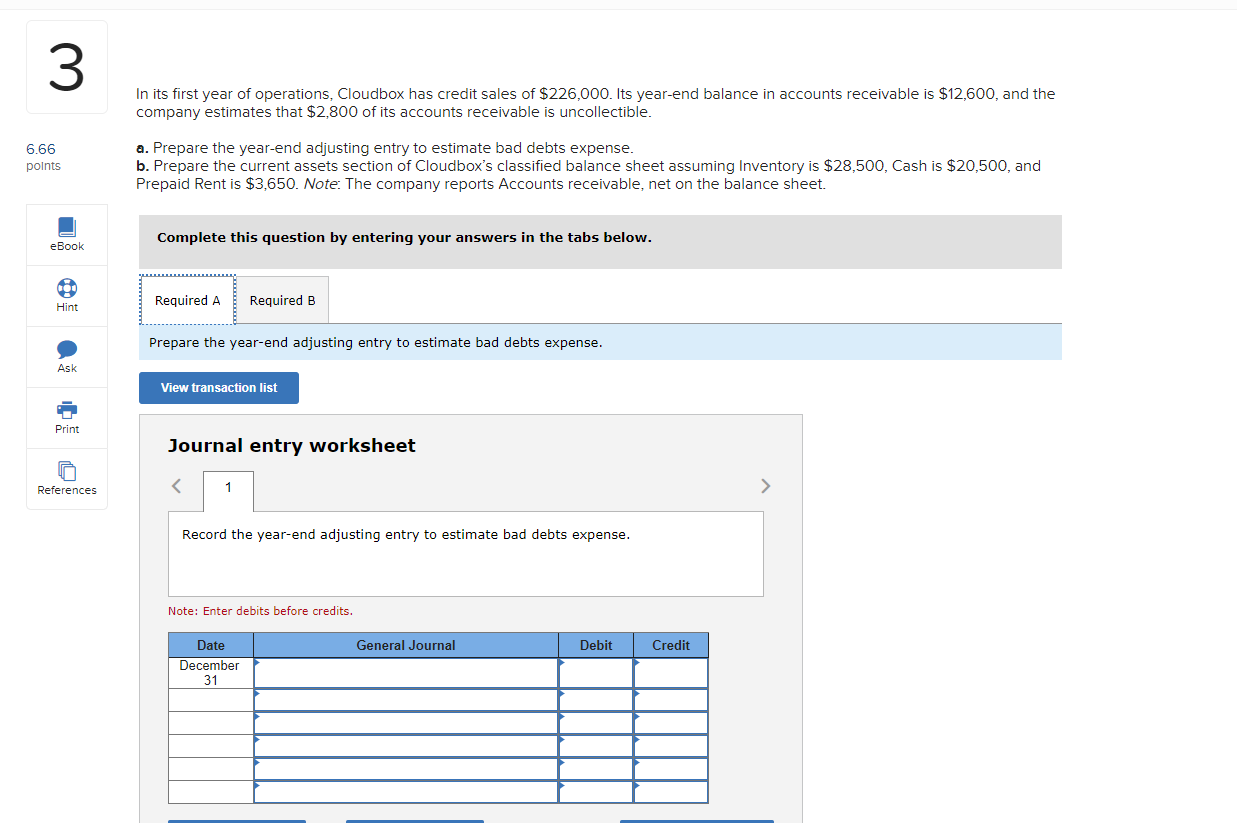

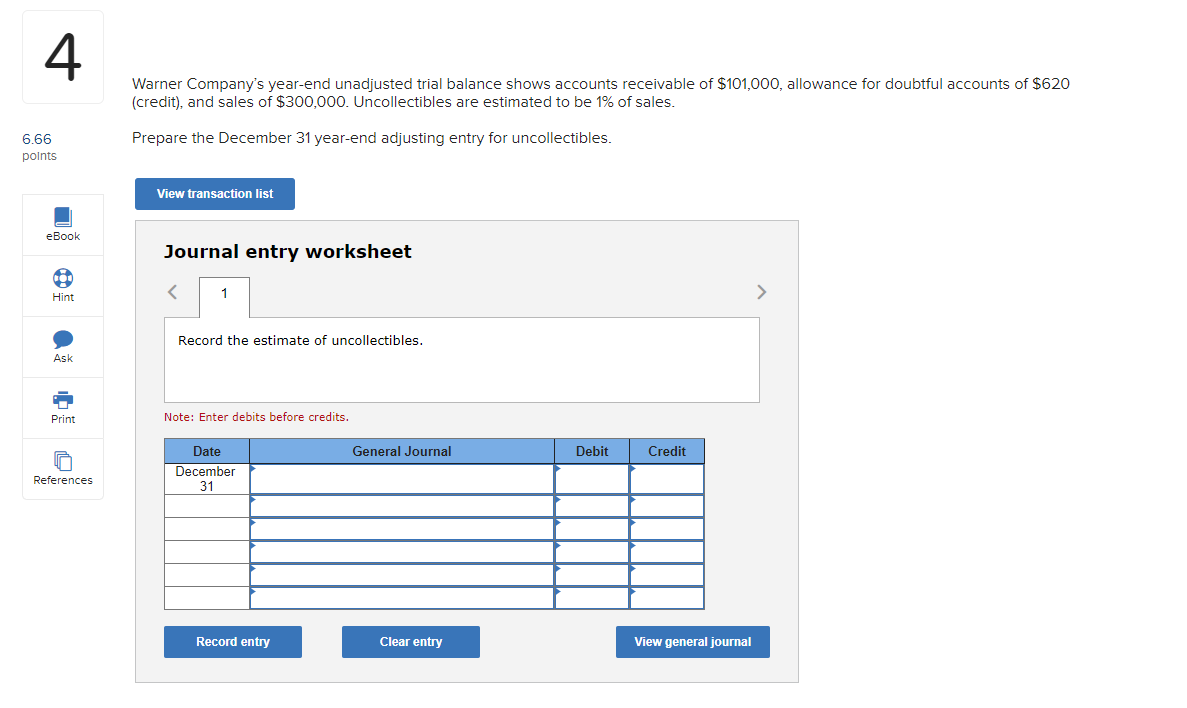

Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $9,200 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. Journal entry worksheet Note: Enter debits before credits. On January 1 , Wei Company begins the accounting period with a $46,000 credit balance in Allowance for Doubtful Accounts. a. On February 1 , the company determined that $10,000 in customer accounts was uncollectible; specifically, $2,500 for Oakley Company and $7,500 for Brookes Company Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $2,500 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received. Journal entry worksheet On February 1 , the company determined that $10,000 in customer accounts was uncollectible; specifically, $2,500 for Oakley Company and $7,500 for Brookes Company. Prepare the journal entry to write off those two accounts. Note: Enter debits before credits. In its first year of operations, Cloudbox has credit sales of $226,000. Its year-end balance in accounts receivable is $12,600, and the company estimates that $2,800 of its accounts receivable is uncollectible. a. Prepare the year-end adjusting entry to estimate bad debts expense. b. Prepare the current assets section of Cloudbox's classified balance sheet assuming Inventory is $28,500, Cash is $20,500, and Prepaid Rent is $3,650. Note: The company reports Accounts receivable, net on the balance sheet. Complete this question by entering your answers in the tabs below. Prepare the year-end adjusting entry to estimate bad debts expense. Journal entry worksheet Record the year-end adjusting entry to estimate bad debts expense. Note: Enter debits before credits. Warner Company's year-end unadjusted trial balance shows accounts receivable of $101,000, allowance for doubtful accounts of $620 (credit), and sales of $300,000. Uncollectibles are estimated to be 1% of sales. Prepare the December 31 year-end adjusting entry for uncollectibles. Journal entry worksheet Record the estimate of uncollectibles. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts