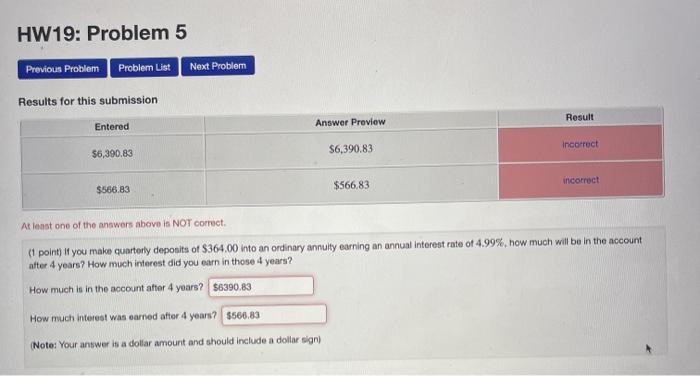

Question: HW19: Problem 5 Previous Problem Problem List Next Problem Results for this submission Entered Result Answer Preview $6,390.83 S6,390.83 Incorrect $566,83 incorrect $566.83 At least

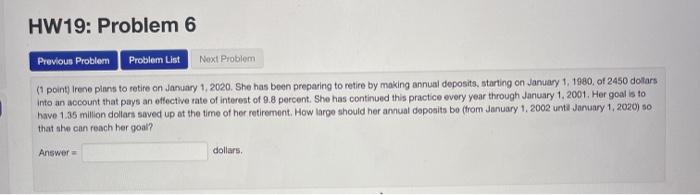

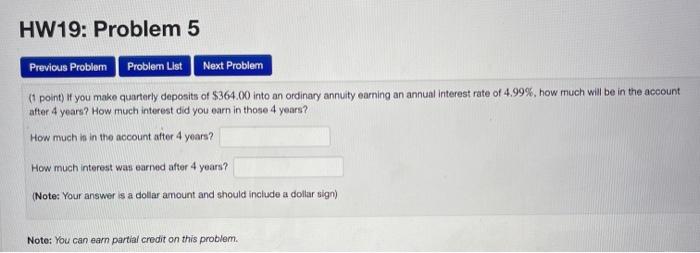

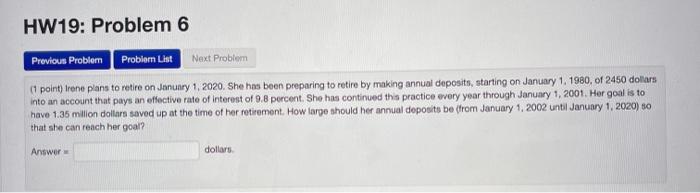

HW19: Problem 5 Previous Problem Problem List Next Problem Results for this submission Entered Result Answer Preview $6,390.83 S6,390.83 Incorrect $566,83 incorrect $566.83 At least one of the answers above is NOT correct point if you make quarterly deposits of $364.00 into an ordinary annuity carning an annual interest rate of 4.99%, how much will be in the account after 4 years? How much interest did you earn in those 4 years? How much is in the account after 4 years? $8390.83 How much interest was earned after 4 years? $566.83 (Note: Your answer is a dollar amount and should include a dollar signi HW19: Problem 6 Previous Problem Problem List Next Problem (1 points treno plans to retire on January 1, 2020. She has been preparing to retire by making annual deposits, starting on January 1, 1980, of 2450 dollars into an account that pays an effective rate of interest of 9.8 percent. She has continued this practice every year through January 1, 2001. Her goal is to have 1.36 million dollar saved up at the time of her retirement. How large should her annual deposits be (from January 1, 2002 until January 1, 2020) that she can reach her goal? Answer dollars HW19: Problem 5 Previous Problem Problem List Next Problem (1 point if you make quarterly deposits of $364.00 into an ordinary annuity earning an annual interest rate of 4.99%, how much will be in the account after 4 years? How much interest did you earn in those 4 years? How much is in the account after 4 years? How much interest was earned after 4 years? (Note: Your answer is a dollar amount and should include a dollar sign) Note: You can earn partial credit on this problem HW19: Problem 6 Previous Problem Probler List Next Problem (1 point) trene plans to retire on January 1, 2020. She has been preparing to retire by making annual deposits, starting on January 1, 1980, of 2450 dollars into an account that pays an effective rate of interest of 9.8 percent. She has continued this practice every year through January 1, 2001. Her goal is to have 1.36 million dollar seved up at the time of her retirement. How large should her annual deposits be from January 1, 2002 until January 1, 2020) 80 that she can reach her goal? Answer dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts